What the Jackson Hole Symposium could mean for your investments

|

This week, the market will focus on the Jackson Hole Economic Symposium, held on August 22-24. The topic is "Reassessing the Effectiveness and Transmission of Monetary Policy." Markets are looking for clues about a potential rate cut in September, with a 69.5% chance of a 25bps cut and a 30.5% chance of a 50bps cut being priced in (source: CME group fedwatch).

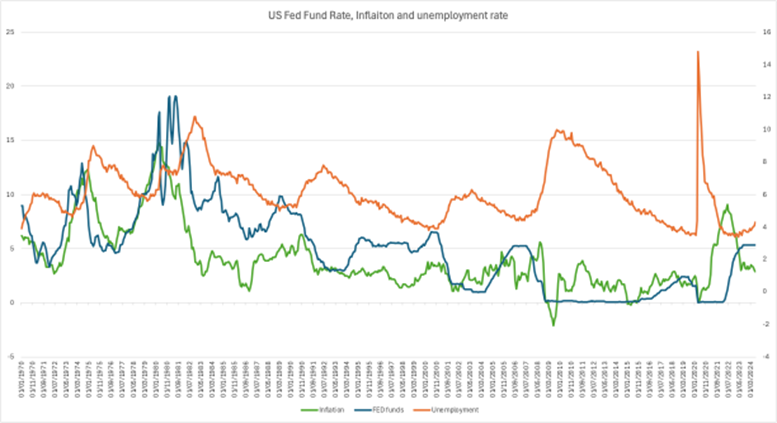

Source: adopted from Reuters

The Federal Reserve's dual mandate is to achieve maximum employment and stable prices. Since 2000, the Fed has prioritised unemployment in its decisions. In 2007, the Fed cut interest rates as unemployment rose, despite later inflation rised. From 2010 to 2016, rates remained near zero until unemployment fell below 5%. After COVID-19, inflation increased in 2021, but rate hikes were delayed until 2022 due to high unemployment. Recently, unemployment has risen to 4.3%, and the Fed is likely to cut rates in September. Chairman Powell is expected to discuss future monetary policy in his upcoming speech.(source: BLS)

Is unemployment caused by AI or the economic downturn?

The influence of AI on the job market has become an undeniable reality. About 30% of workers globally fear AI will replace their jobs in the next three years. However, in fact only 14% have actually experienced job displacement due to AI so far.(source: SEO.AI)

US Employment changed by industry, 1 month net change and 3 month net change.

Source: BLS

Comparing employment changes by industry, unemployment seems most affected by the information sector, possibly due to AI displacing jobs more than the US economic downturn. In July 2024, US retail sales rose by 1% month-over-month, surpassing the forecasted 0.3% gain. This was the largest increase since January 2023, with the most significant growth in motor vehicle and parts dealers (3.6%), followed by electronics and appliance stores (1.6%).

Source: Adopted from Reuters

The chart above displays the link between the Effective Fed Fund Rate and gold price. In 2007, as the Fed Fund Rate fell from 5.26% to 0.15%, gold prices rose by 123%. In 2019, a 2.4% drop in the Fed Fund Rate led to a 50.7% increase in gold prices. On average, a 1% reduction in the Fed Fund Rate results in a 2.2% rise in gold price. If the Fed cuts rates by 1% in the next cycle, gold prices could reach $3,000 per ounce.

Source: MacroMicro

The S&P 500 forward PE ratio is 21.79, which is not considered low but still has room to increase.

Conclusion

The Jackson Hole Economic Symposium, taking place from August 22-24, will be a key event for financial markets this week. With the symposium focusing on "Reassessing the Effectiveness and Transmission of Monetary Policy," market participants are closely watching for signals about potential changes in interest rates. The Chairman Powell speech could significantly influence market trends and investor sentiment, especially given the recent rise in unemployment and the Fed's historical focus on balancing employment and inflation.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.