EUR/USD outlook: Looks for clearer direction signal

|

EUR/USD

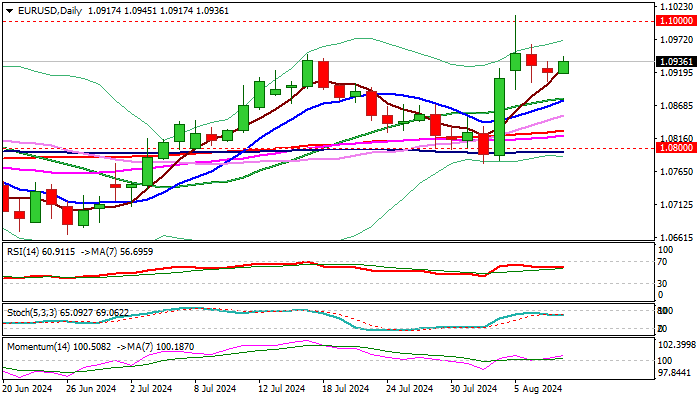

EUR/USD edged higher in Asia / early Europe on Thursday, hinting that pullback from Monday’s spike high (1.1009) might be over.

Signals of formation of a higher base at 1.0900 zone add to positive near-term outlook, as technical studies on daily chart are predominantly bullish, though sustained break above 1.0950/60 zone needed to confirm.

On the other hand, hourly studies are weakening, and recovery attempts may face headwinds on approach to 1.0950 pivot (hourly cloud top / 50% retracement of 1.1009/1.0892 pullback).

This would keep the downside vulnerable, especially on loss of 1.0925 pivot (hourly cloud base / hourly Kijun-sen), which would risk retest of 1.0900 and open way for deeper pullback on break.

Look for clearer direction signal.

Res: 1.0950; 1.0965; 1.0981; 1.1000.

Sup: 1.0925; 1.0890; 1.0875; 1.0850.

Interested in EUR/USD technicals? Check out the key levels

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.