US Dollar Index outlook: Keeps firm tone against its major world counterparts

|

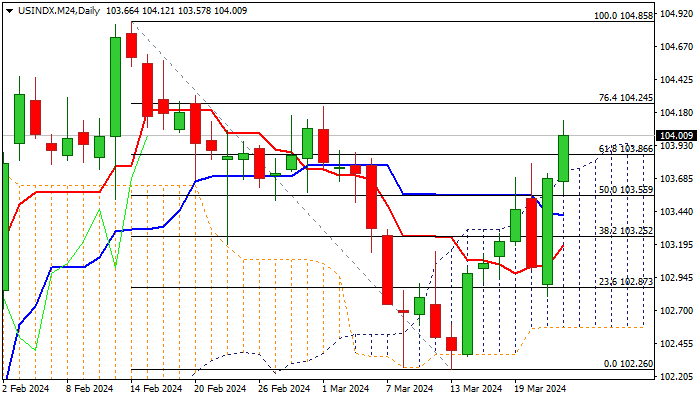

US Dollar Index

The dollar index advances for the second consecutive day and hit three-week high on Friday, also on track for the second weekly gain.

Dollar’s bullish stance was boosted by persisting gap in interest rate settings between the Fed and its major peers, as well as strong signals that the US economy remains resilient, which can accommodate extended period of high borrowing cost.

World’s major central banks already made changes to their monetary policies or sent signals that they are on the way to act in the near future, while the Fed left the rates unchanged in the policy meeting this week and repeated their readiness to start easing monetary policy later this year, but repeated that more evidence that inflation is steadily on the way towards 2% target is needed, before making any decision.

Fresh extension higher generated bullish signals on emerge above the top of daily Ichimoku cloud (103.74) and Fibo 61.8% of 104.85/102.26 (103.86), with close above these levels to confirm signals.

Near-term action is expected to keep bullish bias while holding above daily cloud top

Res: 104.25; 104.56; 104.85; 105.47.

Sup: 103.86; 103.74; 103.48; 103.25.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.