Altcoin gems picked by crypto experts: FTM, SOL, LINK, CRV

|

- Analysts argue that the current market structure has left a huge gap to the upside.

- Experts believe the gap can inevitably get filled and result in massive price rallies in the altcoin.

- Fantom, Solana, Chainlink and Curve DAO are likely to witness largest gains during such phases of the market.

Crypto experts argue that post a bear market structure that lasts several months, there is a “gap” to the upside in alternative currencies. This gap is usually filled when the market structure changes and results in huge upside for holders.

Also read: Ethereum Improvement Proposal EIP-4844 turns experts bullish, will ETH price rally?

Crypto market structure and how it benefits altcoin holders

Crypto experienced a prolonged bear market after Bitcoin hit its new all-time high in November 2021. In the months following BTC’s massive gains, Bitcoin and altcoin prices rallied briefly in mid-2022 before pullbacks induced by the macroeconomic outlook and collapse of several cryptocurrency firms and exchanges.

The market structure turned from bearish to bullish in the beginning of 2023, with BTC’s comeback above the $20,000. Since then, Bitcoin dominance and price has increased consistently.

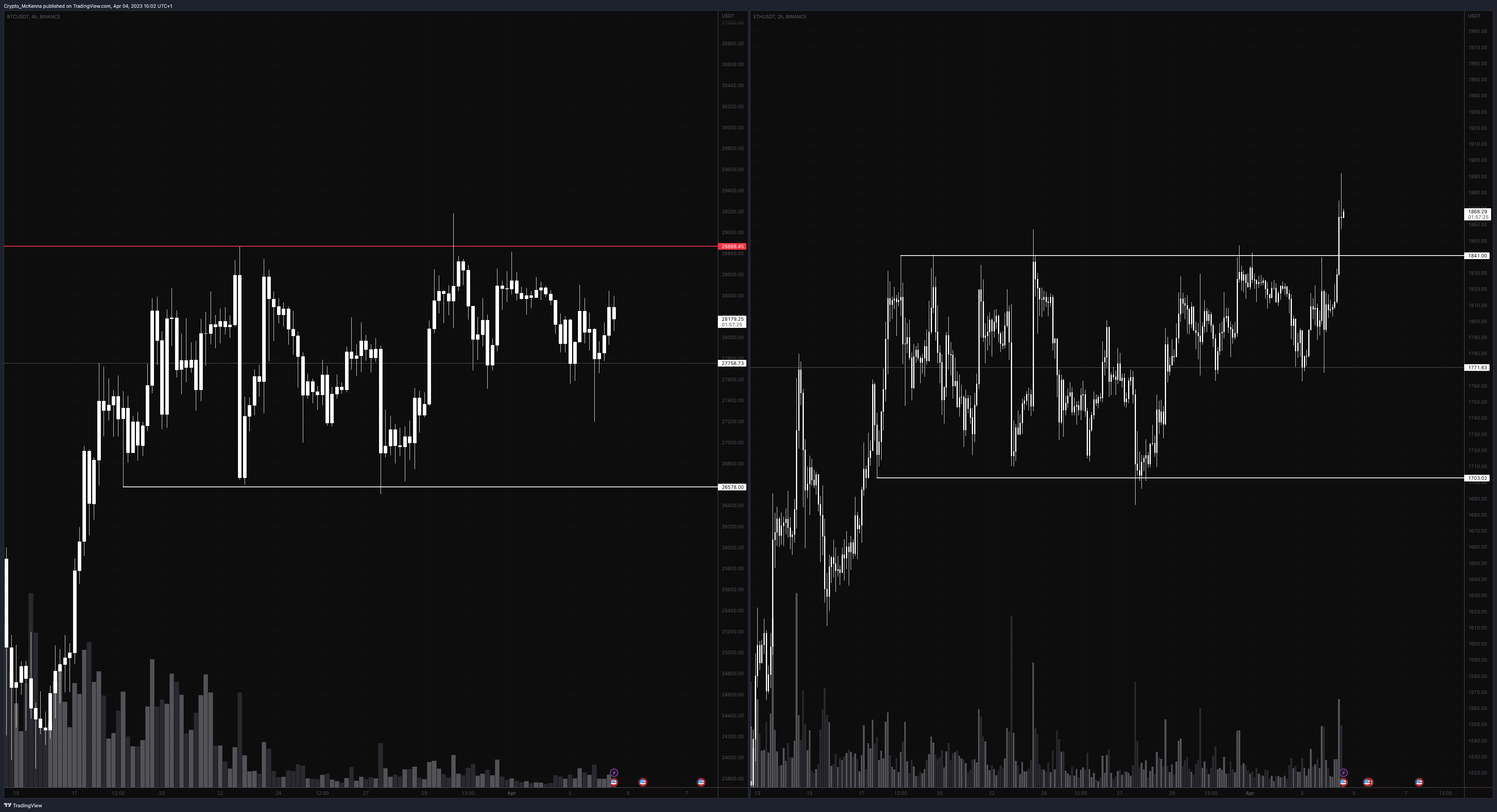

Analyst and expert Crypto Mckenna believes we are in the early innings of capital rotation from Bitcoin to Ethereum. The expert argues that this is evident from ETH price breaking its range high and BTC failing to do so.

BTC/USDT, ETH/USDT price chart

Crypto McKenna’s argument is that traders are front-running the upcoming catalyst, Shanghai upgrade and this usher in an alt season.

Tedtalksmacro, an analyst on Twitter urges market participants to consider the thesis that months long bear markets are followed by “upside” in altcoins.

The beauty of having such a deep and destructive bear market, is that when we come out of it, market structure leaves HUGE gaps to the upside (often >50%) —> which inevitably get filled.

— tedtalksmacro (@tedtalksmacro) April 5, 2023

Many alts look like they need to clear one major high timeframe resistance level here and…

The beauty of having such a deep and destructive bear market, is that when we come out of it, market structure leaves HUGE gaps to the upside (often >50%) —> which inevitably get filled.

— tedtalksmacro (@tedtalksmacro) April 5, 2023

Many alts look like they need to clear one major high timeframe resistance level here and…

According to the technical expert, several altcoins are currently poised to clear one major high time frame resistance level before an explosive rally.

Altcoin gems identified by experts: FTM, SOL, LINK, CRV

Fantom (FTM), Solana (SOL), Chainlink (LINK), and Curve DAO(CRV) were identified as the top altcoins with a potential for an explosive rally in the current market structure, by the community of analysts that responded to TedTalksMacro.

