Bitcoin Price Prediction: BTC/USD confluence levels confirm stacks of hurdles towards $8,400

|

- The cryptocurrencies bleed courtesy of Bitcoin’s drop from highs above $8,400.

- Bitcoin is facing acute resistance towards $8,400 but the downside is equally protected.

Bitcoin is wallowing in red stormy waters after wondering downstream in the wake of the rejection from $8,400. The entire cryptocurrency market is following suit by posting losses ahead of the weekend session. For instance, all the top three coins are suffering under the hands of the bears with Bitcoin trading 1.1% lower on the day, Ethereum at -1.23% and Ripple at -1.25%.

Bitcoin confluence levels

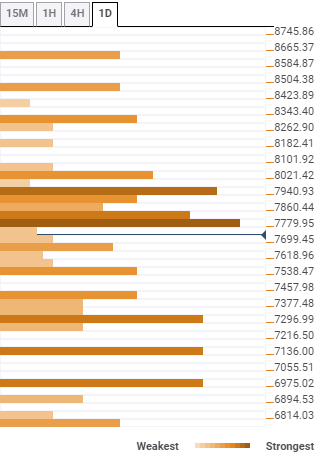

The confluence tool display of support and resistance levels highlights how strongly Bitcoin has been barred from actioning a reversal. The initial resistance at $7,779 is host to various indicators including the previous high 15-minutes, SMA 10 15-mins, previous low one-day, previous low 4-hour and the Bollinger Band 15-mins middle.

The bulls must ready for a fight their lives considering that higher movement will come face to face with more hurdles at $7,860, $7,940, $8,021 and $8,343. However, on breaking the key $8,400 barrier, the journey to $9,000 will be relatively smooth.

On the downside, there are stacks of support areas ready to cushion Bitcoin against a possible drop to $7,000. Such support zones range from $7,699 as highlighted by the pivot point one-day support one, $7,538, $7,457, $7,296 and $7,136.

On the other hand, consolidation is expected in the coming weekend session. However, more action towards $8,400 and the psychological $9,000 is expected next week.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.