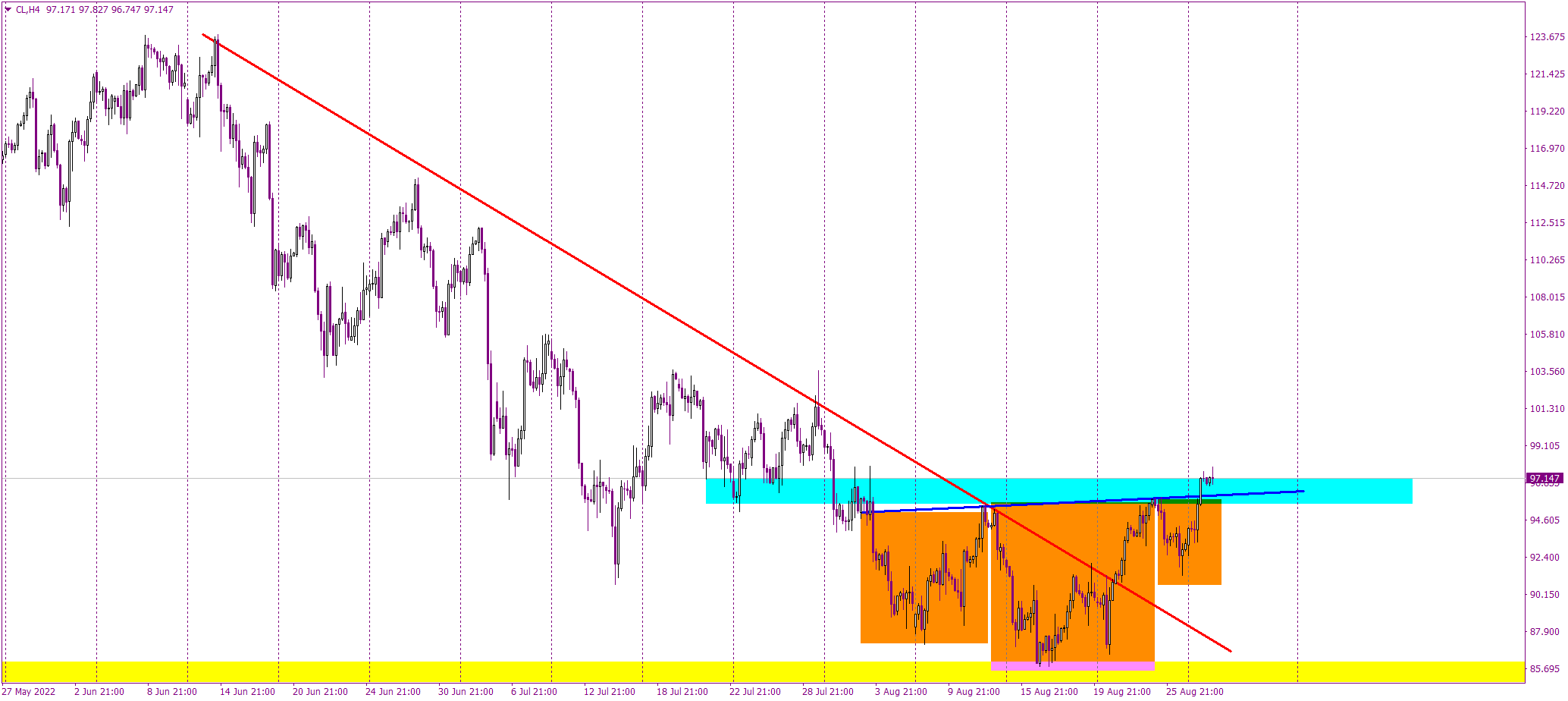

WTI climbs higher after breaking the neckline of the inverted head and shoulders formation

|

Oil is on the run and the upswing is heavily supported by an excellent bullish technical situation on the chart. The buy signal is still fresh as it comes from yesterday, so there’s still a lot of room for buyers to extend the rise.

In the middle of August, WTI bounced off the support on the 86 USD/bbl, which was a local top in October and November last year. The bounce was not random as the price created and inverse head and shoulders pattern (orange), which is a very reliable price action formation. Oil broke the neckline of the pattern (blue) yesterday and that technically, gives us a proper buy signal. A few days before, on the 22nd of August, buyers managed to break the down trendline (red), which should also be considered as a positive factor.

Today, after the breakout of the neckline, the price is continuing to climb higher, targeting August highs. In my opinion, a buy signal is fully ON as long as the price stays above the neckline of the inverted head and shoulders pattern.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.