Slovakia: Strong economic start to 2024

|

-

Strong start for Slovak economy in 2024.

-

ECB decides on first interest rate cut.

-

More than 70% of financing needs are covered.

-

Weaker dollar expected.

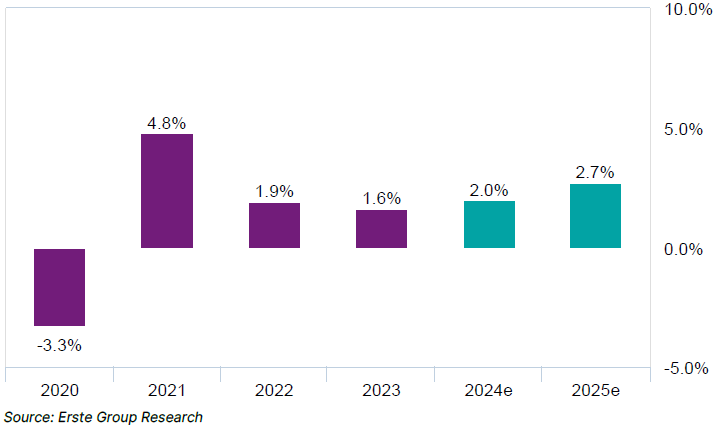

The Slovak economy experienced a strong start to 2024, with y/y GDP growth at 2.7%. The main drivers were household consumption, benefiting from rapid income growth and decreasing inflation, and government consumption. Investment activity showed a relatively weak performance in 1Q24. We anticipate that GDP growth will continue for the remainder of the year, driven primarily by ongoing robust household consumption and increased investment activity, due to NextGen funds. Towards the end of the year, we also expect some boost from foreign demand. Economic growth for this year could thus reach 2%, with slight upside risks.

The inflation rate dropped to two percent, but with the base effect fading out, it will rise again slightly in the coming months. The tight labor market is pushing up wage growth, which creates pressure for price increases. Inflation is expected to average around three percent this year. The Ministry of Finance announced fiscal consolidation in the amount of one percent of GDP annually. However, specific measures are yet to be revealed. For now, it seems that rating agencies have placed their trust in the credibility of this commitment. PM Robert Fico is gradually recovering after an assassination attempt.

GDP (real,y/y)

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.