Bitcoin price analysis: Half value lost in Q1, what next?

|

- More than half market cap lost in first quarter.

- Key technical fight between bulls and bears would decide future trend.

Bitcoin the king, lost more than half of its market capitalisation in the first quarter of 2018 after a stellar 2017 that saw prices rise more than 2000 percent in a bubble like flare up. Can it regain its lost momentum or would it continue to go downhill is something a very technical question.

As reported by this author in the last two days, BTC has an epic battle between bulls and bears wherein it could easily lose half of its value from current levels or reach past its all time highs, all in quick time. (Read those stories here and here)

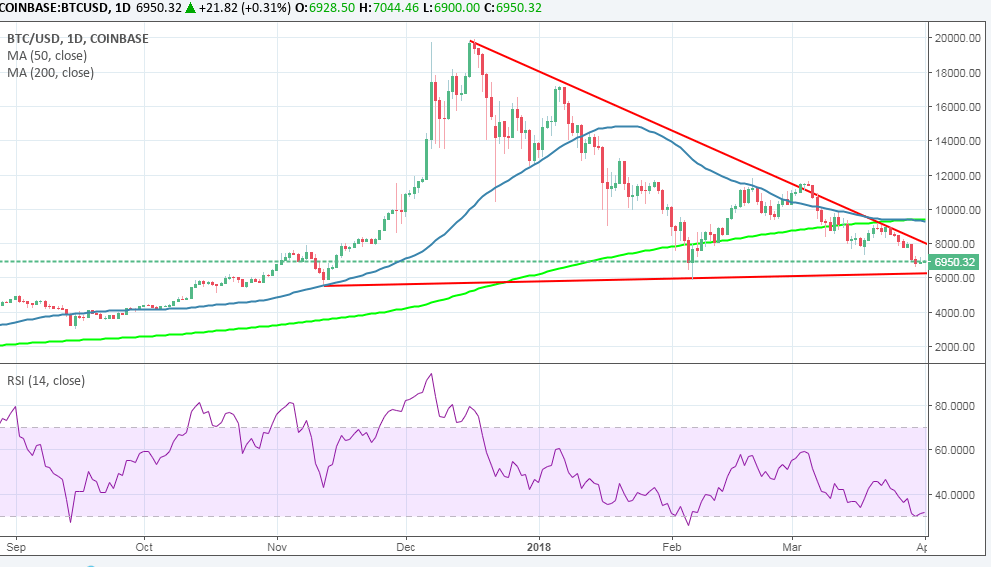

BTC is trading up 0.2 percent at $6,950 and facing resistance at $6,975 and $7,160 levels on the intra day charts while the supports are around $6,739 and $6,554 levels. For bulls, though $8,000 - $8,300 levels needs to cross to win over bears while for bears to gain control, $5,800 - $6,200 is key area.

BTC/USD daily chart:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.