Bitcoin's mass adoption may be slowed down by TD Ameritrade and Charles Schwab deal - Mike Novogratz.

|

- Mike Novogratz cited the reason of slow Bitcoin adoption.

- BTC/USD is moving in a range with the critical support created by $8,000.

TD Ameritrade deal with Charles Schwab will be detrimental to Bitcoin

The head of Galaxy Digital Mike Novogratz believes that the deal between TD Ameritrade and its rival Charles Schwab would affect negatively the whole cryptocurrency industry. According to Novogratz, TD Ameritrade was developing solutions that would have allowed financial advisors to hold and trade Bitcoin; however as Charles Schwab opposes cryptocurrencies, considering them a speculative investment, TD Ameritrade had to ditch its plans.

Notably, TD Ameritrade was a prominent supporter of Bitcoin futures in 2017, while Tim Hockey, the CEO of the company believes that there is a growing demand for crypto-related instruments. He is set to leave the company in February 2020. At that time he cited a disagreement with the Board about the future development of the company.

BTC/USD: technical picture

Meanwhile, the first digital currency has been gaining ground since the beginning of the year. BTC/USD gained over 30% since January 30 as the market has been looking for safe-haven alternatives amid growing global uncertainties. While Bitcoin's safe-haven status is a debatable issue, many experts point out to its correlation with Gold and other assets that are usually bought it calamitous times.

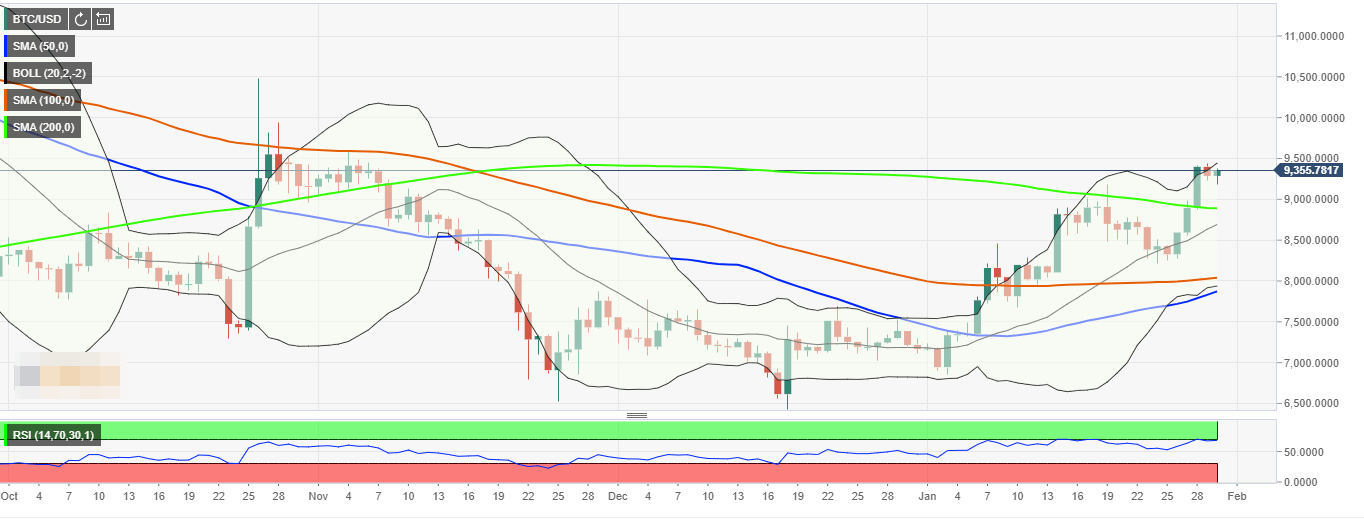

The share of Bitcoin holders making money at a current price settled at 79%, which means these holders may consider booking profits. Looking at the distribution between long-term investors and speculators, it is clear that the overwhelming majority of Bitcoin users are retail traders (88.9%) that hold Bitcoins for less than 30 days. If they start closing their positions, BTC/USD may retreat towards the nearest support area created by a psychological $9,000. A sustainable move below this area will trigger more sell-off towards $8,650, reinforced by the middle line of the daily Bollinger Band. This support area is followed by $8,000 with a confluence of strong technical indicators clustered in this area (SMA100 and SMA50 daily, SMA200 4-hour)

On the upside, a sustainable move above the recent high of $9,432 is needed to open up the way $9,600 and then to a pivotal $10,000 level.

BTC/USD daily chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.