Nonfarm Payrolls Preview: Five scenarios for trading King Dollar as markets plead for pain

Premium|

You have reached your limit of 5 free articles for this month.

Get all exclusive analysis, access our analysis and get Gold and signals alerts

Elevate your trading Journey.

UPGRADE- Economists expect a slowdown in US job growth to 250,000 in September.

- The Fed needs to see pain to pivot from tight policy, putting the focus on jobs.

- Only a sub-100K increase would dethrone the dollar – one of five scenarios.

- Each outcome is accompanied by a potential trade.

No pain, no gain – this gym idiom resonates with stock bulls. The Federal Reserve has said it is willing to accept – and even wants to see – economic pain to see inflation falling. Last month was painful in financial markets, but did American employment also feel the pinch?

The focus of September's Nonfarm Payrolls is on the headline change in jobs, vastly overshadowing wages and other figures. I will focus on the headline, providing five scenarios for market reactions. First, some background.

Soft landing or hard recession?

The Fed has stopped talking about a soft landing but refrains from using the R-word – recession. It is only talking about below-normal growth and the unemployment rate rising to 4.4% from 3.7%. Fewer workers mean less money to spend and easing price pressures.

Earlier, hopes for an easing in the labor shortage – somewhat related to the "Great Resignation" phenomenon – was enough for the Fed. An unsnarling of supply-chain issues also carried hope for inflation to fall. That didn't happen either.

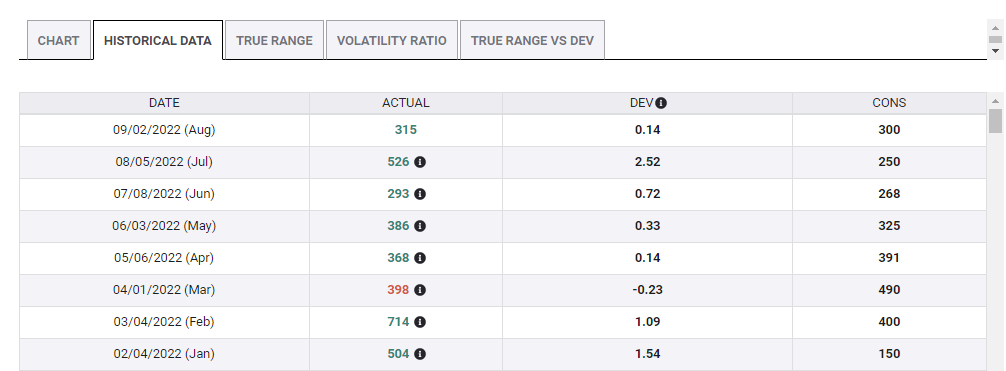

August's super-strong increase in core inflation, 0.6% MoM, has convinced policymakers that pain is needed. The labor market has been far from reflecting anything resembling discomfort. The US gained 315K positions in August, beating expectations for the seventh time in eight months so far this year.

No pain nor discomfort in these numbers:

Source: FXStreet

What would consist of pain? The Fed and markets eye the pre-pandemic average of roughly 200K. That might have been reached in September – at least according to expectations. The economic calendar points to an addition of 250,000 positions, so sub-200K is not too far away.

Five scenarios for Nonfarm Payrolls

1) Within expectations: An outcome of 200-300K would be considered within expectations in current volatile market conditions. It would imply slower US job growth but still healthy expansion. Investors would likely sell stocks and push the dollar higher, albeit moderately.

The focus would quickly shift to next week's all-important inflation report as the real arbiter of the next move.

USD/JPY would likely provide the most straightforward reaction to such an outcome.

2) Below expectations: An increase of 100-200K would already be significant, showing that the economy is creating jobs at a pace lower than the covid era. Stocks would rise on hopes for the Fed to slow its tightening pace and would price a 50 bps hike for November more seriously. The odds are currently tilted in favor of a 75 bps hike. The dollar would fall.

However, after a small move, the basic trend of lower stocks and a stronger dollar would resume. Why? A small drop would be seen as a one-off event – inflation significantly slowed in July only to bounce back in August.

A "sell the rally" move on GBP/USD could be a potential trade – volatility is high in this currency pair, which is set to overreact to a not-so-huge miss.

3) Significantly below expectations: Any sub-100K rise would already be worrying for the US economy, sending the dollar down and stocks surging. The effect would probably last for longer and would not be seen as a one-time event. It would be exacerbated if the US reports a loss of jobs – but that is highly unlikely.

Buying AUD/USD or NZD/USD, the risk currencies could work out well. They tend to surge with stocks.

