ADA slips out of top 10 cryptos, risk heavy correction as on-chain indicators turn bearish

|

- Cardano's market capitalization has plummeted more than 50% since March following loss of top 10 spot among largest cryptocurrencies.

- Investors that bought ADA within the last two years are holding an average loss of 26%.

- ADA long-term holders may be capitulating as its daily and weekly active addresses reached their lowest level since 2020.

- A daily candlestick close above $0.457 will invalidate the bearish thesis.

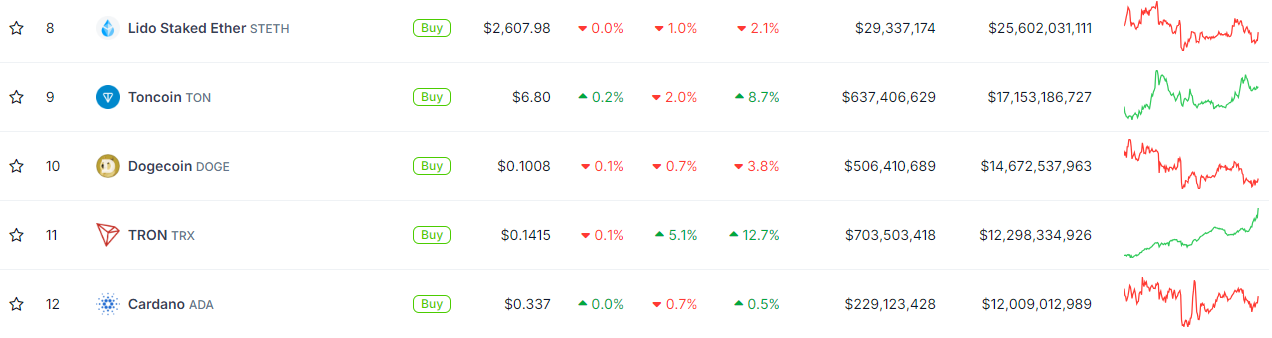

Cardano (ADA) slipped out of the top 10 cryptocurrencies by market capitalization on Monday following a bearish signal across several of its on-chain metrics.

ADA risk further decline after slip from top 10

ADA dropped out of the top 10 cryptocurrencies by market capitalization for the first time in four years on Monday, according to data from CoinGecko.

ADA has largely underperformed in the current cycle compared to other altcoins, considering its price has been on a five-month decline since mid-March. In the same period, its market capitalization has plummeted by 56%, declining from $27.33 billion on March 12 to ~$12 billion on Monday. ADA's price performance since the beginning of the year also shows that investors have seen the value of their holdings decline by 43%.

Top cryptos by market capitalization

Zooming out, IntoTheBlock's Global In/Out of the Money shows that most ADA holders have sustained heavy unrealized losses. Global In/Out of the Money measures all coins and addresses average profit and loss. An address or coin is out of the money if the current price is lesser than its average cost price and vice versa if in the money.

ADA's In/Out of the Money metric reveals that over 78% of addresses and 68% of coins are out of the money, with the largest accumulation zone between $0.4 to $0.6.

Santiment's 365-day Market Value to Realized Value (MVRV), which measures the average performance of all addresses that bought ADA in the past year, reveals that investors in this category are holding an average loss of 26% — the same as its 2-year MVRV.

ADA 365-day Dormant Circulation and MVRV

ADA's 365-day Dormant Circulation, which measures the movement of coins that haven't left an address in the past year, saw a major spike to 719.12 million ADA on Monday — its highest level since 2022. A similar spike is also visible in the 180-day Dormant Circulation. This suggests that long-term holders may be selling their coins, and ADA's price has often declined whenever these metrics see a spike.

Additionally, Cardano's daily and weekly active addresses declined to 19,669 and 112.25K, levels last seen in 2020.

ADA Daily and Weekly Active Addresses

The summary of these on-chain metrics indicates that investors are potentially heavily bearish on ADA.

On the technical analysis side, the Awesome Oscillator posted a bearish saucer on Thursday after a red bar accompanied two consecutive green bars. While the move indicates a downward reversal, prices have remained largely sideways since it occurred. A breach of the support line around $0.275 would strengthen the bearish view.

ADA/USDT Daily chart

On the upside, ADA faces resistance from the 200-day, 100-day and 50-day simple moving averages (SMA). A daily candlestick close above the resistance at $0.457 will invalidate the bearish thesis.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.