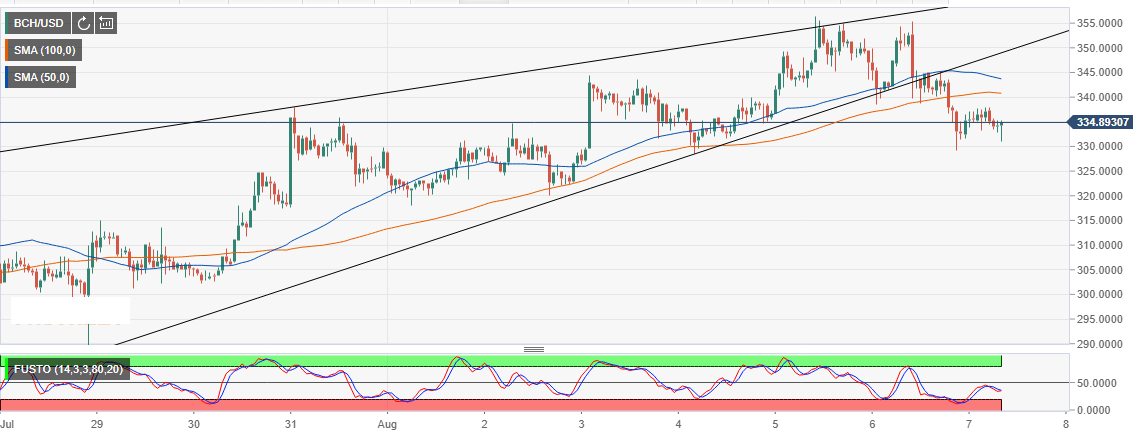

Bitcoin Cash price: BCH/USD rising wedge pattern breakdown targeting $300

|

- Recovery from mid-July lows has been impeccably bullish forming a higher low pattern.

- The prevailing technical picture suggests that the next support $330 is at risk.

Bitcoin Cash made a swing on levels at $355 on August 5 and August 6. However, diminishing buying power saw up leg cut short. Recovery from mid-July lows has been impeccably bullish forming a higher low pattern within a rising wedge pattern.

BCH/USD first corrected above both the 50 Simple Moving Average 1-hour chart and the 100 SMA 1-hour on July 30. The move reignited the bullish momentum allowing the bulls to cement their position above $300. The lock-step trading in the first week of August is seen to have an affinity to for upper levels.

Unfortunately, the reaction to rising wedge pattern, which generally a reversal pattern, has seen the price correct from the highs achieved around $355. Bitcoin Cash is currently trading below the moving averages. The bearish leg has extended under $340 broken support. The prevailing technical picture suggests that the next support $330 is at risk. For instance, the full stochastic oscillator is heading south after failing to rise above 50. If this downward trend continues, we are likely to see, Bitcoin Cash exodus to $300.

BCH/USD 1-hour chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.