Bitcoin and Ethereum struggle with declining price volatility as options traders turn bearish

|

- Bitcoin and Ethereum options traders turn bearish, buying more puts than calls.

- The PCR is between 0.7 and 1 and signals a bearish trend in the two largest cryptocurrencies by market capitalization.

- Ethereum price is struggling to sustain above the $1,800 level with implied volatility of each major term continuing to decline.

Bitcoin (BTC) and Ethereum (ETH) price volatility has declined and options traders have turned bearish on the two largest assets in the crypto space. Ethereum price is battling resistance to stay above $1,800 with an increasing bearish outlook from ETH traders.

Bitcoin, Ethereum Put Call Ratio turns bearish

The Implied Volatility (IV) is the metric that forecasts the range in which traders expect an asset’s price to likely move. IV is low for both Bitcoin and Ethereum. Greeks Live, a cryptocurrency options trading firm, notes that BTC and ETH options traders are bearish and Ethereum's implied volatility has declined to a record low.

Bitcoin and Ethereum options trading data

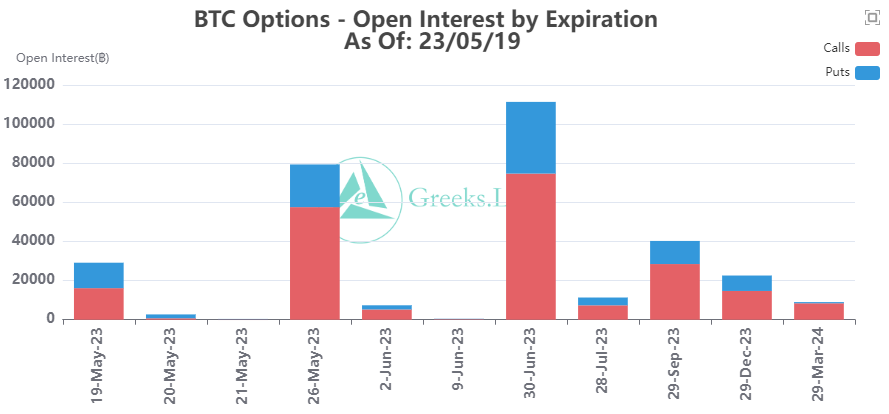

Greeks Live reported that 29,000 Bitcoin options with a notional value of $780 million are about to expire on Friday and the Put Call Ratio (PCR) for BTC is 0.81. The maximum pain point is $27,500.

BTC is trading at $26,900 at press time. For Ether, the PCR is 0.96, and the maximum pain point is $1,800. Ether is trading at $1,808 at press time.

Typically, a PCR between 0.7 and 1, signals that traders are buying more puts than calls and the overall outlook on the asset is bearish. This also signals an opportunity for traders to buy “cheaper calls” as market participants are unable to pick a direction in which Bitcoin and Ethereum prices are most likely to move. After the continuous sideways trading in BTC and ETH over the past week, the number of bearish trades has gradually increased.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.