Bitcoin Cash price analysis: BCH/USD rising wedge pattern spotted

|

- Bitcoin battled to hold on to the 2.1% gains on the day.

- Rising wedge pattern to launch Bitcoin Cash towards $400.

The weekend sessions showed love for the cryptocurrency market. The hibernating bulls made a swing to the upside recording impressive gains across the board. Bitcoin Cash did not lag as it soared to August new highs.

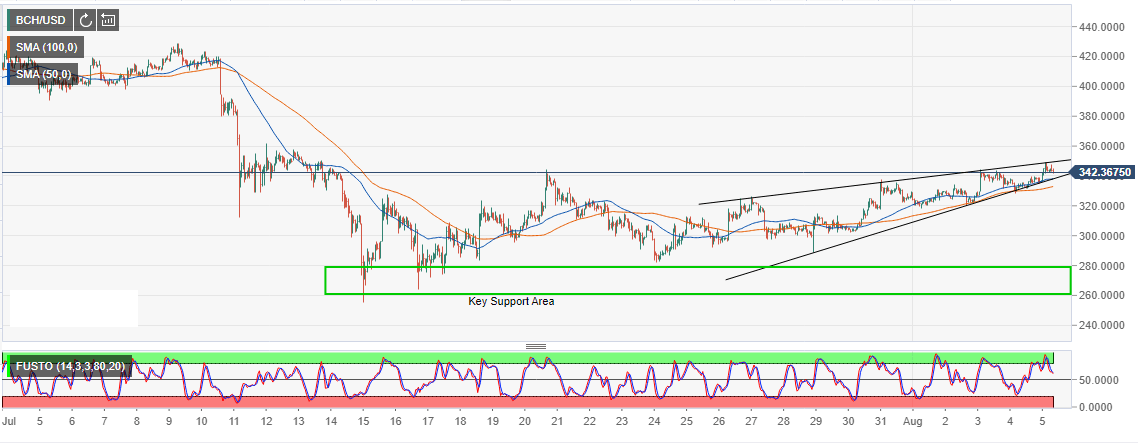

The hourly chart shows $300 level in the rear view as BCH scales the levels above $340. A high formed at $350 before retracement took effect. At press time, Bitcoin Cash is trading at $343 while holding onto the 2.1% gains on the day.

Glancing ahead, Bitcoin Cash is approaching the rising wedge pattern breakout. Trading above the pattern resistance could boost Bitcoin Cash towards $400. Moreover, Bitcoin Cash is strongly supported initially by the 50 Simple Moving Average (SMA) 1-hour chart currently at $333.62. The next support target is the 100 SMA 1-hour holding ground at $332.60.

The primary support holds ground at $320 while $300 will try to stop overstretched losses in case of a reversal. The buyers must be aware that Bitcoin Cash dived to lows around $255 in July and therefore the primary support at $260 - $280 is very important.

BCH/USD 1-hour chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.