Altcoin Price Analysis Bitcoin Cash, Tezos and IOTA: BCH/USD and IOT/USD look to break past key levels

|

- BCH/USD bulls aim for the $300 psychological level.

- IOT/USD bulls aim for the $0.30 psychological level.

- XTZ/USD trends in a downward trending channel.

BCH/USD daily chart

BCH/USD bulls stay in control for the third straight day as the price went up from $289.50 to $291. The MACD shows increasing bullish market momentum. Healthy support lies at $273.35 (SMA 200), $256.50, $248.35, $241 (SMA 20) and $236.20 (SMA 50).

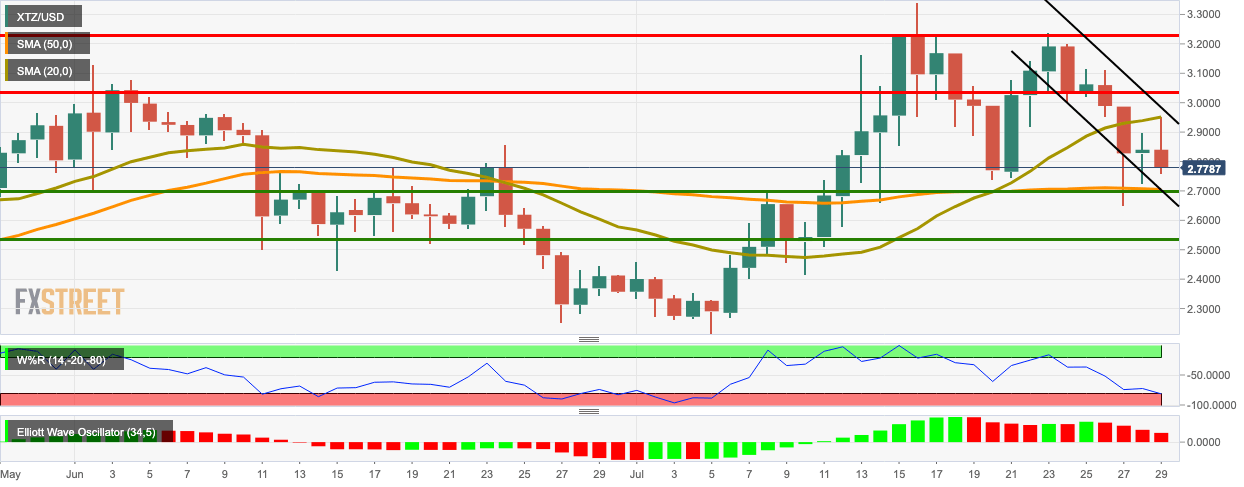

XTZ/USD daily chart

XTZ/USD is trending in a downward channel formation. The price dropped from $2.842 to $2.787. The William’s%R has dipped into the oversold zone and Elliott Oscillator has had four straight red sessions. These two indicators show that the market sentiment is presently bearish.

IOT/USD daily chart

IOT/USD bulls took charge and bouncing up from the upward trending line, going up from $0.2737 to $0.286. The MACD shows sustained bullish momentum, while the RSI has dipped into the overbought zone. The price has healthy support levels at $0.279, $0.268, $0.259 (SMA 20) and $0.24 (SMA 50).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

-637316621544408152.png)