Fantom (FTM)

Fantom is a fast and scalable smart contract blockchain protocol that competes with Ethereum for low cost transactions. Clifton fx, a crypto analyst evaluated the FTM/USDT price chart and noted the formation of a bullish pennant and resulting upside breakout on the four-hour timeframe.

The bullish pennant is a technical trading pattern that precedes the continuation of a strong upside move and is spotted ahead of explosive price rallies.

FTM/USDT 4H price chart

The analyst has predicted a massive run up to the target of $0.58, a likely 25% upswing following the bullish pennant pattern.

Solana (SOL)

Solana is popular as an Ethereum-killer and the project is considered one of the most scalable alternatives to the smart contract blockchain. SOL competed with ADA and AVAX, other Ethereum alternatives.

In the following price chart, Crypto Faibik, a technical expert, spots a descending channel pattern in Solana. A descending channel pattern is usually followed by an upside move, given there is a penetration of the upper trend line.

SOL/USDT 1D price chart

The analyst argues that SOL price is likely to break out of the multi-year trendline resistance at $21 to confirm a bullish breakout. Once SOL price exceeds $21, analysts expect a strong move to the upside with a target of $100, a likely 314% upswing.

Chainlink (LINK)

Chainlink has on-chain metrics supporting the accumulation of LINK and the reduction in LINK supply on exchanges. Based on data from IntoTheBlock, nearly 9.63 million LINK tokens, worth $67.42 million were withdrawn from exchange wallets. This signals a shift in sentiment among Chainlink holders.

LINK balance on exchanges

At the same time, according to on-chain data nearly 70,000 addresses acquired 406 million LINK tokens between $6.3 and $7. This marks $6.3 to $7 as a major support area that could prevent LINK price from plummeting to new lows.

Grail_Whale, an analyst on crypto Twitter evaluated the LINK price chart and noted the consolidation of the altcoin has been ongoing for months.

LINK/USD 1W price chart

Typically, several months of consolidation is followed by a major volatility in the altcoin. The expert therefore predicts a massive rally in Chainlink.

Curve DAO (CRV)

@RodMartin, a technical analyst notes that on the CRV price chart there was a downtrend, retest of a key level, and a similar trend in lower time frames. According to the expert this is a setup that typically results in a massive uptick in the asset’s price.

CRV/USDT 4H and 1H price charts

The analyst’s target for the altcoin is beyond the $1.04 level. A massive move to the upside could send CRV to its $1.27 bullish target.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.