Bitcoin Hash Rate to Hit a Whopping 100 Quintillion for the First Time

|

Bitcoin (BTC) is aiming for a new network record as its hash rate is just inches away from hitting three figures.

Bitcoin hash rate nearing 100 quintillion

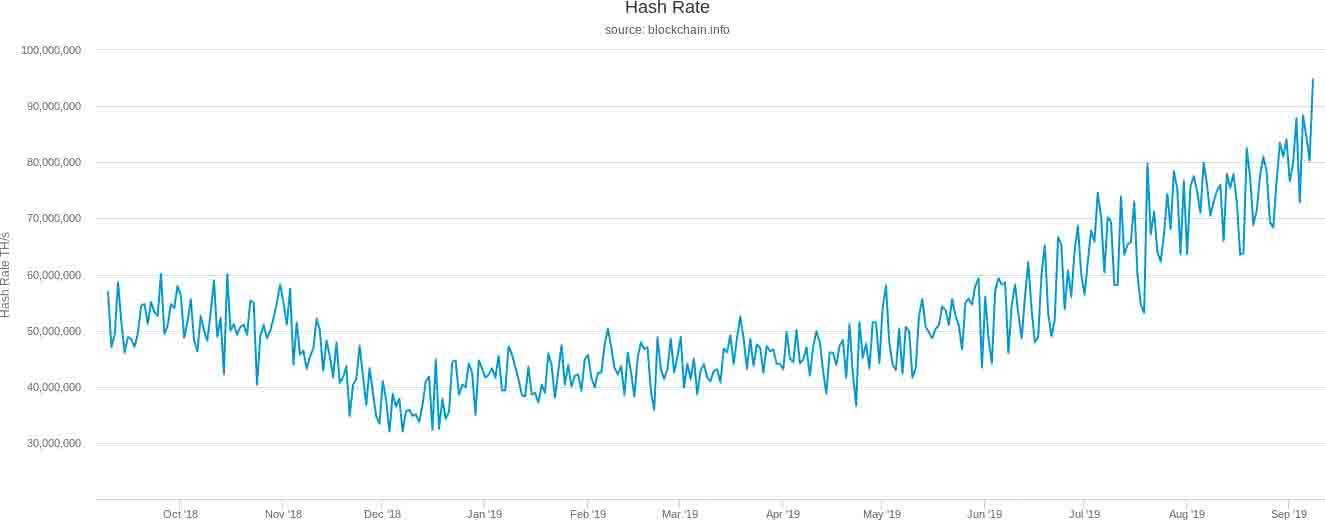

Data from statistics and wallet provider Blockchain published on Sept. 8 shows that as of that date, Bitcoin’s hash rate has topped 94 quintillion hashes per second.

Bitcoin network hash rate. Source: Blockchain

A record in itself, the number is now set to reach 100 quintillion for the first time in Bitcoin’s history, commentators suggest.

As Cointelegraph has explained, hash rate refers to the overall computing power involved in processing Bitcoin transactions. The more power, the more secure and profitable the Bitcoin network is.

Hash rate spent six months in recession during the second half of 2018, before staging a dramatic comeback in January. Three months later, Bitcoin price followed suit, rising from $3,500 to local highs of $13,800.

Keiser: Bitcoin gains will come at fiat’s expense

According to RT host Max Keiser, price traditionally follows hash rate in bull runs. Now, he says, it is fiat currency which will start feeling the strain due to Bitcoin’s success.

“#Bitcoin hash set to break 100 Q. This will start to become a problem for fiat as data centers dedicated to maintaining fiat systems are pulled into the BTC black hole of true value,” he wrote on Twitter on Sunday.

The pace of change in Bitcoin likewise did not go unnoticed by Lightning Torch relay organizer Hodlonaut, who on Twitter noted the metric measured just 6 quintillion in September 2017.

“Today, hashrate increases with that same amount every 2-3 weeks,” he added.

BTC/USD meanwhile has yet to capitalize on network strength again. At press time, the pair traded sideways just below $10,200, having lost almost 4% over the past 24 hours.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.