4) Above expectations: An increase of 300-400K jobs would trigger a sharp market fall and a fresh leg higher for the greenback. It would show that the steady trend of upbeat job growth continues and that the Fed still has more work to do.

Selling EUR/USD would seem like a solid move to such an outcome, fading the recent recovery of the pair.

5) Considerably above expectations: A leap of over 400K positions would send the dollar soaring and shape a market sell-off – and it cannot be ruled out. America gained no fewer than 526K jobs in July and the relatively lower increase in August could be the real one-off.

Selling AUD/USD or NZD/USD would work here – similar to scenario #3, the mirror image of this one.

Final thoughts

While the Fed focuses on inflation, pain in the labor market – full employment is its second mandate – would be significant to markets. The dollar and stock markets are set to respond to any outcome, with the tables still tilted in favor of the greenback and against shares.

- Economists expect a slowdown in US job growth to 250,000 in September.

- The Fed needs to see pain to pivot from tight policy, putting the focus on jobs.

- Only a sub-100K increase would dethrone the dollar – one of five scenarios.

- Each outcome is accompanied by a potential trade.

No pain, no gain – this gym idiom resonates with stock bulls. The Federal Reserve has said it is willing to accept – and even wants to see – economic pain to see inflation falling. Last month was painful in financial markets, but did American employment also feel the pinch?

The focus of September's Nonfarm Payrolls is on the headline change in jobs, vastly overshadowing wages and other figures. I will focus on the headline, providing five scenarios for market reactions. First, some background.

Soft landing or hard recession?

The Fed has stopped talking about a soft landing but refrains from using the R-word – recession. It is only talking about below-normal growth and the unemployment rate rising to 4.4% from 3.7%. Fewer workers mean less money to spend and easing price pressures.

Earlier, hopes for an easing in the labor shortage – somewhat related to the "Great Resignation" phenomenon – was enough for the Fed. An unsnarling of supply-chain issues also carried hope for inflation to fall. That didn't happen either.

August's super-strong increase in core inflation, 0.6% MoM, has convinced policymakers that pain is needed. The labor market has been far from reflecting anything resembling discomfort. The US gained 315K positions in August, beating expectations for the seventh time in eight months so far this year.

No pain nor discomfort in these numbers:

Source: FXStreet

What would consist of pain? The Fed and markets eye the pre-pandemic average of roughly 200K. That might have been reached in September – at least according to expectations. The economic calendar points to an addition of 250,000 positions, so sub-200K is not too far away.

Five scenarios for Nonfarm Payrolls

1) Within expectations: An outcome of 200-300K would be considered within expectations in current volatile market conditions. It would imply slower US job growth but still healthy expansion. Investors would likely sell stocks and push the dollar higher, albeit moderately.

The focus would quickly shift to next week's all-important inflation report as the real arbiter of the next move.

USD/JPY would likely provide the most straightforward reaction to such an outcome.

2) Below expectations: An increase of 100-200K would already be significant, showing that the economy is creating jobs at a pace lower than the covid era. Stocks would rise on hopes for the Fed to slow its tightening pace and would price a 50 bps hike for November more seriously. The odds are currently tilted in favor of a 75 bps hike. The dollar would fall.

However, after a small move, the basic trend of lower stocks and a stronger dollar would resume. Why? A small drop would be seen as a one-off event – inflation significantly slowed in July only to bounce back in August.

A "sell the rally" move on GBP/USD could be a potential trade – volatility is high in this currency pair, which is set to overreact to a not-so-huge miss.

3) Significantly below expectations: Any sub-100K rise would already be worrying for the US economy, sending the dollar down and stocks surging. The effect would probably last for longer and would not be seen as a one-time event. It would be exacerbated if the US reports a loss of jobs – but that is highly unlikely.

Buying AUD/USD or NZD/USD, the risk currencies could work out well. They tend to surge with stocks.

4) Above expectations: An increase of 300-400K jobs would trigger a sharp market fall and a fresh leg higher for the greenback. It would show that the steady trend of upbeat job growth continues and that the Fed still has more work to do.

Selling EUR/USD would seem like a solid move to such an outcome, fading the recent recovery of the pair.

5) Considerably above expectations: A leap of over 400K positions would send the dollar soaring and shape a market sell-off – and it cannot be ruled out. America gained no fewer than 526K jobs in July and the relatively lower increase in August could be the real one-off.

Selling AUD/USD or NZD/USD would work here – similar to scenario #3, the mirror image of this one.

Final thoughts

While the Fed focuses on inflation, pain in the labor market – full employment is its second mandate – would be significant to markets. The dollar and stock markets are set to respond to any outcome, with the tables still tilted in favor of the greenback and against shares.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.