Bank of Japan disappoints markets again despite another YCC tweak

|

It seems the Bank of Japan has opted for a little bit of everything by changing its reference rate for YCC, revising up inflation outlooks and scrapping daily fixed-rate bond purchase operations. However, markets appear disappointed with the BoJ's willingness to keep its YCC framework, with initial reactions showing USD/JPY and JGB yields moving higher.

Perhaps today's tweak is not that minor after all

Following a local media leak on a possible adjustment to the Bank of Japan's Yield Curve Control (YCC) framework, market sentiment quickly shifted from no change in YCC to some change – such as lifting the upper limit ceiling from the current 1.00% to 1.25%, or even higher. The BoJ's verdict was eliminating the effective upper ceiling of 1%, but keeping 1% as a reference (raised from 0.5%) and ending daily fixed-rate bond purchases. This will give the central bank more flexibility but adds more uncertainty to the market.

Many market participants probably think that today's BoJ tweaks are minor, as major policy settings remained unchanged, the reference rate was kept at 1%, and the fiscal year 2025 (FY25) inflation outlook remained below 2%. While it's true that the BoJ tweaked the wording from the upper ceiling to the reference, 1% is still 1%. However, in our view, ending the daily bond purchase program is a major step taken by the Bank of Japan today. It means that it won't explicitly fix the rate any more and will let the market decide. The BoJ can now allow the JGB 10Y yield above the reference, but certainly will not let it get too far.

The revised inflation outlook also hints at possible policy changes in the future, but it has yet to be reached with confidence as the FY25 outlook was kept below 2%. For the time being, the BoJ will continue to maintain its YCC policy and buy more time to anchor long-tenor yields down to support the economy until it confirms continued wage growth beyond this year. Governor Kazuo Ueda also said at its press conference that next spring's wage negotiations are a key event.

BoJ's newest outlook report suggests a pivot is coming

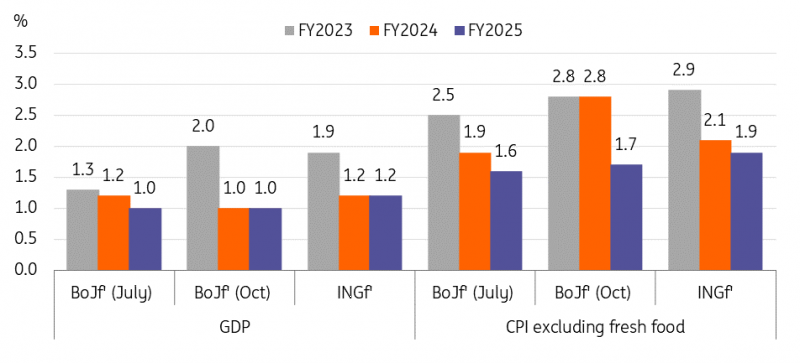

There are two surprises in the newest outlook report that caught our eye. The inflation outlook for FY24 is too high, but too low for FY25. The fiscal year 2023 and 2024 inflation outlooks were upwardly revised to 2.8% from the previous 2.5% and 1.9% respectively, and inched up only to 1.7% from the previous 1.6% for 2025.

We had expected to see an above 2% inflation outlook for FY24, but the following year's outlook should remain untouched. Now, the Bank of Japan forecasts that inflation will likely rise steadily at 2.8% in FY23 and FY24, suggesting that it is set to remain above target throughout FY24. The BoJ seemingly tried to send a message to the market that it considers the current overheated inflation to be transitory by keeping its outlook for FY25 below the 2% target – but at the same time, the higher projection may secure room for the central bank to be flexible on how to respond to higher inflation next year.

Inflation will likely remain high throughout FY 24

Source: Bank of Japan, ING estimates

The next quarterly outlook report will be out in January, and perhaps the Bank of Japan can scrap the YCC at this point. It will heavily depend on global bond market trends. By then, market rates are expected to step down in line with UST moves, and the BoJ will have the right opportunity to abandon YCC as pressure on the JGB also subsides a bit. With today's policy decision, we have revised up our JGB 10Y forecasts for the fourth quarter of 2023 onwards.

The BoJ's bond purchase operations will likely increase to keep market rates not too far from the reference rate of 1%. We're also maintaining our long-standing first rate hike call for the central bank in the second quarter of next year. We have argued for sustainable inflation, the closing of negative output gaps and healthy wage growth as prerequisites for the BoJ's action, and we believe that the central bank's last puzzle of healthy wage growth could be met by the second quarter of 2024.

FX: USD/JPY will keep policy makers busy

A disappointingly modest adjustment to the BoJ's YCC strategy has seen USD/JPY push back above 150. As above, it seems like the BoJ did not want to risk a JGB market meltdown by opting for larger steps today. Unless US data softens sharply or the Federal Reserve surprises by dropping its hawkish bias, it looks like USD/JPY can push onto the 152 area – marking last October's intra-day spike high.

Depending on how USD/JPY gets to 152 – quickly, or in a slow grind – this will probably determine how quickly Japanese authorities intervene. In total, Tokyo sold $70bn in September and October last year, with around half of that coming when USD/JPY spiked to 152 in late October. On the subject of FX intervention, we had been expecting the Ministry of Finance to release FX intervention figures for October today, but have not seen anything yet.

We think that Japanese authorities, like the Chinese authorities, are praying for a turn in the dollar to take pressure off their own currencies. And whilst the dollar stays strong, intervention (or in China's case, funding squeezes) will be used to ride out the strong dollar storm. Today's Bank of Japan move suggests USD/JPY continues to trade around 150 into year-end and has a better chance of turning lower in the first quarter of next year when the dollar should be softer and the BoJ could exit YCC more forcefully.

Read the original analysis: Bank of Japan disappoints markets again despite another YCC tweak

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.