Binance Coin (BNB) runs out of luck as Binance accused of laundering $9 million

|

- BNB retreats from the recent high on a combination of technical and fundamental factors.

- Japanese cryptocurrency exchange Fisco filed a lawsuit against Binance.

The history implies that Bitcoin may follow BNB's lead and break from the range to the upside.

Binance Coin, BNB, hit the new high of $31.27 before the tide changed. The coin dropped below $30.00 to trade at $28.70 by press time. While BNB/USD is still over 27% higher week-on-week, the technical indicators send warning signals. The bearish momentum may start gaining traction.

Binance Coin takes the 8th place in the global cryptocurrency market rating with the current market value of $4.2 billion and an averaged daily trading volume of $1.6 billion, which is a significant increase from the previous week. Being a native token of Binance, it is most actively traded on Binance, on this trading platform.

Binance Coin has run out of luck

BNB was one of the most successful digital assets out of the top-10 during the previous week. The upside momentum has been fuelled by a steady flow of positive fundamental news, including the launch of Binance Smart Chain. On this platform, yield farmers can stake their BUSD and BNB to get rewards in various coins.

Binance has been aggressively expanding into the booming DeFi industry recently. Despite the harsh criticism from the community, the new Chanpeng Zhao initiative seems to be gaining traction. As the FXStreet has previously reported, the total value of the Binance-backed stablecoin BUSD nearly doubled in ten days amid the growing interest in the Binance DeFi offering.

However, the tide has changed for BNB recently as the coin reversed all the gains of the previous two days. The sell-off might have been a factor of technical and fundamental triggers.

Thus, the Japanese cryptocurrency exchange Fisco filed a lawsuit against Binance for alleged involvement in the laundering of $9 million stolen from Zaif hack in 2018. A 33-page claim was filed in the Northern District Court of California on Monday, September 14. Fisco believes that the hackers managed to convert the stolen coins to other assets and cash out on Binance due to the platform's lax KYC (Know Your Customer) policies.

The news might have served as a trigger for the coin's downside correction from overbought territory. Let's have a closer look at the charts to see if the bulls can retake control.

BNB/USD: The technical picture

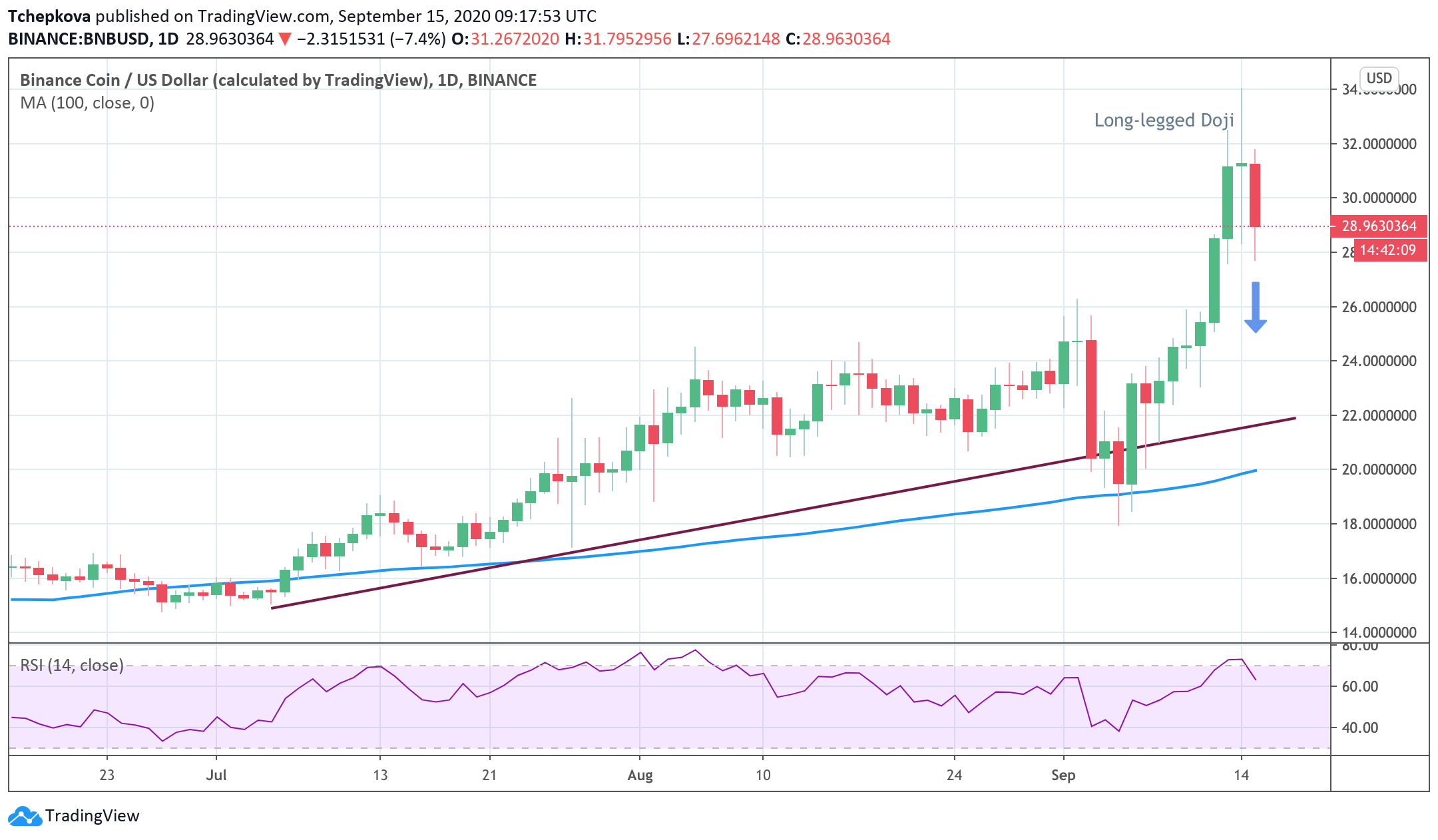

On the daily chart, BNB/USD has created a long-legged Doji candle that may qualify as an Evening Star candlestick pattern. If the bearish momentum is sustained into the end of the day, the pattern will be confirmed, and the sell-off may be extended towards the next bearish target of $22.00, reinforced by an upside-looking trend line.

BNB/USD daily chart

On the 4-hour chart, BNB/USD may retest the bullish trendline at $27.00. This barrier may slow down the sell-off and initiate a recovery towards the psychological $30.00. However, if it is broken, the downside momentum will gain traction with the next focus on $24.00. The 4-hour SMA50 located below this area adds credibility to this barrier. Once it is out of the way, the mentioned above longer-term support of $22.00 will come into focus.

BNB/USD 4-hour chart

To conclude: BNB/USD may develop the bearish correction towards $24.00, which is reinforced by the 4-hour SMA50. The critical barrier comes in the form of an upside-looking trendline and the daily SMA50 at $22.00. On the other hand, a sustainable move above the psychological $30.00 will negate the immediate bearish scenario and allow for an extended recovery.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.