EUR/USD outlook: Bullish bias above 1.0800, all eyes on German debt vote on Tuesday

|

EUR/USD

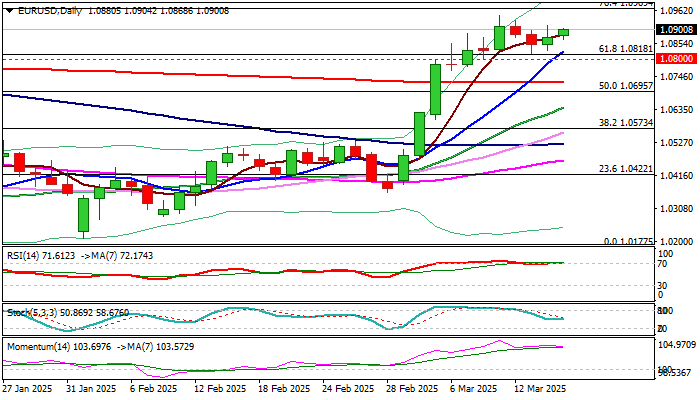

The Euro holds in extended consolidation under new 5-month high, following strong rally in past two weeks.

Technical picture remains bullish on daily chart, though overbought RSI and fading bullish momentum, keep in play risk of deeper pullback.

Near-term action should remain biased higher while the price stays above broken pivotal barriers, now acting as solid supports at 1.0820/00 zone (10DMA / Fibo 61.8% of 1.1214/1.0177 / round figure) and keep in focus targets at 1.0969/1.1000 (Fibo 76.4% / psychological).

Weaker dollar and supportive fundamentals played the key role in the latest rally, with focus on German vote for historical changes to borrowing rules which would allow the plan for massive increase in state borrowing for Euro 500 billion for defense and boost of economic growth.

Res: 1.0947; 1.0969; 1.1000; 1.1024.

Sup: 1.0868; 1.0820; 1.0800; 1.0726.

Interested in EUR/USD technicals? Check out the key levels

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.