Bitcoin Cash price analysis: Bullish flag pattern breakout gets a shot at $170

|

- Bitcoin Cash is the bull among the bears.

- It is likely that Bitcoin Cash will slide back below $170.

Bitcoin Cash is among the few coins hanging in the green following a breakout from a bullish flag pattern that was formed after the price was rejected from trading above $200. Bitcoin Cash buyers have been intent on ensuring that they keep the token at higher levels including drawing the line in the sand at $140.

Apart from Bitcoin Cash and IOTA (MIOTA), all the other assets in the top twenty are in the red. Bitcoin recovered past $3,900 but slipped back into the $3,800 range. Ethereum performed relatively well yesterday. Ripple’s XRP, on the other hand, is unable to correct above $0.4. However, the market is relatively stable; it has added $1 billion in the last 24 hours to stand at 4133 billion.

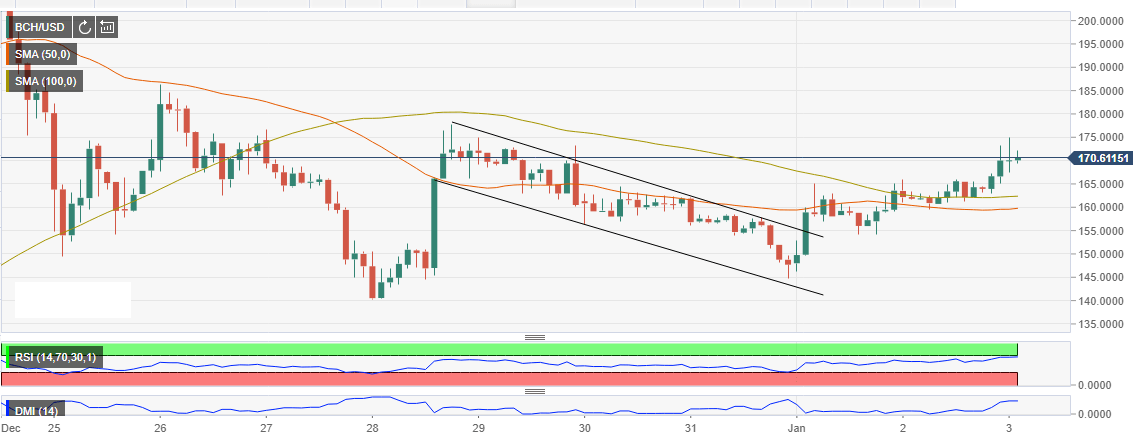

The bullish move that occurred after the bullish flag pattern corrected above the 50-period simple moving average (SMA) and the 100-period SMA on the 2-hour timeframe chart. BCH/USD continued with the upside corrected overcoming the resistance at $160. The asset has attacked the next resistance at $170, although the bulls lack momentum to not only retrace further but also sustain the price above this level. Therefore, according to the technical indicators, it is likely that Bitcoin Cash will slide back below $170. At the same time, buying activity is still high and sideways trading will take effect from now heading into the next sessions of the day.

BCH/USD 12’ chart

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.