Bitcoin market update: BTC/USD appreciates by $1,000 reclaiming $10,500

|

- Market rebounds after a US representative Patrick McHenry showered Bitcoin with praises.

- Bitcoin unlikely to break above $10,000 on Thursday but strongly supported above $10,000.

Bitcoin did not just rise above $10,000, the largest cryptocurrency broke above a second key hurdle at $10,500. The recovery comes after Bitcoin descended to lows at $9,000. An initial attempt at recovery stalled at $10,000 but in its second assault, BTC/USD impressively rose to highs around $10,694.

The rebound in Bitcoin price comes after a US representative Patrick McHenry showered Bitcoin with praises during the much-hyped Facebook Inc.’s hearing regarding Libra. McHenry said that Bitcoin was unstoppable and that corporations like Facebook are only trying to copy what Bitcoin has succeeded doing already.

“I think there’s no capacity to kill Bitcoin. Even the Chinese, with their firewall and their extreme intervention in their society could not kill Bitcoin,” McHenry said.

He also added:

“The essence of Bitcoin is what Libra and Facebook, and corporates are trying to mimic.”

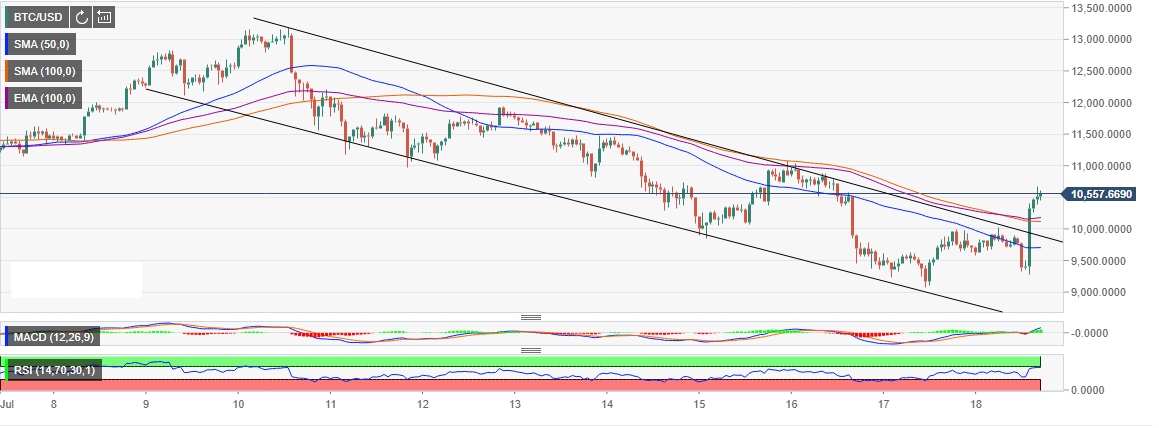

Meanwhile, Bitcoin is trading at $10,541 after correcting higher 8.5% on the day. Technicals indicate the capacity for higher movements, however, it very unlikely that we Bitcoin will break above $11,000 today. On the downside, support will be provided by the moving averages starting with the 100 Exponential Moving Average (EMA) and the 100 Simple Moving Average (SMA). Other key support areas to look out for in the near-term are $10,000, the 50 SMA 1-h, $9,500 and $9,000.

BTC/USD 1-h chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.