Bank of England Interest Rate Decision: Gilts are the crucial topic

Premium|

You have reached your limit of 5 free articles for this month.

Get all exclusive analysis, access our analysis and get Gold and signals alerts

Elevate your trading Journey.

UPGRADE- BOE forecast to raise the Bank Rate for the second time to 0.5%.

- Consumer prices in December rose 5.4%, nearly a 30 year high.

- Passive roll-off of gilt portfolio expected to begin in March.

- Markets and the sterling have priced a rate hike and bond reduction.

The Bank of England is expected to announce its second pandemic first when it details plans for reducing its 895 billion pound ($1.2 trillion) balance sheet.

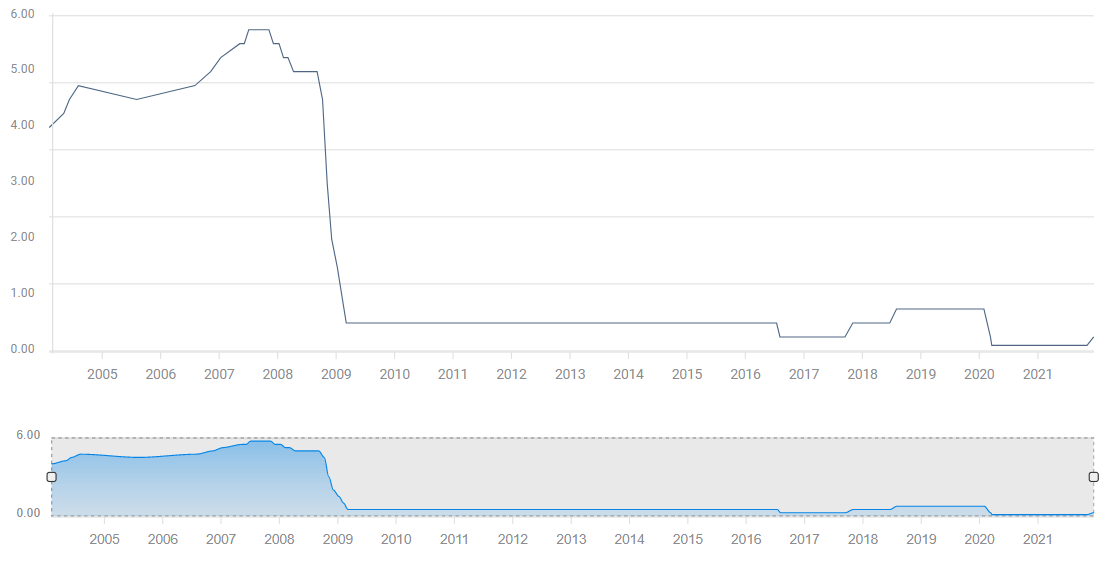

In December, the bank became the first to pull back its COVID accommodation when it raised its base rate from 0.1% to 0.25%. Another increase to 0.5% is widely forecast for Thursday's Bank of England (BoE) policy meeting. This is the rate at which the bank has said it will begin unwinding its portfolio acquired over the past decade. The base rate was 0.75% in January 2020. These would be the first consecutive rate hikes since 2004.

BoE Bank Rate

FXStreet

The BoE owns more than half-the total issuance of standard non-inflation-linked gilts, 875 billion pounds and about 20 billion pounds of corporate debt, bought in an effort to keep commercial interest rates down.

This massive flood of liquidity in the UK economy coupled with nearly two years of effective zero rates–from March 2020 to December 2021 the base rate was 0.1%-complicated by soaring energy costs, supply chain restrictions and strong consumer demand, have produced the most rapid acceleration of domestic inflation on record.

BoE balance sheet

FXStreet

Since the BoE’s own efforts are at least partly responsible for the tremendous surge in prices, the bankers are eager to show that they are in control of monetary policy and able to rein in inflation.

Inflation

The UK Consumer Price Index (CPI) has multiplied over seven times in a year, from 0.7% in January to 5.4% in December. Core prices have soared three times, from 1.4% to 4.2%.

