Bitcoin Price Analysis: BTC on the cusp of heavy losses, $51,000 probes bears

|

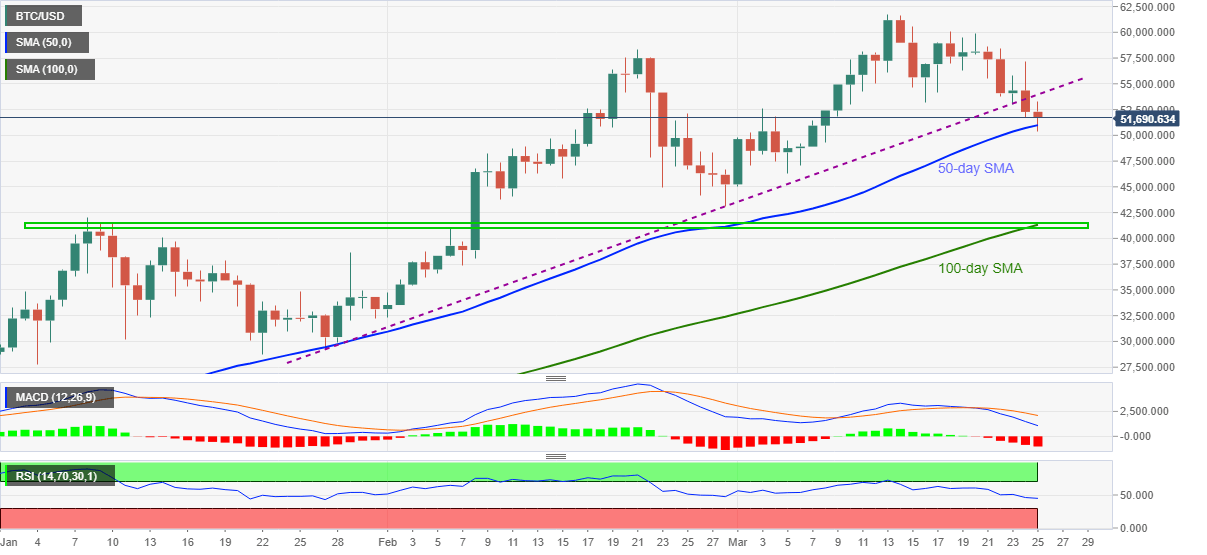

- BTC/USD bears battle 50-day SMA following a downside break of two-month-old support line.

- Late-February low lures sellers ahead of $41,300-450 key support-zone.

- Bulls need to cross February top for re-entry.

Bitcoin fades recent corrective pullback while dropping back to $51,700 during early Friday. In doing so, the cryptocurrency major battles 50-day SMA while keeping Wednesday’s downside break of an ascending trend line from January 27.

Given the bearish MACD and downward sloping RSI, not overbought, favoring the key support break, now resistance, BTC/USD is up for further losses. However, a clear break below the $51,000 threshold, around 50-day SMA, becomes necessary for the sellers’ conviction.

Following that, the quote’s slump towards lows marked on February 10 and 28, respectively around $43,700 and $43,050, can’t be ruled out.

However, any further losses will be challenged by an area comprising 100-day SMA and early 2021 tops, near $41,450-300.

On the flip side, a corrective pullback beyond the previous support line, at $53,850 by the press time, will have to piece February top near $58,350 to convince the BTC/USD bulls.

BTC/USD daily chart

Trend: Further weakness expected

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.