Bitcoin bears battle bulls to prevent a return to $40,000 for BTC

|

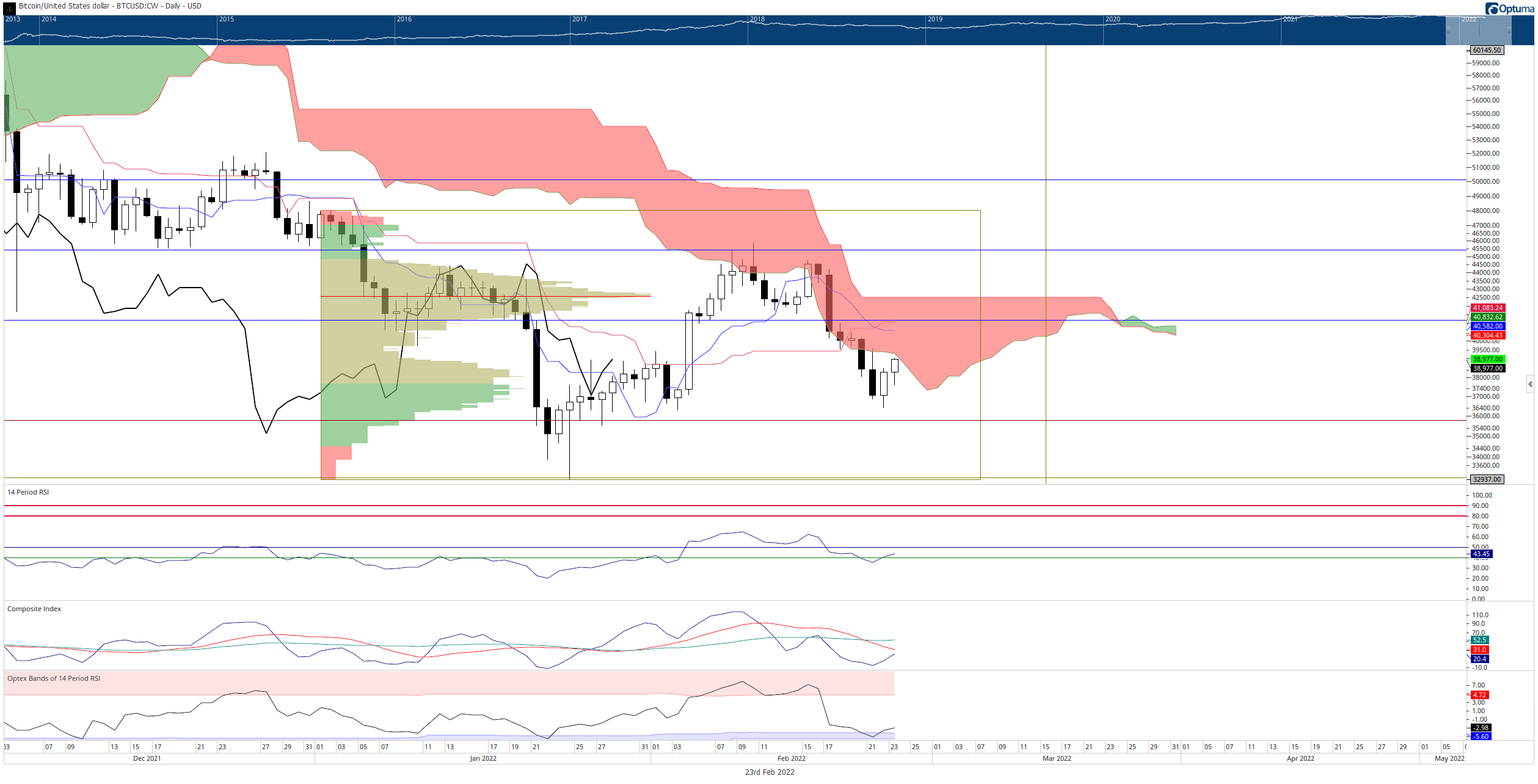

- Bitcoin price testing a return to the inside of the Ichimoku Cloud.

- $40,000 to $41,000 is the first crucial resistance zone bulls must break.

- Failure to return inside the Ichimoku Cloud could confirm a more significant bearish expansion towards $30,000.

Bitcoin price fell below the Ichimoku Cloud over the weekend and extended its losses to sub $40,000 for the first time since early February. However, Tuesday’s price action recovered nearly all of Monday’s losses. Buyers have extended the rally from yesterday, but near-term resistance threatens to terminate that bullish momentum.

Bitcoin price attempts to confirm a bottom and return to $40,000

Bitcoin price has suffered some significant bearish pressure over the past week. Risk-on markets across the globe continue to feel pressure due to Russia’s invasion of Ukraine.

Since last Tuesday (February 15, 2022), Bitcoin has dropped from a swing high of $44,760 to a swing low of $36,400 – nearly a 20% drop in a week. Whether the news or standard technical analysis behavior is to blame, BTC nonetheless returned to test a former resistance level as support – so far, it has held.

Bulls are likely to take over and push Bitcoin price back inside the Ichimoku Cloud to test the 61.8% Fibonacci retracement at $41,160 as resistance. Ultimately, bulls will need to return Bitcoin above the Ichimoku Cloud (Senkou Span B) to return BTC to a full-on bull market. A daily close above $42,685 would position Bitcoin into an Ideal Bullish Ichimoku Breakout, leading to moves beyond $50,000 and into the $60,000 value areas.

BTC/USD Daily Ichimoku Kinko Hyo Chart

However, downside risks are significant. If bears push Bitcoin price to a close below $36,500, then new 2022 lows and even a retest of the 2021 lows at $28,500 is almost a certainty.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.