Bitcoin price back in the red after President Donald Trump signed the controversial CLOUD Act into law

|

- Bitcoin price dips in the wake of President Trump signing the CLOUD Act.

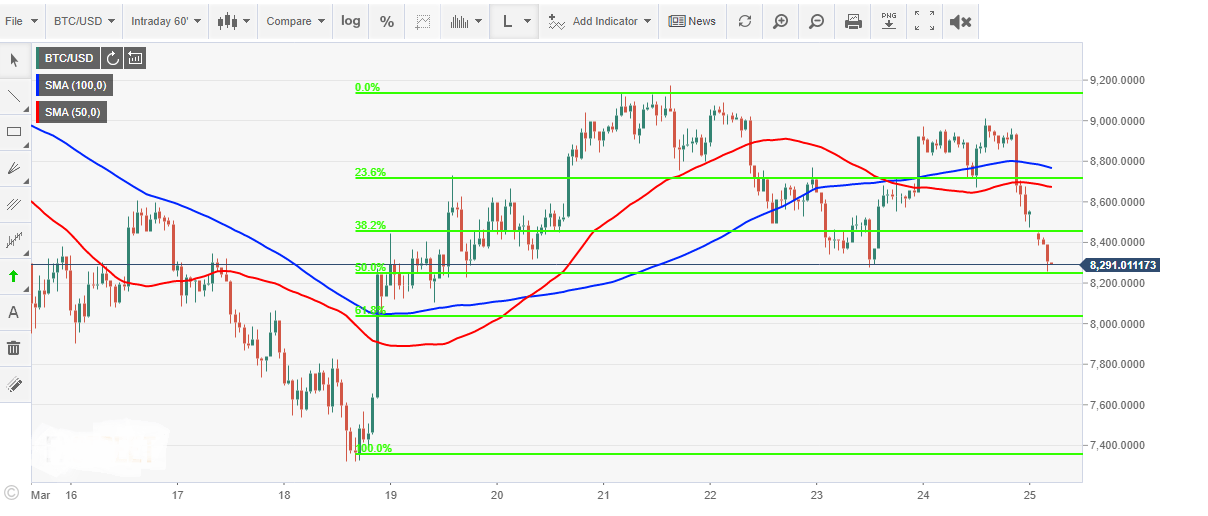

- BTC/USD is testing the 50% Fibonacci retracement level; immediate support level is at $8,200.

Bitcoin price has continued with the drop recorded during weekend trading. The cryptocurrency is down by over 2% in the last 24 hours. BTC/USD exchanged hands at highs of $8,972 on Saturday, after which a downside momentum ensued throughout the rest of the weekend. The declines could be a reaction by the traders to the recent bill the US president signed into law.

The CLOUD Act is raising concerns in the cryptocurrency market especially after the famous whistleblower, Edward Snowden revealed the hand of the National security Agency (NSA) in Bitcoin. He argued that the NSA is secretly monitoring operations on Bitcoin bringing into question the privacy of the coin. On the other hand, the addition of the Bill into the picture is doing very little to encourage Bitcoin users. The CLOUD Act gives other governments the right to access data from different US-based companies to find information on their citizens. Besides, the Act provides the US government with the right to access more private data in the name of security enforcement.

Technically looking at Bitcoin, the price is testing the 50% Fibonacci retracement level with the previous swing high of $9,135 and a low of $7,362. The downside trend was initiated at $8,934, where Bitcoin price broke past key support levels including $8,500 and $8,350. At the moment the immediate support level is at $8,200. In case of a trend reversal and Bitcoin price starts to gain, the 38.2% Fib retracement level will act as resistance at the pivotal $8,500.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.