CPI

FXStreet

As in the United States, another economy afflicted by an astonishing increase in inflation, it is the speed of the gains as much or more than the actual rate that has so unnerved consumers and central bankers. America’s overall CPI in December was even higher at 7% up from 1.4% at the start of the year.

Producer prices have rocketed even faster than retail indicating that manufacturers are absorbing some of the increases and that those pressures have not run their course.

The UK Producer Price Index (PPI) on the input or cost side was 13.5% higher for the year in December. It has jumped from 1.9% in January. Prices on the output side have increased from 0.2% in January to 9.3% in December.

PPI Input

FXStreet

Quantitative easing and tightening

The term quantitative easing (QE) was coined by German economist Richard Werner, while he was working at the Bank of Japan in 1995, to describe buying government bonds as a means of overcoming the limitation of standard central bank interest rate policy.

In the financial crisis of 2007-08 quantitative easing was used by the US, the UK and the Eurozone to drive economic interest rates below their nominal base rates which were already at or next to zero.

Before the US Federal Reserve began its first round of bond acquisition in late 2008, the central bank held between $700 and $800 billion of Treasury notes on its balance sheet. By the end of three rounds of QE in 2013 the Fed portfolio had ballooned to over $4 trillion. In the two years of the pandemic that has been doubled to almost $9 trillion.

Quantitative tightening (QT) is the reverse of easing. Instead of buying bonds, the bank either lets bonds mature and does not reinvest the proceeds in new debt, thereby reducing its holdings, or it actively sells bonds into the credit market. Either way liquidity in the financial system is diminished, ostensibly fomenting higher interest rates.

BOE QT

The BOE’s 0.5% rate target for a passive or roll-off QT should be met on Thursday and Governor Andrew Bailey is expected to discuss the plans for reducing the bank's balance sheet.

A passive process could begin in March when the 4% 2022 gilt matures. The bank owns 25 billion of this note. A pure roll-off of the bond portfolio would see the holdings fall to about 435 billion pounds by 2031, which would be about equal to the banks pre-pandemic holding

Last August the BOE said it would actively sell gilts until the “Bank Rate had risen to at least 1%” and “depending on economic circumstances at the time.”

The BoE has given little guidance about how large it wants its balance sheet to be, other than that it will be “materially larger” than before the 2008 crisis, and some way below its current level.

Results and risk

Many but not all economists think that interest rates on government debt will rise and the yield curve steepen as bond availability goes up. This in turn, should move commercial interest rates higher as well.

It is also possible that a risk-averse financial system, having suffered two major crises in little more than a decade, will be able to absorb the debt without major changes in interest rates.

No central bank has attempted a prolonged reduction in its balance sheet. The US effort that began in late 2017 with about $4.5 trillion on the Fed’s balance sheet, managed only about a $700 billion reduction by October 2019 when acquisitions began to rise again.

Federal Reserve total assets

Minutes from the Fed’s December meeting showed that the members had discussed shrinking the balance sheet without agreeing on timing or methods.

Were bond prices to fall steeply any financial entity with large debt holdings would face large paper losses on a bond portfolio. As the value of their bonds fell, banks, insurance companies and like institutions would have to raise extra capital.

Markets

The BoE’s early start in the policy race on December 16 gave the sterling a decided trading advantage. The pound is the only major currency to have risen against the US dollar this year. As of this writing the amount the gain is not much, about half a figure to 1.3573. Against its new Brexit competitor, the euro, the pound’s valuation has increased about 1% since the EUR/GBP closed the old year at 0.8412.

The Federal Reserve has joined the anti-inflation campaign with an expected rate increase at the March 16 meeting and a portfolio reduction to begin then or soon thereafter. By the end of this year the BoE rate advantage should have disappeared as the Fed is predicted, by itself in addition to most commentators, to have moved forcefully against inflation.

