Bitcoin Price Prediction: BTC/USD looming breakdown to $8,500 – Confluence Detector

|

- Bitcoin price recovery from the dip on Thursday is in for a rough ride with strong barriers at $9,169 and $9,264.

- Bitcoin bulls must hold Bitcoin above $9,000 to avert possible extreme losses to $8,500.

Following a period of consolidation above $9,200, Bitcoin price plunged towards $9,000 on Thursday. The volatility, although minimal happened after some top Twitter accounts including Elon Musk’s were hacked. A recovery ensued following the widespread drop that mainly affected altcoins such as Ripple (XRP), Stellar (XLM) and Tezos (XTZ). Bitcoin stepped above $9,100 but gains towards $9,200 are yet to materialize as we will see with the analysis of the confluence resistance and support areas.

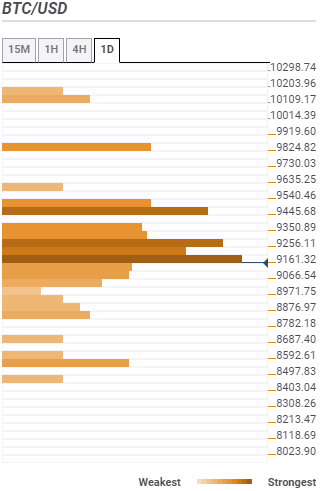

Bitcoin confluence resistance and support levels

Bitcoin bulls must brace for a rough ride in the coming sessions. Note that, the confluence tool highlights the first resistance at $9,169.50. The same zone holds various technical indicators like the SMA five 1-hour, the SMA 100 15-minutes, the Fibonacci 61.8% weekly, the previous high 1-hour and the Bollinger Band 15-minutes upper curve among others.

This resistance is likely to extend towards the second hurdle at $9,264 making it an uphill task to sustain gains. Some of the indicators in the second resistance zones are the pivot point one-day resistance one, the SMA 200 1-hour, SMA 50 4-hour and the Fibonacci 38.2% weekly.

On the downside, support levels are scarce and also not strong enough. For this reason, Bitcoin not holding above $9,000 would open the Pandora box, with renewed bearish forces pushing it to $8,500 or even $8,000. For now, we can look forward to the mild support at $9,074 as highlighted by the pivot point one-day resistance one, the Bollinger Band 1-hour lower curve and the Fibonacci 23.6% one-day.

Other weaker support areas include $8,979.77, $8,884.90, $8,600.29 and $8,505. Therefore, it is essential that buyers hold Bitcoin above $9,000 as if their lives depend on it. Losses towards $8,500 could gain momentum below $8,000.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.