Analyzing exchange stablecoin holdings: Will Tether (USDT) lose relevance as Binance favors True USD (TUSD)?

|

- Binance, OKX and ByBit are the top three exchanges based on stablecoin balances.

- These three platforms favor Tether, the most popular stablecoin, and have USDT as their top stablecoin holding.

- While Circle’s DAI took second place, USDC and BUSD battled for third place.

Analysis of exchange stablecoin holdings reveals that Binance, a major player in the crypto ecosystem, is slowly shifting its stablecoin allegiances. Tether USD (USDT) remains the undisputed leader among stablecoins, but things could be about to change in the coming days.

Read more: The lawsuit against Binance highlights cryptocurrency infrastructure risks

Stablecoin data reveals exchanges prefer Tether (USDT)

Increasingly regulatory oversight has caused the cryptocurrency market to get extremely volatile. The stablecoin ecosystem has, in particular, witnessed the most drastic shift in paradigm after the United States Securities and Exchange Commission (SEC) targeted two major US stablecoin issuers - Paxos issuing Binance USD (BUSD) and Circle issuing USD Coin (USDC).

Since the SEC’s intervention, the stablecoins’ market capitalizations have plummeted drastically. Exchanges connected to the aforementioned stablecoins have had to make some changes to the way they operate.

According to data provider Nansen, the top three exchanges based on stablecoin balances include Binance, OKX and ByBit, holding $11.30 billion, $3.64 billion and $0.98 billion, respectively.

Clearly, Binance is the winner in terms of stablecoin holdings, and that is a given, considering the platform’s popularity. All the exchanges seem to have USDT as their top stablecoin, again, this is obvious considering that it is the crowd-favorite despite the allegations and lawsuits.

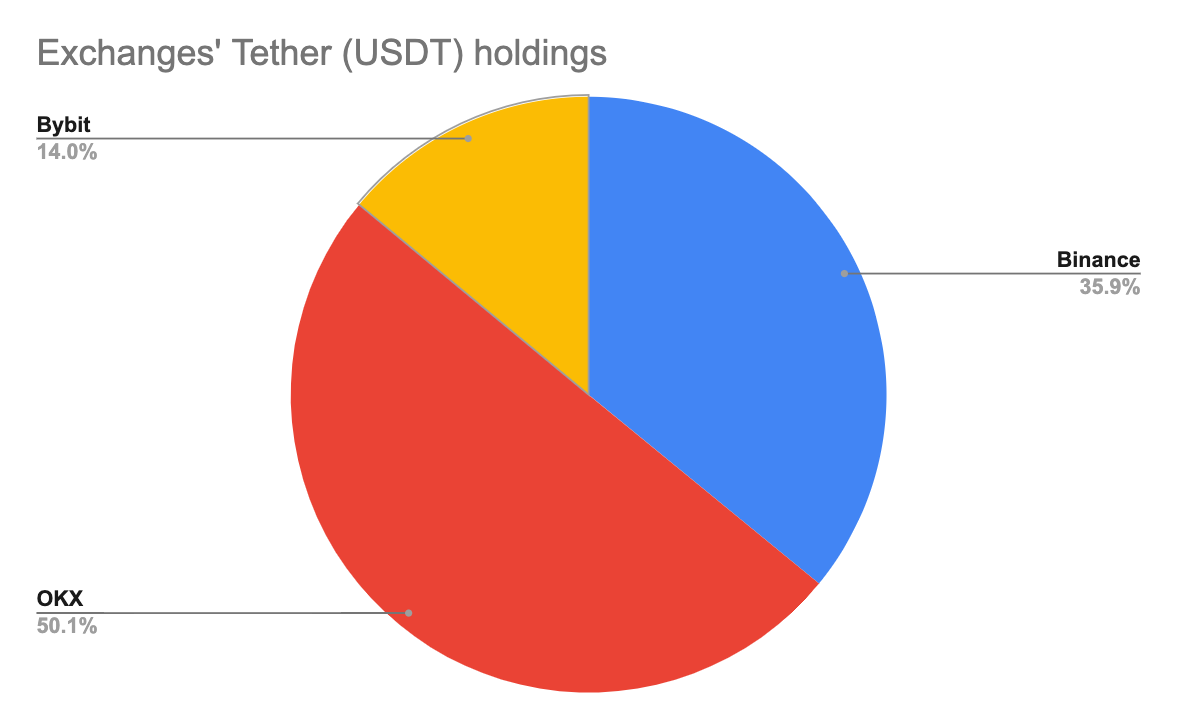

As seen in the chart below, Binance, which currently has $2.45 billion in USDT tokens, is not the top holder of Tether but the Seychelles-based OKX exchange, which has $3.42 billion in its coffers.

Top exchanges’ tether (USDT) holdings

Looking at the second largest holdings, investors can note that Dai (DAI) is the crowd favorite. Binance is yet again the largest holder of DAI, followed by OKX and ByBit.

The third largest holding is Circle’s USDC due to its recent run-in with the SEC.

Exchanges stablecoin holdings breakdown

Binance’s history with Tether and recent changes

Binance CEO Changepeng “CZ” Zhao has been accused of many things, including the collapse of the US-based FTX exchange, which was a huge supporter of Tether. Although Binance has not openly supported USDT or its parent companies, it has had massive holdings of the stablecoin due to its popularity.

In September 2022, Binance held nearly $5 billion worth of USDT. But since then, it has reduced its exposure to the stablecoin, instead focussing its efforts instead on promoting BUSD with zero-fee trading.

As Binance extended this program to other trading pairs on July 8, 2022, its market share increased rapidly from 50% to 72%, according to Kaiko research analyst Riyad Carey. However, one of the world’s largest exchanges announced on March 22, 2023, that it would halt the zero-fee trading promotion since the promotion has not helped stem its loss in market share from a peak of 70% to 58%.

There are two reasons why Binance’s share of USDT has decreased

- The first one is obvious - due to the intervention of the SEC, Binance has been reducing exposure to relatively risky stablecoins, including USDC, BUSD and USDT. Tether has been in the regulators’ crosshair for quite some time, but things seem to have settled down for now. Binance held roughly $18.58 billion in BUSD in September 2022, but due to the intervention of the SEC, the exchange’s BUSD balance has depleted by more than 50% to $7.13 billion.

- The second reason is speculation that Binance is adding more exposure to True USD (TUSD), which has connections with TRON founder Justin Sun.

Here’s a comparison of its stablecoin holdings between September 2022 and March 2023.

Binance stablecoin holdings % change

Starting mid-March 2023, Binance has started promoting the utilization of TUSD on its platform via new features like listings, swaps and loans.

The latest announcement from Binance notes the addition of multiple altcoin pairs and also encourages market makers via its “zero maker fees” policy.

Answering the question: Will Tether’s relevance decrease?

It is highly unlikely that Tether will fall out of the stablecoin race after being at the helm for such a long time. Why? As Binance reduces its USDT holdings, OKX is stepping in to replace Binance. In fact, OKX is the largest centralized exchange holder of USDT.

Apart from the regulatory concern, there is no reason for Binance to completely reject the most popular base pair for cryptocurrency trading. The exchange could reduce the exposure to USDT while it builds up its TUSD coffers, but as mentioned earlier, it will not abandon Tether.

The only scenario in which that would occur is if the regulators nail Tether down in a lawsuit. This could prompt Binance and other exchanges to do the same.

Exchange stablecoin holdings breakdown

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.