GBP/USD outlook: Holds near new multi-month low, UK and US CPI reports in focus

|

GBP/USD

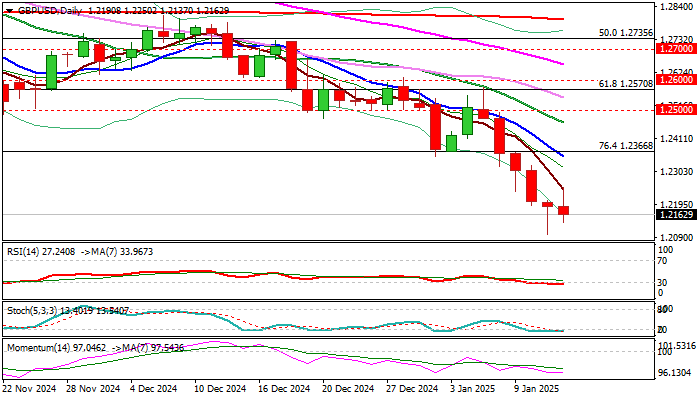

Cable came under fresh pressure on Tuesday and looks for retest of new multi-month low (1.2099) after recovery from Monday’s strong downside rejection failed repeatedly at 1.2250 zone.

Bears regained control after a mild correction, with loss of 1.2099 low (also monthly cloud base) to open way for test of 1.2037/00 targets (4 Oct 2023 low / psychological).

Daily studies remain in full bearish setup, though oversold conditions may keep near term action on hold for some time.

Upticks are likely to be limited and ideally capped under 1.2350/60 zone falling 10DMA / broken Fibo 76.4% support) as fundamentals are dollar positive.

US Dec PPI missed expectations but came above previous month’s figure (y/y), which signals that inflation remains elevated and to further soften Fed’s rate cut outlook for 2025.

Markets focus on UK and US December inflation reports (due on Wednesday) which would further pressure pound, as price pressure is expected to rise, and UK economy remains on fragile legs.

The dollar would benefit more from the anticipated implementation of tariffs, proposed by Trump’s administration, even on the latest comments that tariff implementation might be gradual at the beginning.

Res: 1.2250; 1.2299; 1.2360; 1.2400.

Sup: 1.2099; 1.2069; 1.2037; 1.2000.

Interested in GBP/USD technicals? Check out the key levels

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.