Manufacturing on the borderline: Will January industrial production last?

|

Summary

Colder weather helped boost industrial output at the start of the year, yet there are some signs of a slow awakening in manufacturing production. Higher borrowing costs and a prioritization of software over hardware have sapped broad manufacturing, yet tariffs are the biggest risk to recovery this year.

Wake me up when the tariffs end

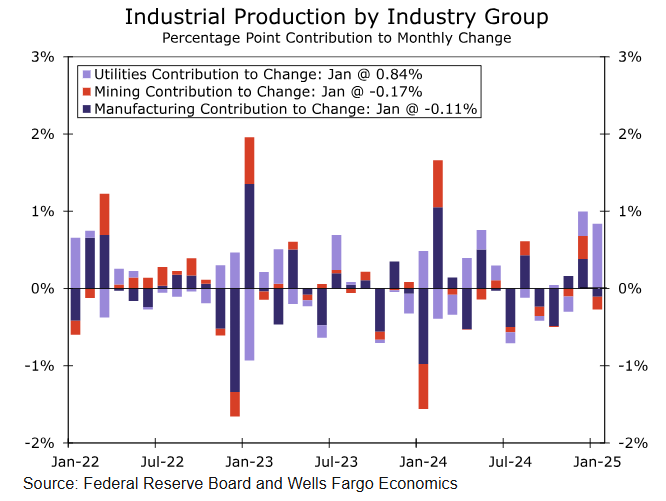

There's some sign of life in the industrial sector. Overall production rose 0.5% in January, which comes off an upwardly-revised 1% gain in December. Most of the increase came from the utilities sector last month, where output leaped 7.2% (chart). Colder-weather and unusual winter storms across the Southern portion of the country likely were responsible for the strength here.

Yet, when you look beyond utilities, the data were a bit more lackluster. Mining production slipped 1.2% and manufacturing pulled back 0.1%. On a year-ago basis, manufacturing picked up at the start of the year, which is somewhat consistent with the ISM manufacturing index breaking above 50 in January and signaling expansion for the first time since 2022 (chart). But, the hard-manufacturing data in this release continue to paint a picture of activity only slowly awakening.

Most of the manufacturing weakness stemmed from auto & parts production specifically, which slipped 5.2% last month. In excluding autos, manufacturing production rose 0.2%. Elsewhere, a continued strike-related pick up in aircraft manufacturing helped offset weakness, with aerospace production posting its second 6%+ monthly gain. The two largest U.S. manufacturing industries, chemicals and food & beverages, were flat and modestly down last month.

The manufacturing sector has been struggling to find its legs. Higher financing costs have eroded demand for large capex among businesses, while a prioritization of software over hardware this cycle has left traditional manufacturers with less demand. Consider the categories associated with automation and software have actually done quite well and bucked the stalling manufacturing trend. Computer & electronic products' production, for example, picked up 1.5% in January and is up 5.3% over the past year, the second highest annual gain behind chemicals. Selected high-tech industries overall are up 6.2% over the past year, compared to just a 0.7% gain in non-high-tech manufacturing.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.