Bitcoin price dives below $27,000 ahead of US Nonfarm Payrolls May report

|

- Bitcoin price opened June below $27,000 as market participants prepare for the release of US Nonfarm Payrolls May report.

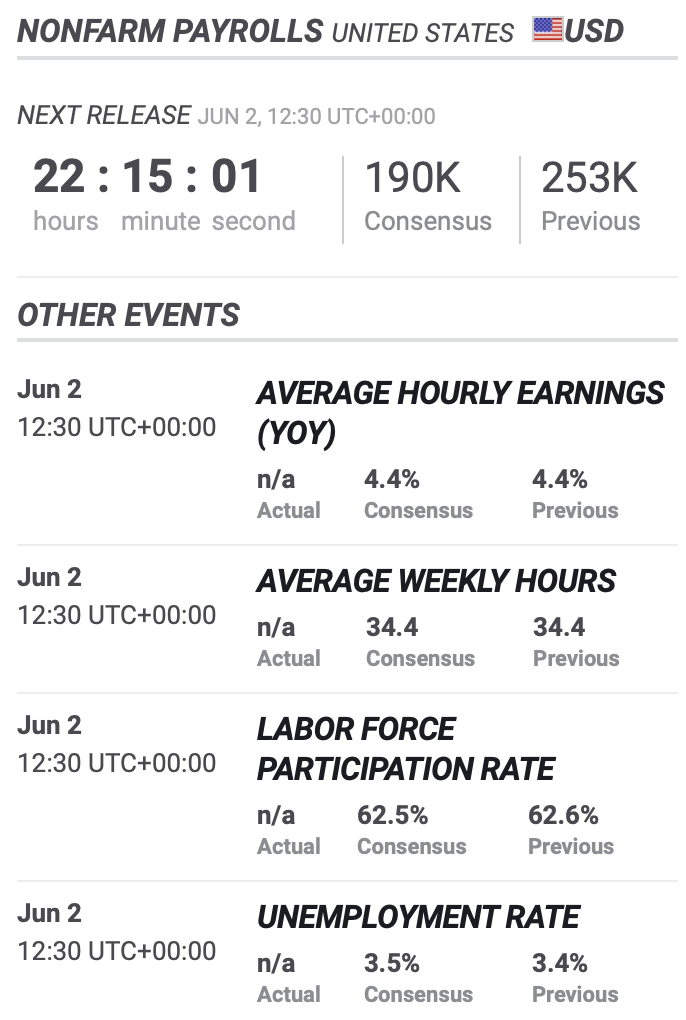

- The consensus is that 190,000 jobs were likely added in May, against the above-expectations 253,000 in April.

- A strong jobs report on Friday could support the US Dollar and increase pressure on assets like Bitcoin and Ethereum.

Crypto market participants are closely watching the US Nonfarm Payrolls (NFP) report that is due to be released by the Bureau of Labour Statistics (BLS) on Friday. Market expectations anticipates 190,000 jobs were likely added in May.

The addition of payrolls has eased over the past few months, alongside a decline in wage growth. The market consensus for the unemployment rate is a slight increase from 3.4% to 3.5% in May.

Also read: XRP unlocks tokens worth $500 million as SEC vs. Ripple verdict looms

Market expectations from the US Nonfarm Payrolls report

The NFP is considered an indicator that provides insight into the state of employment across the US. The effects of the Nonfarm Payrolls data tend to be limited to currency pairs involving the US Dollar. This implies there is an impact on cryptocurrencies like Bitcoin and Ethereum.

Hotter-than-expected job report supports the US Dollar Index and increases the selling pressure on risk assets like Bitcoin and Ethereum. This is likely to slow down the recovery of the two largest cryptocurrencies by market capitalization.

FXStreet economic indicator for US Nonfarm Payrolls May release

Bitcoin opened June below the $27,000 level after closing May with the first monthly loss of 2023. Bitcoin price is therefore likely to face a challenge in its recovery to the April 2023 peak of $31,049.

Bitcoin/US Dollar one-day price chart

As seen in the price chart above, Bitcoin price is likely to find support at the 200-day Exponential Moving Average (EMA) at $25,150 in the event of further decline.

If Bitcoin price climbs higher, it faces resistance between $27,709 and $28,929 on its path to the April peak of $31,049.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.