Bitcoin positions for bullish breakout as the road to $70,000 becomes more clear

|

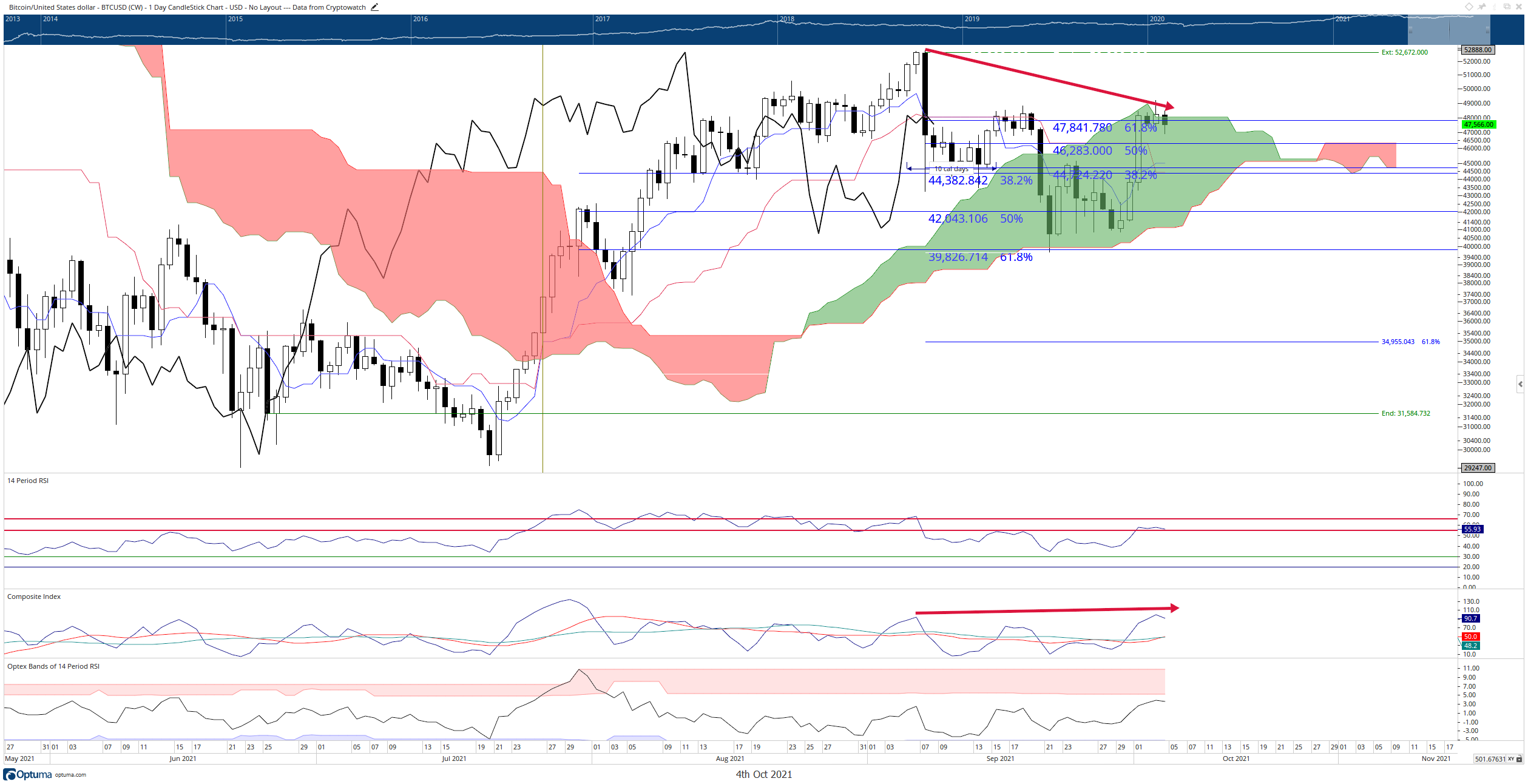

- Bitcoin price needs two more Ichimoku conditions to confirm a bullish breakout.

- A close at $49,150 would help confirm a new bullish expansion phase.

- Some almost imperceptible bearish divergence may point to a bull trap.

Bitcoin price has experienced a massive rally throughout the last couple of days of September and the beginning of October. A nearly 20% gain from the September 29th low to the weekend high has generated substantial interest and expectations to a new bullish breakout for Bitcoin.

Bitcoin price looks for a close above $49,000 to propel Bitcoin to new all-time highs

Bitcoin price, despite the intense buying pressure, remains inside the Cloud. Since returning inside the Cloud on September 20th, the price action has been another example of the frustration and volatility and instrument faces inside the Cloud. Sellers appeared in overwhelming control until facing buying support at $40,000; the buyers now feel that same control.

There are two conditions left on Bitcoin’s daily Ichimoku chart that would help confirm a new push towards all-time highs. First, Bitcoin price must close above the Cloud. Second, the Chikou Span must be above the Candlesticks and in ‘open space’ (a condition where it will not intercept any candlesticks over the following five to ten subsequent periods). Technically, both conditions are fulfilled if Bitcoin were to close at $48,160 – however, the Chikou Span would intercept the future candlesticks in six days. On the other hand, a close above $49,150 would put price above the Cloud and the most recent swing high as well as position the Chikou Span into ‘open space.’

BTC/USD Daily Ichimoku Chart

However, bulls should be mindful of conditions that favor the short side of the market. First, there is an almost ‘sneaky’ form of hidden bearish divergence between Bitcoin price and the Composite Index. Second, the position of the Optex Bands is near the extremes and is currently showing a slight slope to the south. Finally, the Relative Strength Index was shifted into bear market conditions, with the RSI flattening out against the first overbought condition at 55. When you consider that Bitcoin price has been halted against the top of the Cloud for the past four consecutive days, buyers should be cautious – a return to the $30,000 trading range is still likely.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.