Bank of England to hold rates against backdrop of sticky inflation

|

There are visible signs of disagreement at the Bank of England on the pace of rate cuts required this year. But with wage growth and inflation remaining sticky, we expect the Bank to keep rates on hold this Thursday, ahead of the next rate cut in May.

Drama aside, the Bank has – if anything – become more hawkish

Drama is not often synonymous with the Bank of England. But February’s meeting was nothing short of a bombshell. Catherine Mann, who for months had led the opposition to rate cuts, surprised everyone with her vote for a 50bp rate cut. And that posed the question: if the arch-hawk is prepared to vote for faster rate cuts, will the rest of the committee soon follow suit?

For all the excitement, the answer seems to be no. Most officials that have spoken since have struck a much more cautious tone. And looking beyond Mann’s vote, the February meeting had a more hawkish flavour. The statement talked about a “careful approach” to further easing. The new forecasts pointed to higher inflation this year, despite a sharp rise in market rates (which would normally dampen growth and price pressures).

The disagreement boils down to two things. First, Mann believes in a much more activist approach to setting policy than her peers. She was more aggressive on rate hikes, and now takes the same view on cuts. We sympathise with that view; the fixed-rate nature of UK lending (especially mortgages) means that policy changes take longer to feed through than they once did. If you believe the outlook for growth and inflation is shifting, then gradual rate cuts are initially much less effective than they once were.

And that’s the second point: Mann does believe the outlook has materially shifted. In recent comments, she has talked about the risk of “non-linear” falls in employment, in response to hefty tax hikes coming through for employers next month.

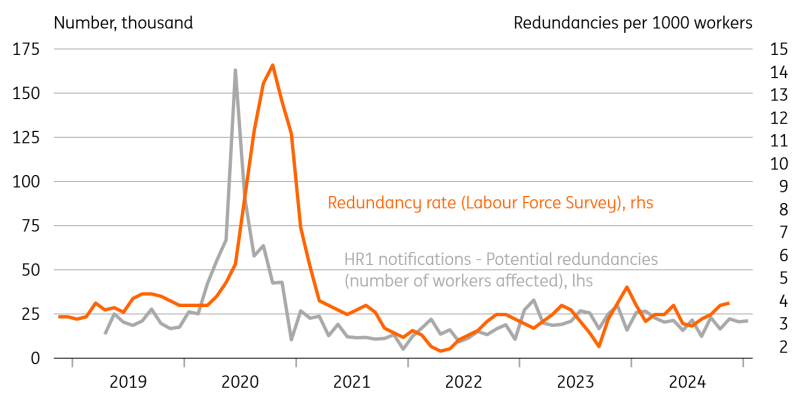

Certainly, the vibes surrounding the jobs market have gotten dramatically worse. Survey after survey has pointed to weaker hiring intentions, while talk of layoffs has increased. For now, though, that negativity hasn’t shown up in the hard data. Companies are required to report redundancies to the government via an HR1 notification. These haven’t shown any discernible uptick so far.

Redundancies haven't risen – yet

Source: Macrobond

Our base case is three more cuts this year

As long as that remains the case, the wider focus at the Bank will stay squarely on inflation. The simple fact is that wage growth is at 6%, while services inflation is bouncing around 5%. That’s an uncomfortable position for the BoE, even if both of those numbers should come lower through this year. Wage growth should gradually tick lower given the jobs market has cooled appreciably over recent months, irrespective of the forthcoming tax hike. Services inflation should be closer to 4%, or perhaps even below, by the summer, on account of more benign annual price hikes this spring.

For now, though, there’s little that’s happened since the February meeting that will have caused officials to shift their position. A rate cut is highly unlikely this week, given the Bank’s well-established pattern of cutting rates once per quarter. And when it comes to the vote split, we suspect we’ll get either a repeat of February’s 7-2 vote in favour of no change (with Dhingra and Mann dissenting, presumably in favour of a 25bp cut), or perhaps a 6-3 (with Alan Taylor joining calls for a cut, having done so back in December).

We expect Bank Rate to fall a bit further than markets are pricing

Source: Macrobond, ING

Our base case is that the Bank continues on its current course of gradual rate cuts, with moves in May, August and November. We don’t rule out a faster pace though that would require more obvious and abrupt signs of weakening in the jobs market. We doubt the government’s Spring Statement on 26 March, where some spending cuts are widely expected, will dramatically change the story for the Bank.

Markets are still a tad reluctant to bake in those three remaining rate cuts in 2025 fully; 55bp of easing is priced by December. And despite the decent repricing lower in US rates over recent weeks, investors don’t expect rates to go any lower in 2026 or beyond. Markets are pricing a floor for Bank Rate of 3.9%, compared to our own forecast of 3.25%, which we expect to be reached by the summer of 2026.

Read the original analysis: Bank of England to hold rates against backdrop of sticky inflation

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.