BTC price nears $110K after Trump Bitcoin reserve odds spike to 60%

|

Bitcoin spiked to new all-time highs on Jan. 20 as analysis warned of a BTC price reversal and the possibility of President-elect Donald Trump “creating a Bitcoin reserve in first 100 days” spiked on Polymarket.

BTC/USD 1-day chart. Source: Cointelegraph/TradingView

Bitcoin traders risk it all at new all-time highs

Data from Cointelegraph Markets Pro and TradingView confirmed a new Bitcoin (BTC $107,396) record high of $109,356 on Bitstamp.

Coming on the back of broad volatility across crypto markets, the return to price discovery took daily gains over 8%.

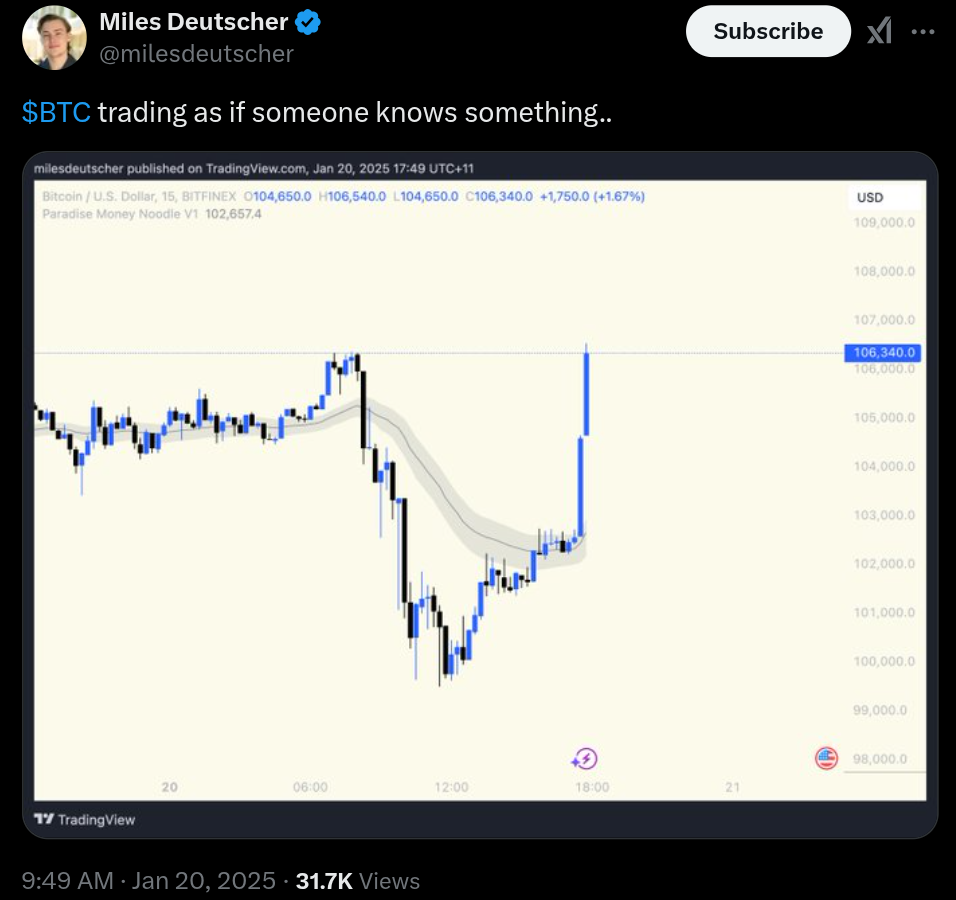

Source: Miles Deutscher

The weekly close had seen a dip below the $100,000 mark as a mixture of confusion and suspicious moves accompanied the controversial memecoin associated with Trump.

Trump’s inauguration set the tone for more instability on the day. Pro-crypto policy announcements and new all-time highs had long been anticipated.

For trader Skew, however, the writing was on the wall.

“Price testing supply here,” he wrote in ongoing commentary on X.

Potentially front running tomorrow to create exit liquidity.

BTC/USDT order book data for Binance. Source: Skew/X

An accompanying chart showed liquidity conditions on major exchange Binance, with Skew implying that late buyers, seeing the new highs, could end up “stuck” at those new peak levels as the market reverses downhill.

Signs of pain were already visible in liquidation data, with crypto longs alone unwinding to the tune of nearly $1 billion in the 24 hours to the time of writing.

BTC price breakout “doesn’t get much cleaner”

Other market participants’ reactions agreed that Bitcoin may be trading on undisclosed information, possibly involving the Trump administration’s vow to create a strategic reserve using both BTC and certain altcoins.

Data from prediction service Polymarket put the odds of this becoming a reality at over 50% on the day.

Source: Polymarket

“Someone clearly knows something on $btc,” crypto influencer hedgedhog argued, like Skew noting “huge” supply creating a hurdle for bulls at $110,000.

“$110K supply remains with added ask liquidity around $109K,” Skew added in a subsequent update.

Market providing liquidity for higher here, let's see if this sizeable buyer can crack it.

BTC/USDT order book data for Binance. Source: Skew/X

A confident IncomeSharks praised the way in which BTC/USD broke out of its consolidation range in place for the past month.

“Doesn’t get much cleaner than that,” the trader told X followers.

BTC/USD 1-day chart. Source: IncomeSharks/X

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.