GBP/USD Forecast: Bulls poised to challenge the 1.4000 mark

Premium|

You have reached your limit of 5 free articles for this month.

Get all exclusive analysis, access our analysis and get Gold and signals alerts

Elevate your trading Journey.

UPGRADEGBP/USD Current price: 1.3980

- UK monthly GDP is foreseen at -4.9% in February, down from 1.2% in the previous month.

- Industrial Production in the UK is foreseen contracting 4% YoY in January.

- GBP/USD poised to extend its advance in the near term beyond 1.4000.

A weaker dollar helped GBP/USD reach 1.3986, its highest for this week, with the pair holding on to gains at the end of the American session. The pair surged on the back of sub-1.50% 10-year Treasury yields, as the latter fell to 1.475% ahead of the opening. The greenback remained under pressure despite the latter recovered to 1.52%.

The UK published the February RICS Housing Price Balance, which beat expectations by printing at 52%. This Friday, the kingdom will release January Industrial Production, foreseen at -4% YoY, and the monthly Gross Domestic Product, foreseen at -4.9% from 1.2% in January. The country will also unveil the January Trade Balance.

GBP/USD short-term technical outlook

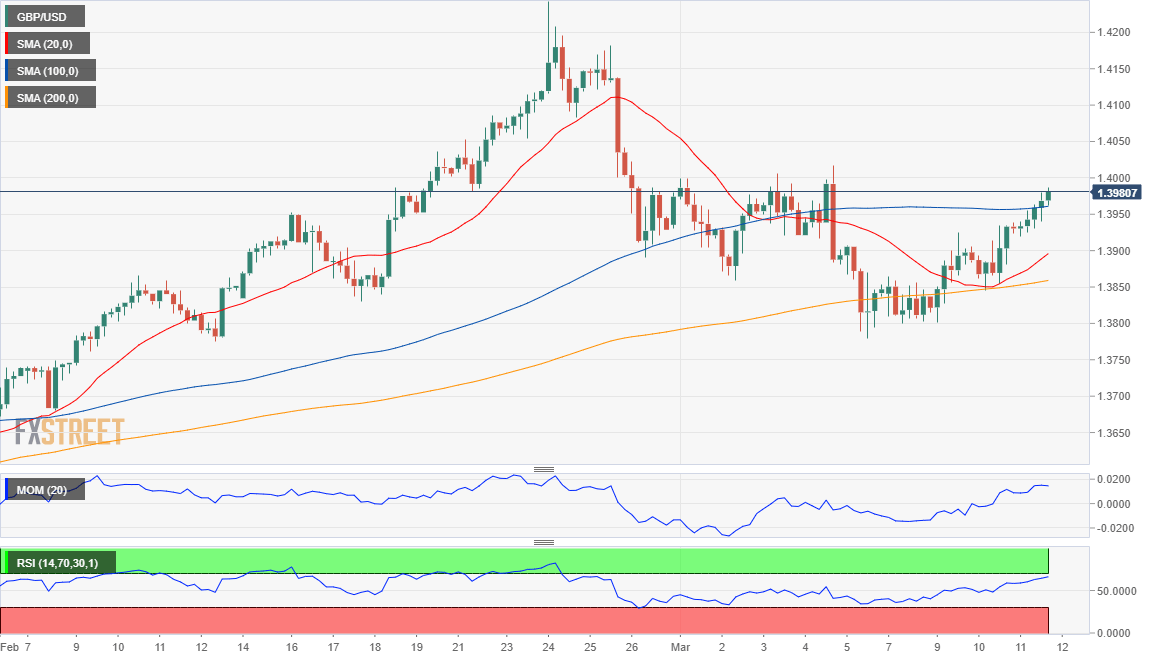

The GBP/USD pair has room to extend its advance, as the 4-hour chart shows that it is developing above its 100 SMA for the first time in a week. The moving average remains directionless, but the 20 SMA advances below it. In the meantime, the Momentum aims to resume its advance while the RSI stabilizes near overbought readings, supporting a bullish continuation in the near-term.

Support levels: 1.3930 1.3890 1.3845

Resistance levels: 1.4000 1.4045 1.4090

GBP/USD Current price: 1.3980

- UK monthly GDP is foreseen at -4.9% in February, down from 1.2% in the previous month.

- Industrial Production in the UK is foreseen contracting 4% YoY in January.

- GBP/USD poised to extend its advance in the near term beyond 1.4000.

A weaker dollar helped GBP/USD reach 1.3986, its highest for this week, with the pair holding on to gains at the end of the American session. The pair surged on the back of sub-1.50% 10-year Treasury yields, as the latter fell to 1.475% ahead of the opening. The greenback remained under pressure despite the latter recovered to 1.52%.

The UK published the February RICS Housing Price Balance, which beat expectations by printing at 52%. This Friday, the kingdom will release January Industrial Production, foreseen at -4% YoY, and the monthly Gross Domestic Product, foreseen at -4.9% from 1.2% in January. The country will also unveil the January Trade Balance.

GBP/USD short-term technical outlook

The GBP/USD pair has room to extend its advance, as the 4-hour chart shows that it is developing above its 100 SMA for the first time in a week. The moving average remains directionless, but the 20 SMA advances below it. In the meantime, the Momentum aims to resume its advance while the RSI stabilizes near overbought readings, supporting a bullish continuation in the near-term.

Support levels: 1.3930 1.3890 1.3845

Resistance levels: 1.4000 1.4045 1.4090

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.