Bitcoin price set to retest key support level amid ETFs outflow and miners reserve concerns

|

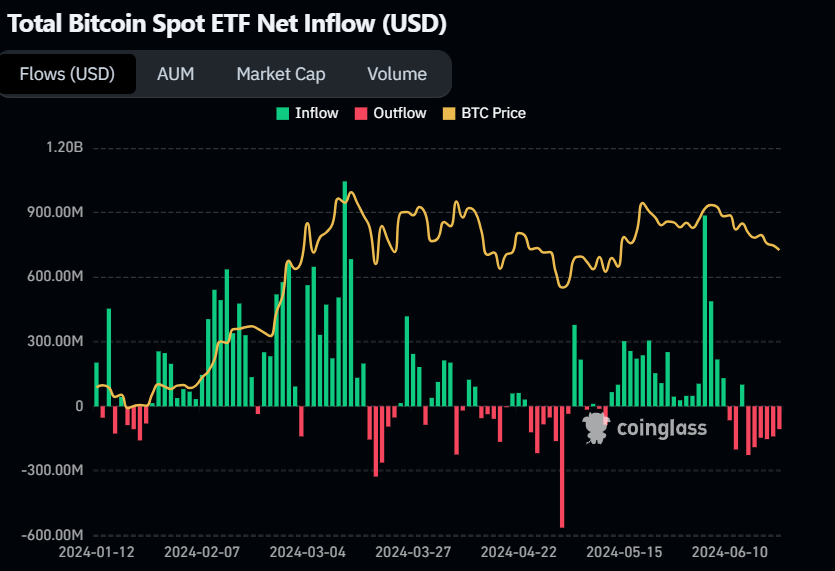

- Bitcoin spot ETFs show continuous outflow from June 13 to June 21.

- BTC miners have also seen a decline in their reserves.

- Bitcoin price is trading inside a descending wedge, and a breakout above $64,600 signals a bullish move.

Bitcoin (BTC) price extends past week's decline and falls below $63,000 on Monday. BTC faces resistance amid ongoing outflows from Bitcoin spot ETFs over the past six days. Concurrently, BTC miners have experienced declining reserves, and German authorities have continued depositing BTC on centralized exchanges since last week.

Daily digest market movers: Bitcoin spot ETF by VanEck goes live in Australia's largest stock exchange

- The Bitcoin spot ETFs show a continuous six-day outflow totaling $960.2 million from June 13 to June 21. The 11 spot BTC ETFs, holding $55.55 billion in Bitcoin reserves, divested at least 15,000 BTC or more last week.

BTC spot ETF Net Inflow chart

- Miners have also seen a decline in their reserves. Between June 20 and June 22, Bitcoin miners reduced their net holdings by 1,125 BTC. It’s challenging for BTC miners as the hash price, or the expected value of 1 petahash per second (PH/s) per day, hovers just above $49.39 per PH/s.

Bitcoin Hashprice Index chart

- Additionally, German authorities transferred $110.88 million in Bitcoin from their wallet to exchanges last week. Some of these funds were directed to Coinbase, Bitstamp and the wallet also interacted with Kraken.

German Government Bitcoin transactions chart

- The Australian Securities Exchange said on its official Twitter account that VanEck's spot Bitcoin ETF officially went live on Australia's largest stock exchange on June 20. The debut represents a significant step toward mainstream acceptance and integration of Bitcoin into the global financial ecosystem.

ASX welcomes VBTC to the exchange! Congratulations to the @vaneck_au team for launching the first crypto ETF on ASX. https://t.co/QM7iYfNZRO #ASXBell pic.twitter.com/f7MiHDqIoZ

— ASX The heart of Australia's financial markets (@ASX) June 20, 2024

ASX welcomes VBTC to the exchange! Congratulations to the @vaneck_au team for launching the first crypto ETF on ASX. https://t.co/QM7iYfNZRO #ASXBell pic.twitter.com/f7MiHDqIoZ

— ASX The heart of Australia's financial markets (@ASX) June 20, 2024

- Michael Saylor's investment firm MicroStrategy acquired an additional 11,931 Bitcoins and now holds 226,331 BTC, the company said in a statement on Thursday. MicroStrategy announced that, during the period between April 27 and June 19, MicroStrategy acquired approximately 11,931 Bitcoin worth $786 million in cash, using proceeds from the Offering and Excess Cash, at an average price of approximately $65,883 per Bitcoin, inclusive of fees and expenses.Michael Saylor's investment move signals that MicroStrategy bought the dips in BTC prices.

MicroStrategy has acquired an additional 11,931 BTC for ~$786.0M using proceeds from convertible notes & excess cash for ~$65,883 per #bitcoin. As of 6/20/24, $MSTR hodls 226,331 $BTC acquired for ~$8.33B at average price of $36,798 per bitcoin.https://t.co/jE9dGqqnON

— Michael Saylor⚡️ (@saylor) June 20, 2024

MicroStrategy has acquired an additional 11,931 BTC for ~$786.0M using proceeds from convertible notes & excess cash for ~$65,883 per #bitcoin. As of 6/20/24, $MSTR hodls 226,331 $BTC acquired for ~$8.33B at average price of $36,798 per bitcoin.https://t.co/jE9dGqqnON

— Michael Saylor⚡️ (@saylor) June 20, 2024

Technical analysis: BTC consolidates within a descending wedge

Bitcoin price is trading inside a descending channel, drawn from multiple swing highs and lows between early June and mid-June, as shown in the daily chart below.

BTC is currently testing support at $62,451, the 61.8% Fibonacci retracement level from a swing low of $56,552 on May 1 to a swing high of $71,995 on May 21. If this support holds and BTC breaks above the descending channel, it could rally 7.5% to reach its previous weekly resistance level of $67,147.

The Relative Strength Index (RSI) and the Awesome Oscillator (AO) indicators on the daily chart are below their respective mean levels of 50 and zero. If bulls are indeed making a comeback, then both momentum indicators must regain their positions above their respective mean levels.

This development would provide additional momentum to the recovery rally.

If bullish sentiment prevails and the overall cryptocurrency market shows optimism, BTC may extend its rally by 6% from $67,147 to retest its previous weekly resistance level of $71,280.

BTC/USDT 1-day chart

However, if Bitcoin price breaks and closes below its daily support level of $60,800, the bullish thesis could be invalidated, leading to a 4% crash to its weekly support level of $58,375.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.