European Stock Market Moves Boosted on the Easing Tensions in Middle Eastern

|

The European stock market moves mixed on Friday in a week driven by diplomatic tensions between the United States and Iran.

DAX climb 22.4 points and 0.17% reaching 13,530 points, while the Euro Stoxx 50 remains neutral at 3,798.2 pts, CAC 40 dips 8.3 points or 0.14% fading to 6,041.6 pts, and FTSE 100 off 0.31% or 23.4 points declining up to 100 points 7595.6 points.

The traders' sentiment improved this week as tensions between the United States and Iran eased.

On the other hand, United Kingdom legislators approved a bill that will allow the exit of the European Union on January 31st. While in France, the government continues to advance the reform of the pension system despite protests against it.

Technical Overview

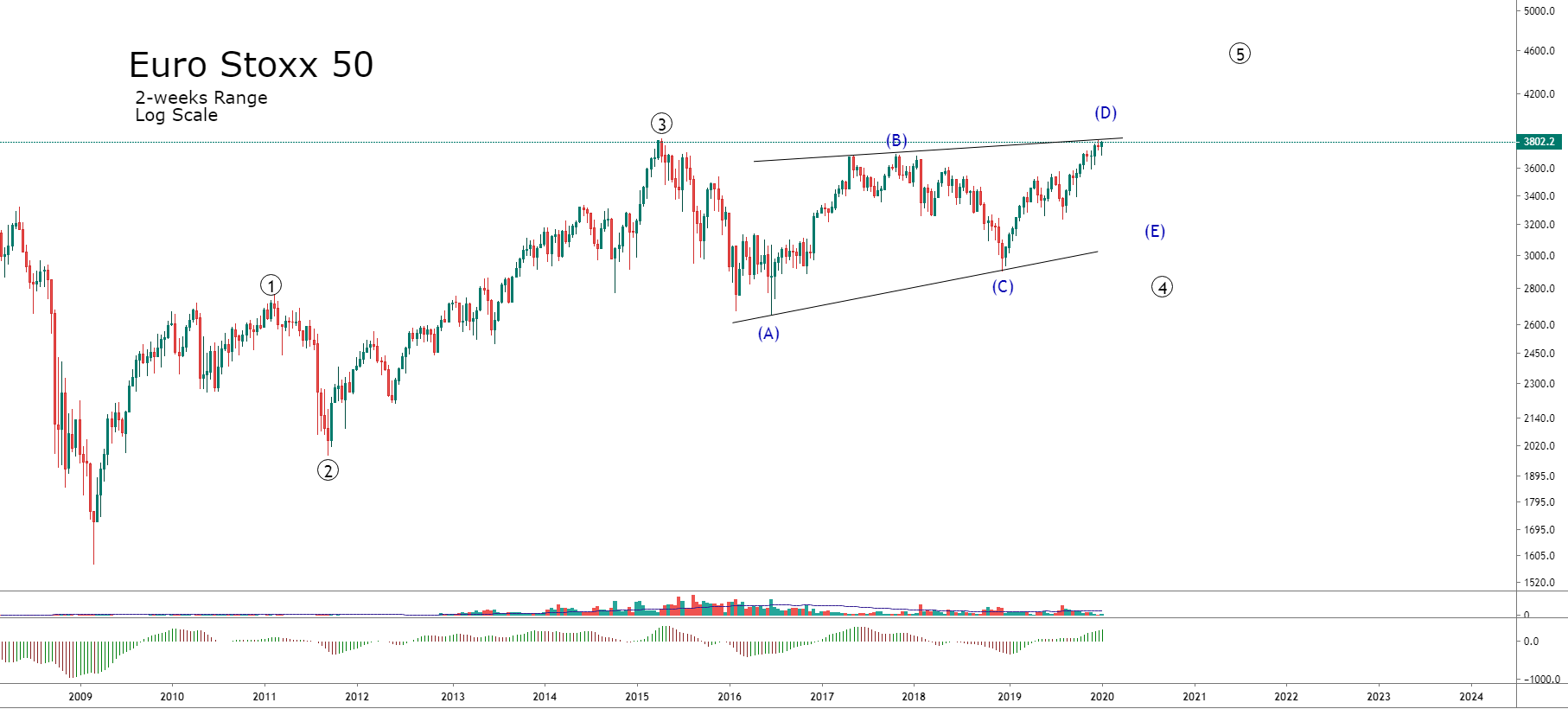

The Euro Stoxx 50 index in its 2-week chart in log scale, shows that the price moves in a long-term sideways sequence, which corresponds to a wave four of Primary degree labeled in black.

The Elliott Wave theory brings us the clue that the internal sequence of the triangle formation should evolve with five internal legs. These segments hold a subdivision that follows a 3-3-3-3-3 sequence in their inner waves.

According to this Elliott's waves rule, the Euro Stoxx 50 runs in a wave (D) of intermediate degree labeled in blue.

The following chart exposes to the Pan-European index in its daily timeframe. From the figure, we observe that it is composed of three segments that accomplish the Elliott wave rule of a triangle pattern.

The Euro Stoxx 50 has begun wave C on August 15th, 2019, when the price found buyers at 3,233.6 pts. Under this context, the Pan-European index could be running in the third wave of Minute degree labeled in black.

Therefore, once completed the wave three of Minute degree, the Euro Stoxx 50 should start developing the fourth and fifth waves of Minute degree. Once these waves are completed, the index will end the wave C of Minor degree, and in consequence, the wave (D) of Intermediate degree.

In conclusion, the current bull market still has space to continue advancing, likely to the zone of 4,000 pts.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.