The BoE and sterling advantage versus the euro will improve in the second half of the year. Though Eurozone headline inflation was 5.1% in January, barely less than the UK rate of 5.4%, the European Central Bank (ECB) has only recently begun to acknowledge that runaway prices are a problem. With the ECB’s base rate is at 0%, continental yields also have further to rise. The pound is already close to its pandemic and seven-year highs against the united currency. Before June 2016 there were two years when the cross traded down to 0.7000. Unless the ECB changes policy quickly that territory lies open.

Gilt rates have climbed sharply in the New Year. The 2-year yield is 36 basis points to the good at 1.02% and the 10-year has added 32 points to 1.29%. These are comparable to the increases in the US where the 2-year Treasury yield has gained 42 basis points to 1.15% and the 10-year 27 points to 1.78%.

While markets have priced Thursday’s expected 0.25% rate BoE increase and the acknowledgement that portfolio reductions will begin in March, there is much room for maneuver in the latter three-quarters of the year. The BoE, like its Atlantic counterpart, is sensitive to economic conditions. If the UK economy slows or stops, the BoE would pause its rate campaign even if it does not disavow the overall goal of defeating inflation with higher rates.

After the relative certainty of the first quarter, there is as yet, no interest rate or market assurance for the rest of the year.

- BOE forecast to raise the Bank Rate for the second time to 0.5%.

- Consumer prices in December rose 5.4%, nearly a 30 year high.

- Passive roll-off of gilt portfolio expected to begin in March.

- Markets and the sterling have priced a rate hike and bond reduction.

The Bank of England is expected to announce its second pandemic first when it details plans for reducing its 895 billion pound ($1.2 trillion) balance sheet.

In December, the bank became the first to pull back its COVID accommodation when it raised its base rate from 0.1% to 0.25%. Another increase to 0.5% is widely forecast for Thursday's Bank of England (BoE) policy meeting. This is the rate at which the bank has said it will begin unwinding its portfolio acquired over the past decade. The base rate was 0.75% in January 2020. These would be the first consecutive rate hikes since 2004.

BoE Bank Rate

FXStreet

The BoE owns more than half-the total issuance of standard non-inflation-linked gilts, 875 billion pounds and about 20 billion pounds of corporate debt, bought in an effort to keep commercial interest rates down.

This massive flood of liquidity in the UK economy coupled with nearly two years of effective zero rates–from March 2020 to December 2021 the base rate was 0.1%-complicated by soaring energy costs, supply chain restrictions and strong consumer demand, have produced the most rapid acceleration of domestic inflation on record.

BoE balance sheet

FXStreet

Since the BoE’s own efforts are at least partly responsible for the tremendous surge in prices, the bankers are eager to show that they are in control of monetary policy and able to rein in inflation.

Inflation

The UK Consumer Price Index (CPI) has multiplied over seven times in a year, from 0.7% in January to 5.4% in December. Core prices have soared three times, from 1.4% to 4.2%.

CPI

FXStreet

As in the United States, another economy afflicted by an astonishing increase in inflation, it is the speed of the gains as much or more than the actual rate that has so unnerved consumers and central bankers. America’s overall CPI in December was even higher at 7% up from 1.4% at the start of the year.

Producer prices have rocketed even faster than retail indicating that manufacturers are absorbing some of the increases and that those pressures have not run their course.

The UK Producer Price Index (PPI) on the input or cost side was 13.5% higher for the year in December. It has jumped from 1.9% in January. Prices on the output side have increased from 0.2% in January to 9.3% in December.

PPI Input

FXStreet

Quantitative easing and tightening

The term quantitative easing (QE) was coined by German economist Richard Werner, while he was working at the Bank of Japan in 1995, to describe buying government bonds as a means of overcoming the limitation of standard central bank interest rate policy.

In the financial crisis of 2007-08 quantitative easing was used by the US, the UK and the Eurozone to drive economic interest rates below their nominal base rates which were already at or next to zero.

