AUD/USD Price Forecast: Bearish outlook likely below the 200-day SMA

Premium|

You have reached your limit of 5 free articles for this month.

Take advantage of the Special Price just for today!

50% OFF and access to ALL our articles and insights.

Subscribe to Premium- AUD/USD resumed its downtrend and tumbled to six-week lows near 0.6650.

- The US Dollar kept its strong tone as the “Trump trade” re-emerged.

- Next on the downside for the pair comes the 200-day SMA.

After two consecutive daily advances, AUD/USD met some fresh selling pressure on Monday, coming all the way down to revisit the area near 0.6650 in response to the strong performance of the US Dollar (USD).

This daily downtick in the Australian Dollar occurred on the back of the continuation of the strong march north in the Greenback in place since the beginning of the month and persistent concerns over China’s recent stimulus measures.

The renewed weakness also came in the context of a marked drop in copper prices, while iron ore prices saw a humble decline. This dynamic unfolded amid ongoing scepticism about the true impact of China’s stimulus efforts.

On the monetary policy front, the Reserve Bank of Australia (RBA) kept its cash rate steady at 4.35% during its September meeting. Despite recognising inflationary risks, Governor Michele Bullock suggested that a rate hike is not imminent.

Later, the RBA’s meeting minutes revealed a more dovish outlook compared to August, which had hinted at stable rates for the near future.

Current market sentiment shows a 50% likelihood of a 25-basis-point rate cut by the end of the year. The RBA is expected to be among the last of the G10 central banks to lower rates, likely in response to slowing economic growth and easing inflation pressures.

While potential rate cuts from the Federal Reserve could provide some relief to AUD/USD later this year, the uncertainty surrounding China’s economic outlook and stimulus efforts remains a key challenge.

Earlier in the session, Deputy Governor Hauser sought to manage expectations regarding RBA easing, warning that rates in Australia would not drop as much or as soon as those of other central banks, partly due to inflation remaining "too high." Hauser further noted that most RBA models indicate a neutral rate between 3-4%, implying that the current policy rate of 4.35% is not highly restrictive.

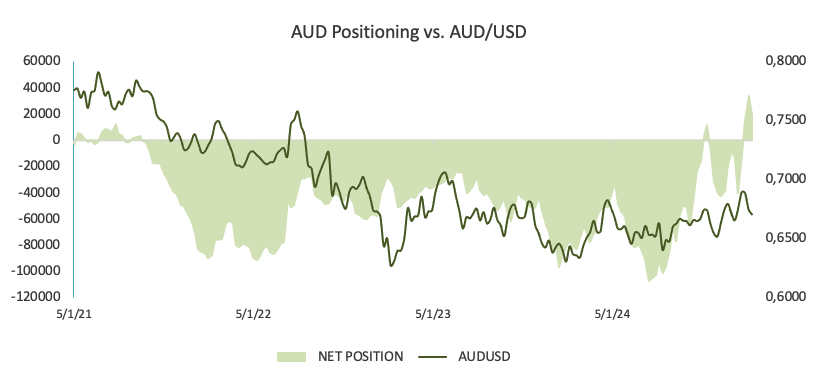

On the positioning front, non-commercial players (speculators) remained net long in the Aussie Dollar for the third week in a row amidst a modest pullback in open interest. These positions will surely be put to the test in the upcoming weeks, always hinging on the progress (or lack of) of the Chinese stimulus packages.

Looking ahead, next week’s release of advanced Judo Bank Manufacturing and Services PMIs will be closely watched in Australia.

AUD/USD daily chart

AUD/USD short-term technical outlook

Extra losses might send the AUD/USD down to its October low of 0.6654 (October 21), ahead of the September low of 0.6622 (September 11), which remains supported by the crucial 200-day SMA.

On the plus side, the first challenge occurs at the 2024 high of 0.6942 (September 30), just before the critical 0.7000 level.

The four-hour chart suggests a deterioration of the very near-term outlook. That said, initial contention lies at 0.66564, followed by 0.6622. On the upside, the initial resistance level is 0.6758 seconded by the 200-SMA at 0.6767. The RSI tumbled to 32.

- AUD/USD resumed its downtrend and tumbled to six-week lows near 0.6650.

- The US Dollar kept its strong tone as the “Trump trade” re-emerged.

- Next on the downside for the pair comes the 200-day SMA.

After two consecutive daily advances, AUD/USD met some fresh selling pressure on Monday, coming all the way down to revisit the area near 0.6650 in response to the strong performance of the US Dollar (USD).

This daily downtick in the Australian Dollar occurred on the back of the continuation of the strong march north in the Greenback in place since the beginning of the month and persistent concerns over China’s recent stimulus measures.

The renewed weakness also came in the context of a marked drop in copper prices, while iron ore prices saw a humble decline. This dynamic unfolded amid ongoing scepticism about the true impact of China’s stimulus efforts.

On the monetary policy front, the Reserve Bank of Australia (RBA) kept its cash rate steady at 4.35% during its September meeting. Despite recognising inflationary risks, Governor Michele Bullock suggested that a rate hike is not imminent.

Later, the RBA’s meeting minutes revealed a more dovish outlook compared to August, which had hinted at stable rates for the near future.

Current market sentiment shows a 50% likelihood of a 25-basis-point rate cut by the end of the year. The RBA is expected to be among the last of the G10 central banks to lower rates, likely in response to slowing economic growth and easing inflation pressures.

While potential rate cuts from the Federal Reserve could provide some relief to AUD/USD later this year, the uncertainty surrounding China’s economic outlook and stimulus efforts remains a key challenge.

Earlier in the session, Deputy Governor Hauser sought to manage expectations regarding RBA easing, warning that rates in Australia would not drop as much or as soon as those of other central banks, partly due to inflation remaining "too high." Hauser further noted that most RBA models indicate a neutral rate between 3-4%, implying that the current policy rate of 4.35% is not highly restrictive.

On the positioning front, non-commercial players (speculators) remained net long in the Aussie Dollar for the third week in a row amidst a modest pullback in open interest. These positions will surely be put to the test in the upcoming weeks, always hinging on the progress (or lack of) of the Chinese stimulus packages.

Looking ahead, next week’s release of advanced Judo Bank Manufacturing and Services PMIs will be closely watched in Australia.

AUD/USD daily chart

AUD/USD short-term technical outlook

Extra losses might send the AUD/USD down to its October low of 0.6654 (October 21), ahead of the September low of 0.6622 (September 11), which remains supported by the crucial 200-day SMA.

On the plus side, the first challenge occurs at the 2024 high of 0.6942 (September 30), just before the critical 0.7000 level.

The four-hour chart suggests a deterioration of the very near-term outlook. That said, initial contention lies at 0.66564, followed by 0.6622. On the upside, the initial resistance level is 0.6758 seconded by the 200-SMA at 0.6767. The RSI tumbled to 32.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.