Bitcoin (BTC) price range crippled

|

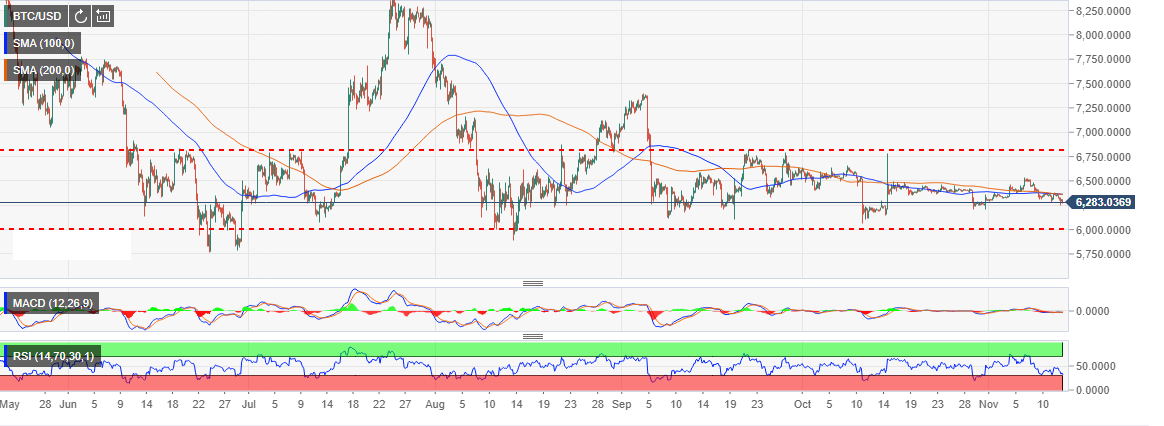

- Bitcoin price stability since September is impressive.

- BTC/USD slides below $6,300; finds a support at $6,250.

- Moving average (4-hour chart) resistance to limit gains heading to $6,400.

The stability in the cryptocurrency space represents that of a mature market. For example, Bitcoin has not faced any other devastating waterfall drop from August. The declines at the beginning of August saw Bitcoin drop below $6,000 taking refuge above the support at $5,800.

The buyers augmented their grip on the price towards the end of the same month where Bitcoin rose above $7,000. The upward trend continued touching $7,400 before another drop in the first week of September. Interestingly, the price has since been crippled within a range with the upper limit at $6,824.43 and the range support at $6,000.

In the past couple of months, Bitcoin has remained ranged bound. The stability has also led to the decreasing trading activity and trading volumes. The trading in November has had Bitcoin price step slightly above $6,500. However, due to lack of support, Bitcoin has trimmed gains below $6,300.

At press time, Bitcoin value is at $6,283 and the immediate support rests at $6,250. Although $6,000 is the main support zone, buyers will find another support at $6,200. Besides, $6,100 has acted as an anchor several times before. On the flipside, both the 4-hour simple moving average (50 and 100) will limit gains towards $6,400. Meanwhile, Bitcoin bulls must push for a price pullback above $6,300.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.