Before the US Federal Reserve began its first round of bond acquisition in late 2008, the central bank held between $700 and $800 billion of Treasury notes on its balance sheet. By the end of three rounds of QE in 2013 the Fed portfolio had ballooned to over $4 trillion. In the two years of the pandemic that has been doubled to almost $9 trillion.

Quantitative tightening (QT) is the reverse of easing. Instead of buying bonds, the bank either lets bonds mature and does not reinvest the proceeds in new debt, thereby reducing its holdings, or it actively sells bonds into the credit market. Either way liquidity in the financial system is diminished, ostensibly fomenting higher interest rates.

BOE QT

The BOE’s 0.5% rate target for a passive or roll-off QT should be met on Thursday and Governor Andrew Bailey is expected to discuss the plans for reducing the bank's balance sheet.

A passive process could begin in March when the 4% 2022 gilt matures. The bank owns 25 billion of this note. A pure roll-off of the bond portfolio would see the holdings fall to about 435 billion pounds by 2031, which would be about equal to the banks pre-pandemic holding

Last August the BOE said it would actively sell gilts until the “Bank Rate had risen to at least 1%” and “depending on economic circumstances at the time.”

The BoE has given little guidance about how large it wants its balance sheet to be, other than that it will be “materially larger” than before the 2008 crisis, and some way below its current level.

Results and risk

Many but not all economists think that interest rates on government debt will rise and the yield curve steepen as bond availability goes up. This in turn, should move commercial interest rates higher as well.

It is also possible that a risk-averse financial system, having suffered two major crises in little more than a decade, will be able to absorb the debt without major changes in interest rates.

No central bank has attempted a prolonged reduction in its balance sheet. The US effort that began in late 2017 with about $4.5 trillion on the Fed’s balance sheet, managed only about a $700 billion reduction by October 2019 when acquisitions began to rise again.

Federal Reserve total assets

Minutes from the Fed’s December meeting showed that the members had discussed shrinking the balance sheet without agreeing on timing or methods.

Were bond prices to fall steeply any financial entity with large debt holdings would face large paper losses on a bond portfolio. As the value of their bonds fell, banks, insurance companies and like institutions would have to raise extra capital.

Markets

The BoE’s early start in the policy race on December 16 gave the sterling a decided trading advantage. The pound is the only major currency to have risen against the US dollar this year. As of this writing the amount the gain is not much, about half a figure to 1.3573. Against its new Brexit competitor, the euro, the pound’s valuation has increased about 1% since the EUR/GBP closed the old year at 0.8412.

The Federal Reserve has joined the anti-inflation campaign with an expected rate increase at the March 16 meeting and a portfolio reduction to begin then or soon thereafter. By the end of this year the BoE rate advantage should have disappeared as the Fed is predicted, by itself in addition to most commentators, to have moved forcefully against inflation.

The BoE and sterling advantage versus the euro will improve in the second half of the year. Though Eurozone headline inflation was 5.1% in January, barely less than the UK rate of 5.4%, the European Central Bank (ECB) has only recently begun to acknowledge that runaway prices are a problem. With the ECB’s base rate is at 0%, continental yields also have further to rise. The pound is already close to its pandemic and seven-year highs against the united currency. Before June 2016 there were two years when the cross traded down to 0.7000. Unless the ECB changes policy quickly that territory lies open.

Gilt rates have climbed sharply in the New Year. The 2-year yield is 36 basis points to the good at 1.02% and the 10-year has added 32 points to 1.29%. These are comparable to the increases in the US where the 2-year Treasury yield has gained 42 basis points to 1.15% and the 10-year 27 points to 1.78%.

While markets have priced Thursday’s expected 0.25% rate BoE increase and the acknowledgement that portfolio reductions will begin in March, there is much room for maneuver in the latter three-quarters of the year. The BoE, like its Atlantic counterpart, is sensitive to economic conditions. If the UK economy slows or stops, the BoE would pause its rate campaign even if it does not disavow the overall goal of defeating inflation with higher rates.

After the relative certainty of the first quarter, there is as yet, no interest rate or market assurance for the rest of the year.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.