Three Fundamentals: Year-end flows, Jobless Claims and ISM Manufacturing PMI stand out

Premium|

You have reached your limit of 5 free articles for this month.

Get all exclusive analysis, access our analysis and get Gold and signals alerts

Elevate your trading Journey.

UPGRADE- Money managers may adjust their portfolios ahead of the year-end.

- Weekly US Jobless Claims serve as the first meaningful release in 2025.

- The ISM Manufacturing PMI provides an initial indication ahead of Nonfarm Payrolls.

There is life beyond New Year's parties – for those trading markets, there is room for volatility and action in the days around the holiday.

1) End-of-year flows may trigger wild price action

Tuesday, especially toward the end of the European session. Money managers receive "report cards" at the end of each quarter and, more importantly, at the end of the calendar year. In 2024, Stocks, Gold, and the US Dollar rose, but at an uneven pace.

To hold onto the right share of each asset, managers need to sell and buy assets. Most have already adjusted their portfolios according to changes in valuations, but some last-minute adjustments always occur.

Moreover, this scramble comes on top of low liquidity, as many market participants are off for the whole week. That means irrational price action on December 31, which is then – at least partially – undone on January 2. The full price action is set to return only next week.

2) Jobless Claims provide first opportunity to react to data in 2025

Thursday, 13:30 GMT. Weekly unemployment claims are considered the "canary in the coalmine" to any deterioration in the labor market. In recent months, these have been depressed, pointing to a healthy demand for workers.

The release on January 2 is for the week that ended on December 27. It is set to show an outcome similar to the 219K reported in the previous week. An outcome closer to 200K would boost the US Dollar and Stocks while pressing on Gold. A figure above 230K would do the opposite.

Any significant deviation could result in substantial price action. Some traders will have returned to markets after the holiday with fresh energy, while others are still off for the week. The illiquidity means small orders could trigger bigger moves.

3) ISM Manufacturing PMI may trigger fireworks

Friday, 15:00. The first Friday of the month does not feature Nonfarm Payrolls this time – these are released on January 10. However, enthusiastic traders have the first hint toward that critical release to chew on.

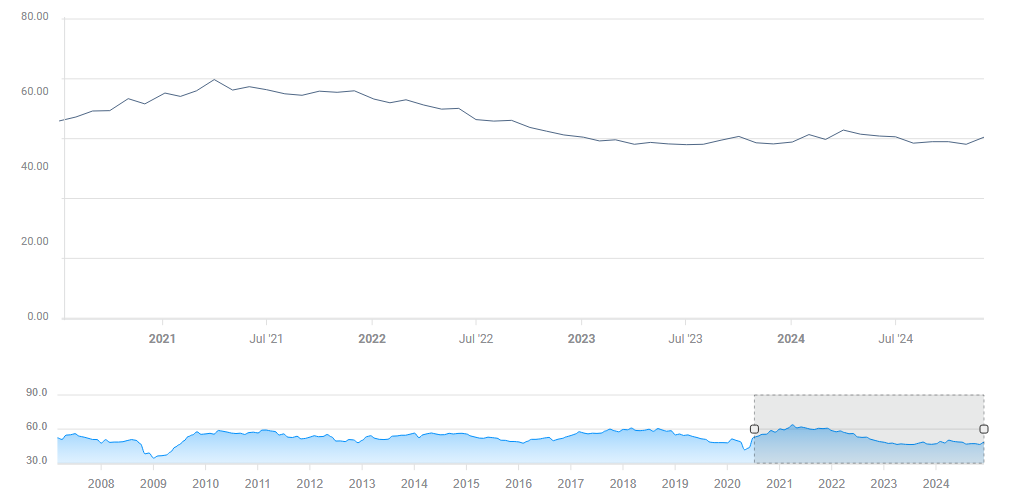

The ISM Manufacturing PMI is a forward-looking snapshot of the sentiment in the industrial sector. It has been struggling lately, hovering below the 50-point threshold separating expansion from contraction.

ISM Manufacturing PMI. Source: FXStreet.

After hitting 48.4 in November, a score of 48.3 is on the cards for December. The Employment component of this indicator came out at 48.1 last time, also pointing to hiring struggles among manufacturers.

Any improvement in both the headline and the employment component would boost Stocks and the US Dollar while weighing on Gold. Another downbeat figure would do the opposite.

I expect an uptick in enthusiasm, allowing those energetic investors who have returned to show their animal spirits and boost markets.

Final Thoughts

The lack of liquidity means many moves, especially on December 31, will be hard to explain. Trade with care – or enjoy the holiday.

- Money managers may adjust their portfolios ahead of the year-end.

- Weekly US Jobless Claims serve as the first meaningful release in 2025.

- The ISM Manufacturing PMI provides an initial indication ahead of Nonfarm Payrolls.

There is life beyond New Year's parties – for those trading markets, there is room for volatility and action in the days around the holiday.

1) End-of-year flows may trigger wild price action

Tuesday, especially toward the end of the European session. Money managers receive "report cards" at the end of each quarter and, more importantly, at the end of the calendar year. In 2024, Stocks, Gold, and the US Dollar rose, but at an uneven pace.

To hold onto the right share of each asset, managers need to sell and buy assets. Most have already adjusted their portfolios according to changes in valuations, but some last-minute adjustments always occur.

Moreover, this scramble comes on top of low liquidity, as many market participants are off for the whole week. That means irrational price action on December 31, which is then – at least partially – undone on January 2. The full price action is set to return only next week.

2) Jobless Claims provide first opportunity to react to data in 2025

Thursday, 13:30 GMT. Weekly unemployment claims are considered the "canary in the coalmine" to any deterioration in the labor market. In recent months, these have been depressed, pointing to a healthy demand for workers.

The release on January 2 is for the week that ended on December 27. It is set to show an outcome similar to the 219K reported in the previous week. An outcome closer to 200K would boost the US Dollar and Stocks while pressing on Gold. A figure above 230K would do the opposite.

Any significant deviation could result in substantial price action. Some traders will have returned to markets after the holiday with fresh energy, while others are still off for the week. The illiquidity means small orders could trigger bigger moves.

3) ISM Manufacturing PMI may trigger fireworks

Friday, 15:00. The first Friday of the month does not feature Nonfarm Payrolls this time – these are released on January 10. However, enthusiastic traders have the first hint toward that critical release to chew on.

The ISM Manufacturing PMI is a forward-looking snapshot of the sentiment in the industrial sector. It has been struggling lately, hovering below the 50-point threshold separating expansion from contraction.

ISM Manufacturing PMI. Source: FXStreet.

After hitting 48.4 in November, a score of 48.3 is on the cards for December. The Employment component of this indicator came out at 48.1 last time, also pointing to hiring struggles among manufacturers.

Any improvement in both the headline and the employment component would boost Stocks and the US Dollar while weighing on Gold. Another downbeat figure would do the opposite.

I expect an uptick in enthusiasm, allowing those energetic investors who have returned to show their animal spirits and boost markets.

Final Thoughts

The lack of liquidity means many moves, especially on December 31, will be hard to explain. Trade with care – or enjoy the holiday.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

![EUR/USD breakdown under $1.1300 targets $1.1050 [Video]](https://editorial.fxsstatic.com/images/i/EURUSD-bearish-object_XtraSmall.png)