Bitcoin below $10,000 is not the end of the world - Galaxy Digital’s CEO

|

- Mike Novogratz points out to Bitcoin's long-term bull’s trend.

- The cryptocurrency may find support on approach to $9,000.

There is no reason to panic even though Bitcoin has fallen below $10,000, according to the prominent cryptocurrency investor and a founder of merchant bank Galaxy Digital Mike Novogratz.

The bull market of 2019 is still valid, he said speaking in the interview with Bloomberg TV. Despite the recent sell-off, BTC is still up over 200% from the levels registered at the beginning of the year, which means that long-term investors are making profits.

“Bitcoin started the year at $3,800, traded at $3,500 and now it’s at $10,200 and so it’s up 200% odd percent already. It has had a huge run, and so I think this is a bit of consolidation,” he explained.

Notably, Bitcoin collapsed in a couple of hours after Novogratz comments. The first cryptocurrency lost about $500 of its value in a matter of minutes and touched $9,321, which is the lowest level since July 18. At the time of writing, BTC/USD is changing hands at $9,480, down 7% on a day-on-day basis.

Novogratz believes that increased institutional interest will lay the ground for the next strong bull cycle for Bitcoin.

“The institutions that are making longer-term decisions are making sure they’ve got custody, making sure their ducks are lined up — and they’re slowly and steadily moving in,” he commented.

Sure enough, he is not the only hardcore bull out there. The CEO of deVere Group, Nigel Green, claimed recently that $10,000 was a new bottom for BTC - right before the bears, smashed it away.

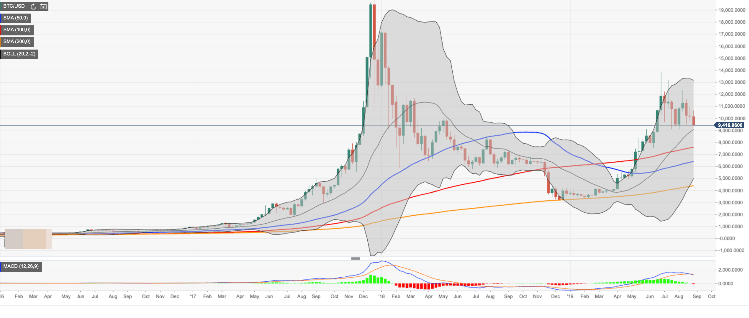

Looking technically, BTC/USD may extend the downside towards $9,000. This area strengthened by the middle line of weekly Bollinger Band serves as strong support that is likely to tame the bears and attract new buyers to the market. Once it is out of the way, the downside correction may gain traction with the next focus on $7,500. This area is guarded by SMA100 (Simple Moving Average) weekly and SMA200 daily.

BTC/USD, weekly chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.