AVAX price enters downtrend to $54 despite Coinbase listing

|

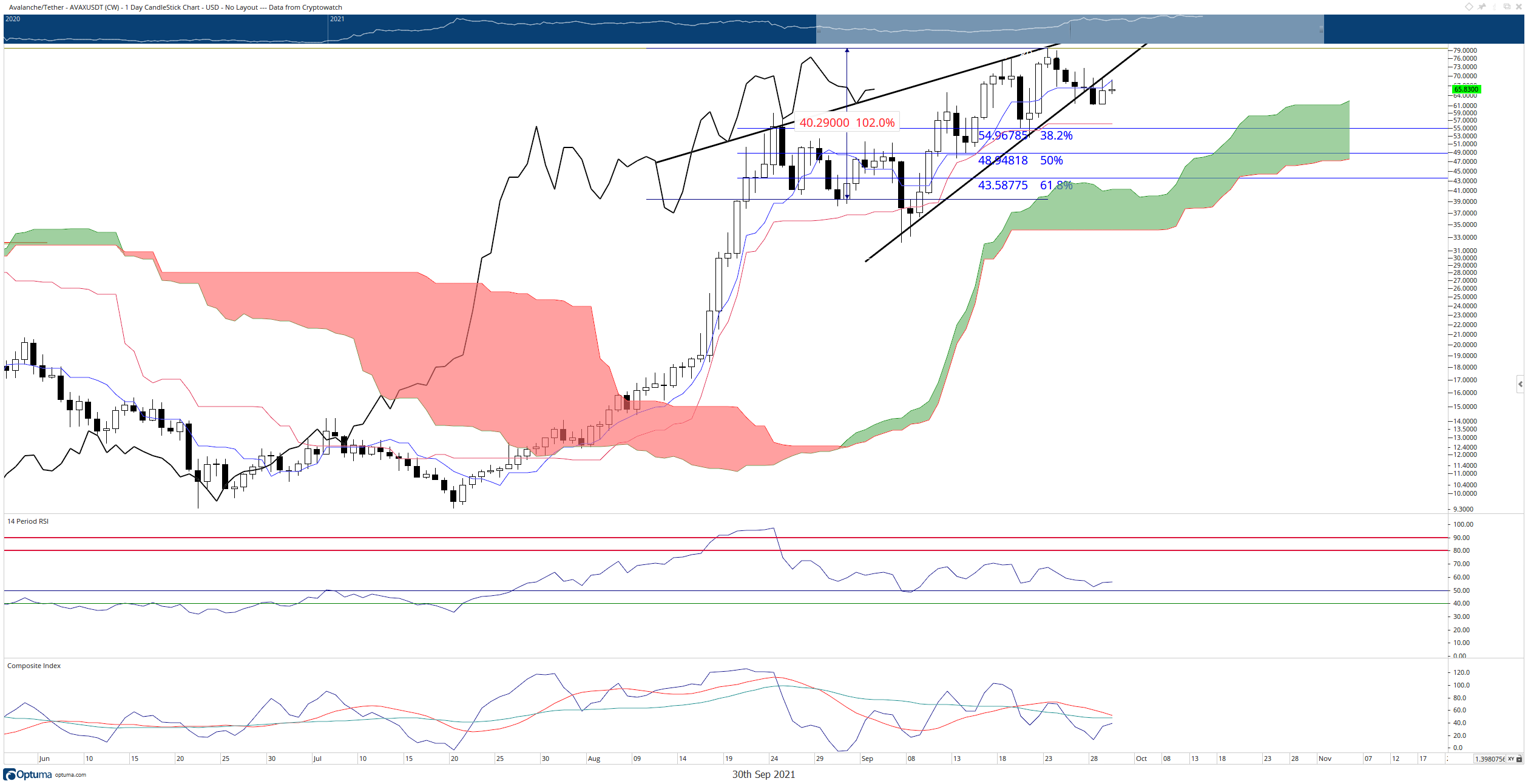

- AVAX price slides below the bearish rising wedge pattern, warning of a deep retracement.

- The standard Coinbase pump and dump behavior weigh on short-term bullish action.

- Sellers eye the $54 level for a short target; bulls look for support.

AVAX price has been on a tear recently, easily outperforming all of its peers. As a result, the downside pressure seen in the broader cryptocurrency of -50% to -70% decreases in September is foreign to AVAX. Instead, AVAX has more than double from the September 1st open.

AVAX price pulls back and drops below a significant bearish pattern

AVAX price has been the envy of bullish traders, rallying over 106% from the September open. However, a rising wedge has formed, signaling a deep corrective move ahead. There was some hope that the Coinbase listing announced on September 29th would propel AVAX back into the wedge and eliminate any bearish momentum, but the lower trendline of the wedge held as resistance.

The Coinbase listing, while bullish from a fundamental viewpoint, has almost always resulted in a pump and dump price action behavior. AVAX price was the definition of ‘priced in’ when it came to the announcement, with early buyers now eyeing the opportunity to take profit. Short sellers will target the confluence zone of support at $54, where the Kijun-Sen and 38.2% Fibonacci retracement exist.

AVAX/USDT Daily Ichimoku Chart

Buyers will need to close AVAX price above the Tenkan-Sen and ultimately return to inside the rising wedge. Then, they must continue the momentum higher to breakout above the rising wedge. If they can complete that scenario, then all of the short-term bearish outlooks will be invalidated.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.