AI tokens could rally ahead of Nvidia earnings

|

- Cryptocurrencies in the Artificial Intelligence category could see gains as the market prepares for Nvidia earnings next week.

- Shares of Nvidia have emerged as the poster child for AI crypto tokens, assets noted a rally post the previous earnings report.

- AI tokens noted gains in their prices in the last week of February 2024 following Nvidia earnings.

Native cryptocurrencies of several blockchain projects using Artificial Intelligence (AI) could register gains in the coming week as the market prepares for Nvidia (NVDA) earnings report. Render (RNDR) and Origintrail (TRAC) posted gains in the past 24 hours, while other AI tokens in the top 20 assets ranked by market capitalization were hit by a correction.

AI token narrative could gain relevance next week

Amidst other narratives, AI tokens could gather momentum with the upcoming earnings result of Nvidia next week. The $2.3 trillion company’s stock emerged as a poster child for the crypto AI sector and gains in the stock catalyzed a rally in cryptocurrency tokens.

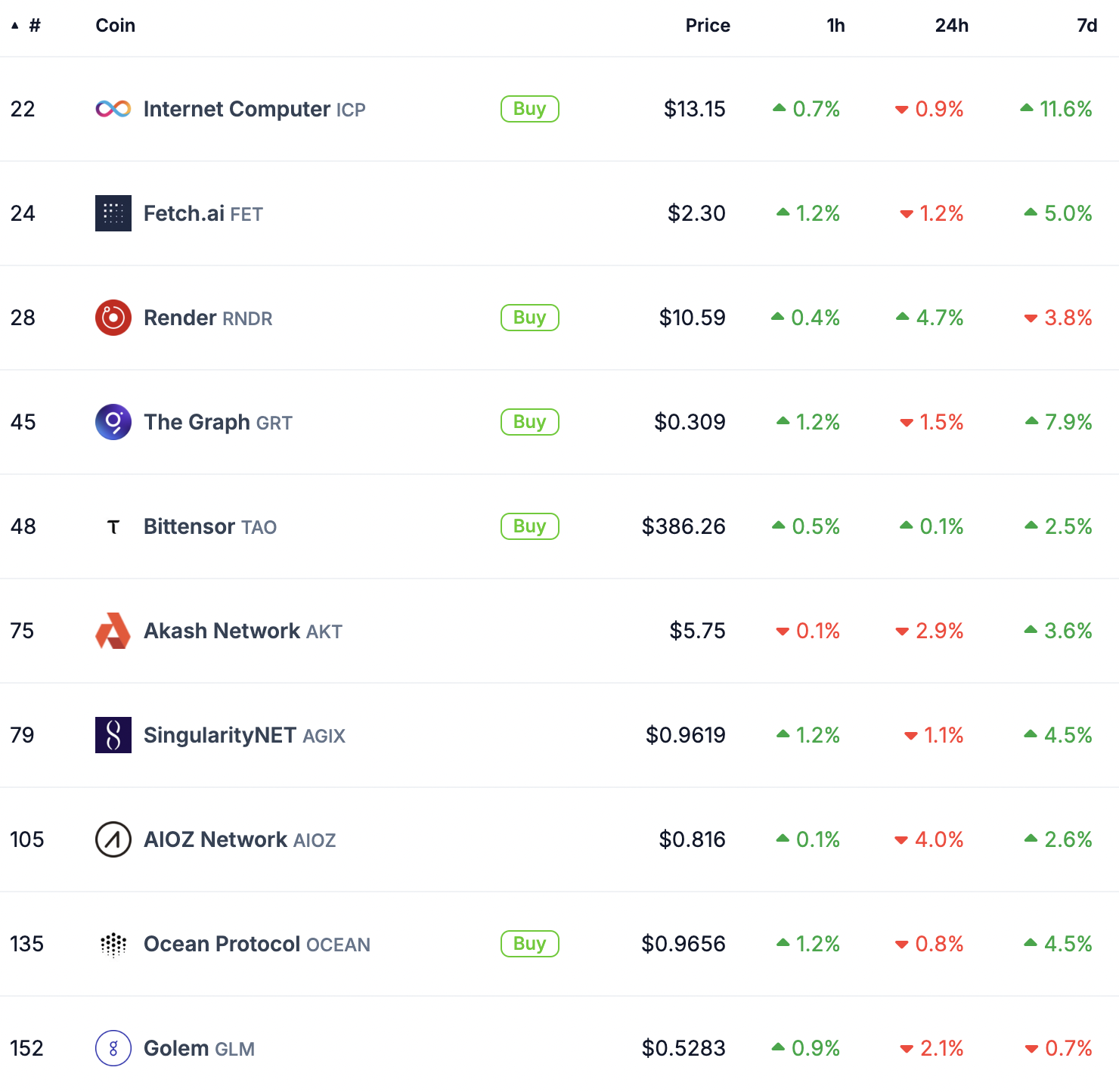

Data from CoinGecko shows that Fetch.ai (FET), Render (RNDR), the Graph (GRT), Bittensor (TAO), Akash Network (AKT), SingularityNET (AGIX) have sustained their gains from the past seven days even as most tokens suffered a correction in the past 24 hours.

AI token prices

AI tokens present a “buy the dip” opportunity to sidelined traders as they await a recovery in prices, fueled by the report next week. When Nvidia released earnings in February, shares of Nasdaq-listed chipmaker and tokens in the top 20 in the AI category posted gains. These assets gained up to 30% in value in the last week of February, based on data from Coingecko.

Tokens in the artificial intelligence category can expect both an increase in activity and social media mentions and a surge in value next week, if history repeats. The earnings result is scheduled for May 22.

(This story was corrected on March 20 at 11:02 GMT to say that the chipmaker's company is Nvidia, while NVDA is the ticker.)

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.