WTI outlook: Oil falls below $70 per barrel as tariff concerns further sour the sentiment

|

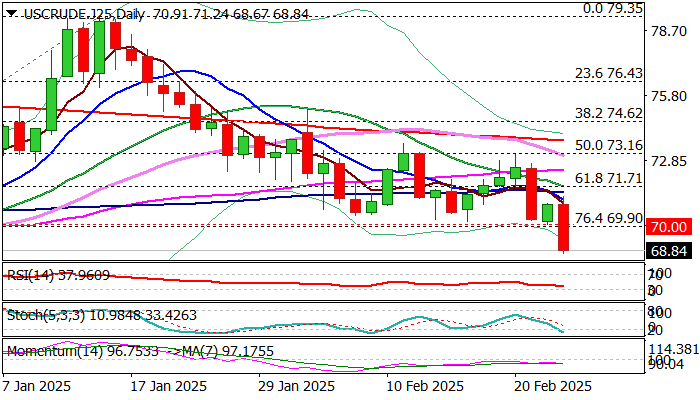

WTI oil price fell below psychological $70 support on Tuesday and hit the lowest levels in two months.

Oil was down nearly 3% on renewed fears about the global economy and lower demand after the latest economic data showed that German economy contracted for the second straight quarter and US consumer confidence declined at the fastest pace since mid-2021.

Strong concerns among investors were also fueled by US tariffs on imports, as President Trump signaled that initially delayed tariffs on imports from Canada and Mexico, will be implemented according to the schedule – at the beginning of next month.

Tariffs on China’s goods imports further contribute to negative outlook, as this would directly fuel inflation, while consequences of trade war would be significant.

Negative fundamentals continue to sour the sentiment and raise pressure on oil prices.

Sustained break below $70/$69.90 supports (psychological / Fibo 76.4% of $66.98/$79.35 rally) to further firm bearish stance and risk dip towards weekly base at $67.00/66.30 zone (Oct/Dec 2024).

Broken $70 zone reverted to solid resistance which should ideally cap.

Res: 69.79; 70.00; 70.83; 71.44

Sup: 68.44; 67.70; 66.98; 66.54

Interested in WTI technicals? Check out the key levels

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.