Avalanche’s AVAX find its floor before rallying back to $70

|

- AVAX price hits a technical bottom and finalizes its major downtrend.

- Greater than 100% rally incoming.

- Further downside risks remain a concern but are minor compared to the potential upside.

AVAX price is currently down nearly 41% for the week, which may be a blessing in disguise. Instead of traders suffering months upon months of a slow bleed, major pain has been inflicted quickly and is hopefully almost over.

AVAX price collapses but is halted at a powerful support zone

AVAX price has followed the same massive flash crash affecting the rest of the cryptocurrency market. However, the end of the downtrend and sell-off is likely here.

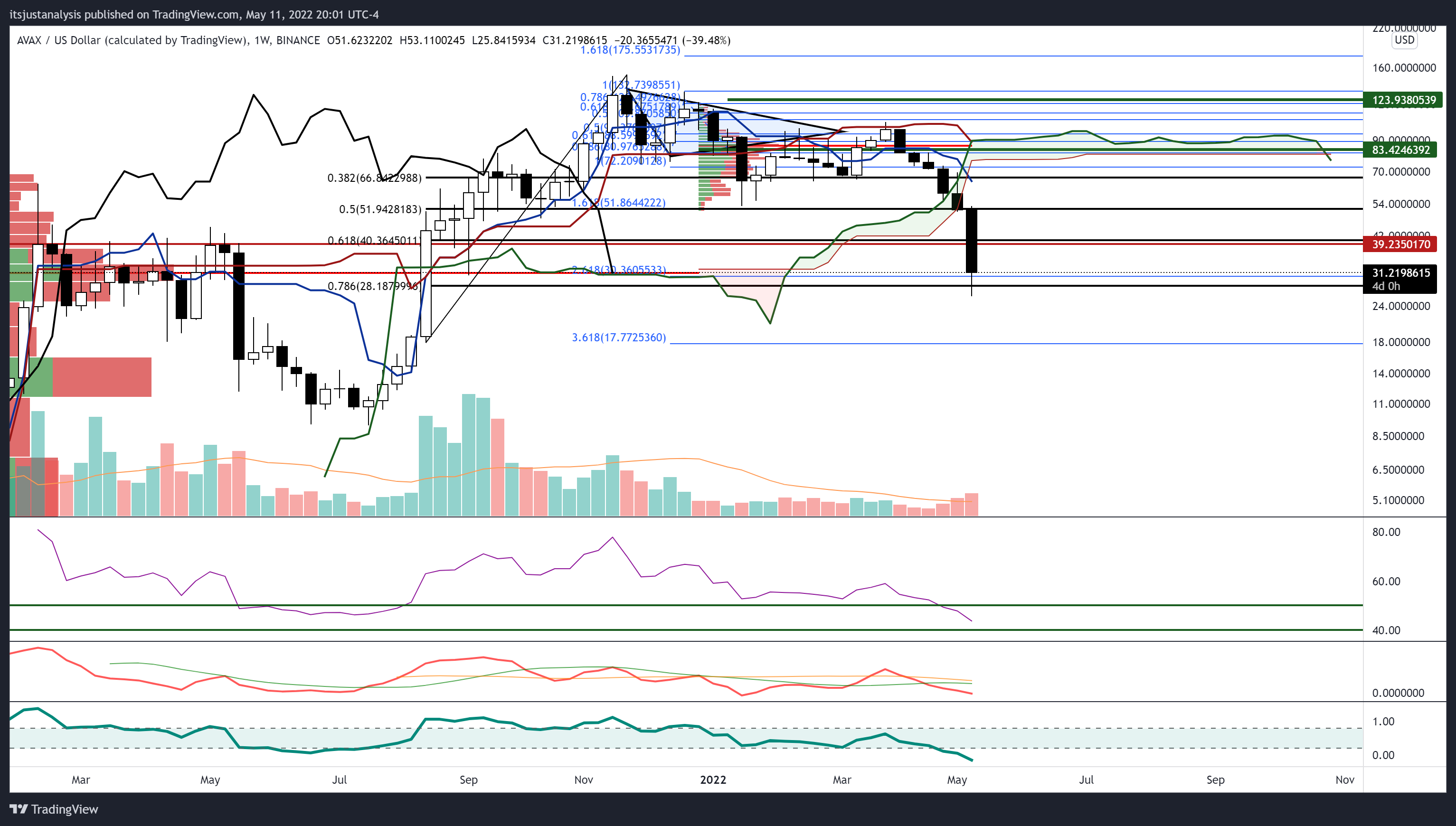

The $30 value area contains three of the most powerful technical support levels. $30 includes the 2021 Volume Point of Control, the 78.6% Fibonacci retracement, and the critical 261.8% Fibonacci expansion. The collection of those three levels creates the single strongest support structure for AVAX price until the $17 zone.

AVAX price hitting its bottom is the all-time low in the %B oscillator, the Relative Strength Index hitting the final oversold level in a bear market (40), and the Composite Index developing regular bearish divergence.

Additionally, AVAX price has had five consecutive weeks of rising volume while price declined – a perfect example of the maxim: ‘volume precedes price.’

AVAX/USD Weekly Ichimoku Kinko Hyo Chart

The projected high that AVAX price will hit before strong selling returns is the $70 value area which contains the weekly Tenkan-Sen, 38.2% Fibonacci retracement, and a high volume node in the 2022 Volume Profile.

Downside risks are likely limited to the $17 value area.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.