Blast Layer 2 locks users’ $568 million for three months, drawing criticism from Paradigm

|

- Blast has opened deposits for Ethereum and stablecoins to its one-way deposit contract, locking tokens for three months.

- The Layer 2 will offer stakers Blast Points in addition to ETH staking rewards from Lido and yields from MakerDAO.

- Paradigm criticized Blast’s three month lock on withdrawals and decision to launch the bridge before the Layer 2.

Blast is a Layer 2 project launched by the founders of Blur, a decentralized NFT marketplace for traders. The project has now launched a one-way deposit contract for users to send their ETH and stablecoins, earning points in exchange. The move, however, effectively means user’s funds will be locked for three months. Paradigm, an investment firm, has critiqued the decision.

Also read: Bitcoin price sustains above $37,200 as mining difficulty hits record high

Blast locks over $568 million in its contract, withdrawals open in three months

Layer 2 project Blast has been criticized by crypto influencers, analysts and one of the investment firms that backed the project, for its plan to keep user assets locked for a three month time period. Blast’s founders decided to lock assets and open the bridge before opening withdrawals for users or launching Layer 2.

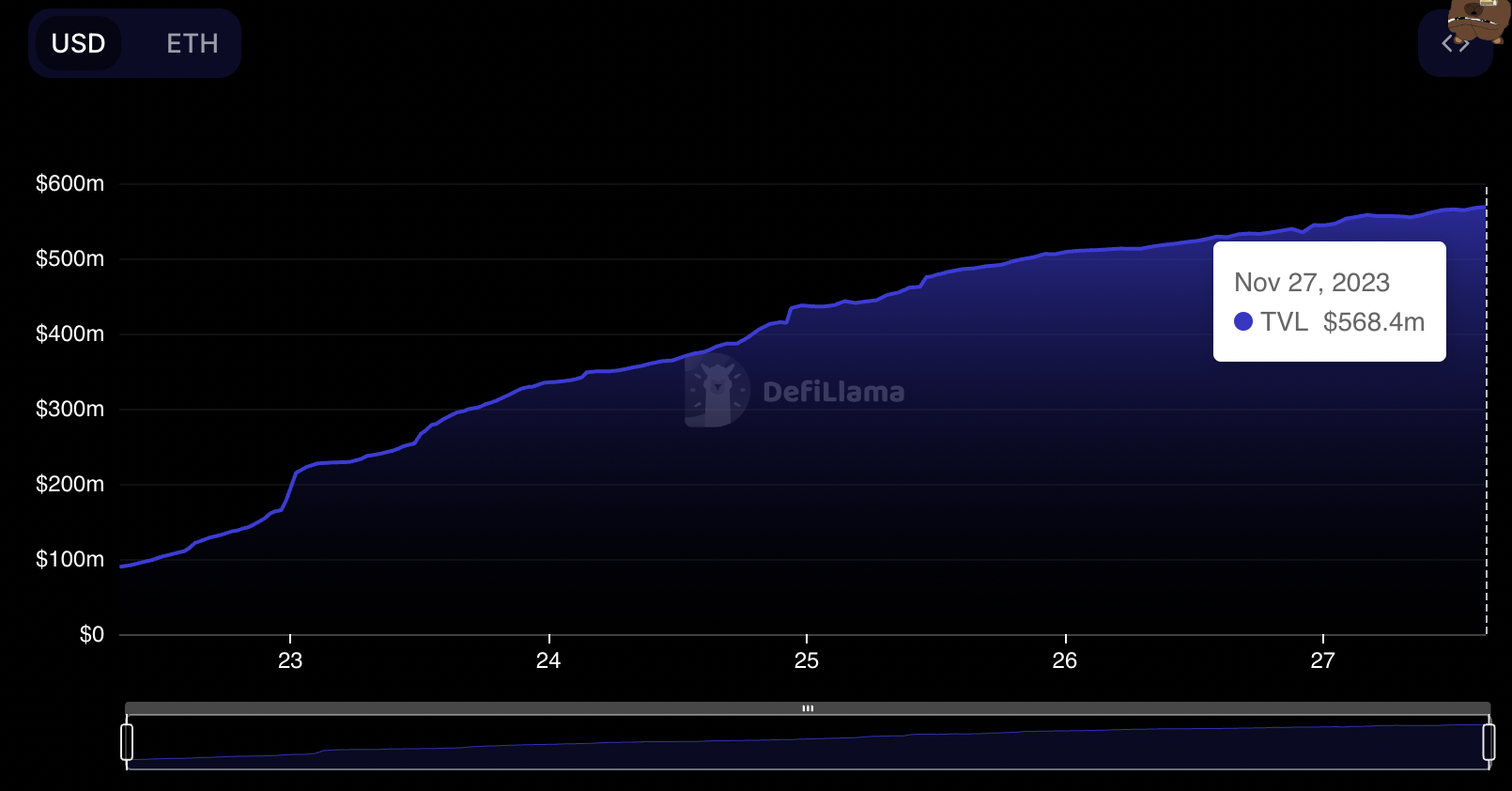

Users have locked a total of $568 million worth of ETH and stablecoins in the one-way deposit contract, according to data from crypto tracker DeFiLlama. Despite the Fear, Uncertainty and Doubt (FUD) surrounding the project users will not be able to withdraw their assets.

Blast TVL on DeFiLlama

Paradigm shared criticism for Blast and its founders in a recent tweet on X, calling out the team for their marketing tactics. Depositors are earning “Blast Points” in exchange for their ETH and stablecoin deposits, which are staked on Lido or sent to MakerDAO to earn yields. At the end of three months, depositors will earn the staking rewards, stablecoin yields and “Blast Points.”

Within a week of its launch, the project garnered the interest of a large community of crypto traders, despite its security concerns, absence of testnet or working Layer 2 project. Blast founders are therefore facing pushback from their investors, who think the marketing tactics deployed have cheapened the efforts of the team.

Paradigm disagrees with the launch of a bridge before the Layer 2 project launch and criticizes the three-month user-asset withdrawal delay.

There are a lot of components of Blast that I’m excited about and would be interested in engaging with people on. That said, we at Paradigm think the announcement this week crossed lines in both messaging and execution. For example, we don’t agree with the decision to launch the…

— Dan Robinson (@danrobinson) November 26, 2023

There are a lot of components of Blast that I’m excited about and would be interested in engaging with people on. That said, we at Paradigm think the announcement this week crossed lines in both messaging and execution. For example, we don’t agree with the decision to launch the…

— Dan Robinson (@danrobinson) November 26, 2023

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.