Gold outlook: Continues to benefit from Fed's recent dovish shift

|

XAU/USD

Gold price eased from five-week high on Friday, driven by a partial profit-taking at the end of the week, following a three-day rally.

The yellow metal was supported by recent US economic data which showed weaker than expected US core inflation numbers in December and revived narrative of more Fed rate cuts in 2025.

Markets bet for two cuts against initially signaled only one cut this year, while the latest comments from Fed Governor about possible three or four cuts if coming data show further weakening, that added to hopes of stronger policy easing by the US central bank.

However, economists remain cautious in anticipation of stronger boost of the US economic growth by Trump’s administration and new tariffs on imports to US that would provide fresh boost to inflation.

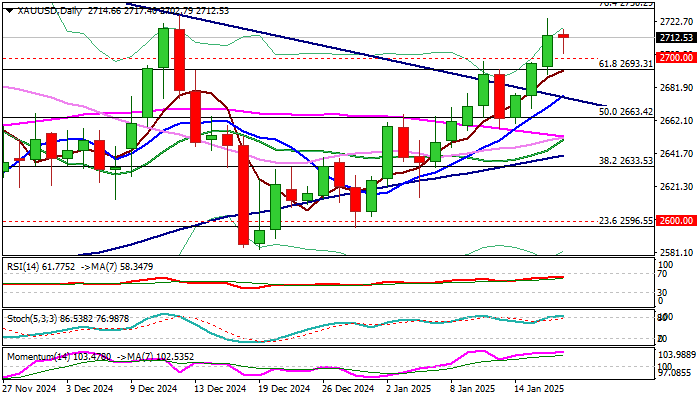

Technical picture remains firmly bullish on daily chart and underpins the action, as gold heads for the third straight weekly gain that adds to positive near-term outlook.

We look for weekly close above broken barriers at $2700/$2693 (psychological / Fibo 61.8% of $2790/$2536) to confirm bullish stance.

Also, these levels now reverted to solid supports which should ideally contain dips and keep larger bulls intact.

Immediate targets lay at $2726/30 (Dec 12 lower top / Fibo 76.4%) followed by $2749 (Nov 5/6 double top) which guards a record high at $2790 (posted on Oct 31).

Caution on dip below $2693, although broader bias is expected to remain with bulls while $2675 support (broken bear trendline / rising 10DMA) holds.

Res: 2726; 2730; 2749; 2762.

Sup: 2700; 2693; 2675; 2663.

Interested in XAU/USD technicals? Check out the key levels

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.