- Spot gold has rallied to the highest levels since 2013 on the FOMC's dovish outcome.

- On a technical basis, its blue skies from here but a pull-back to 1364 could be on the cards.

Gold has rallied in Tokyo following a dovish outcome overnight from the FOMC meeting. US yields have now dropped to the lowest levels since the start of Sep 2017 levels, extending the downside from overnight and in the aftermath of the Federal Reserve with a reading in Tokyo as low as 2.004%; US yields were as high as 2.098% ahead of the Fed overnight. Gold prices have subsequently rallied to the highest levels since 2013, just about surpassing the 2014 highs by a few bucks. The high, so far, has been $1,394, but at the time of writing, the yellow metal has pulled back to $1,381.

FOMC outcome

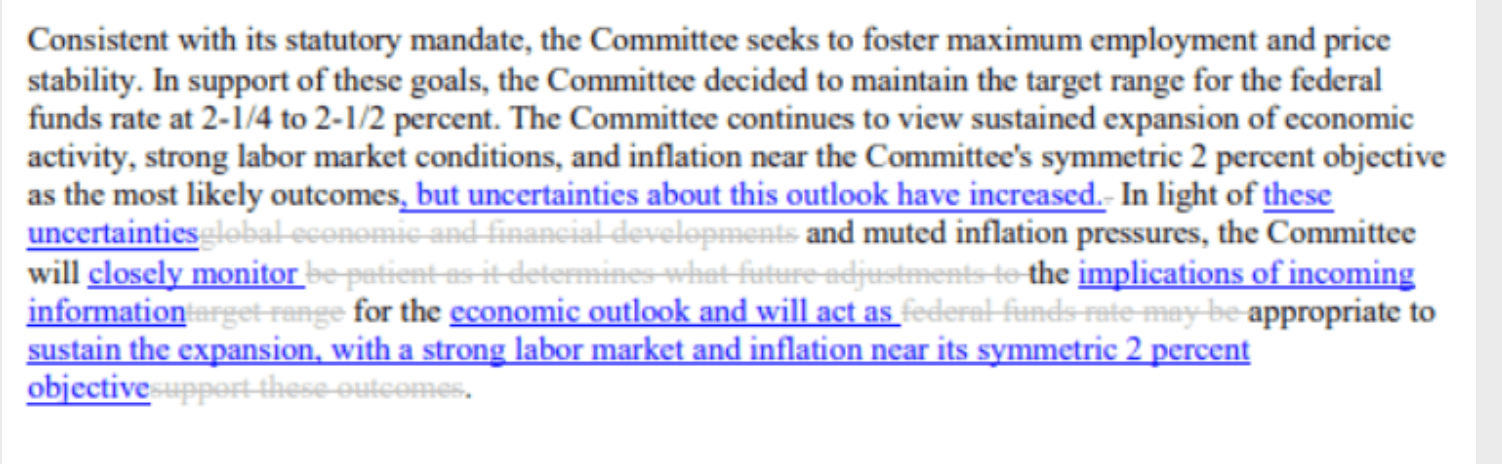

The Federal Reserve chose to leave monetary policy unchanged, as expected, but the members of the committee chose to signal to the market an easing bias by dropping language saying it would be 'patient' on future policy adjustments. There was one member, James Bullard, the St Louis Fed President, who actually voted for an immediate 25bp rate cut.

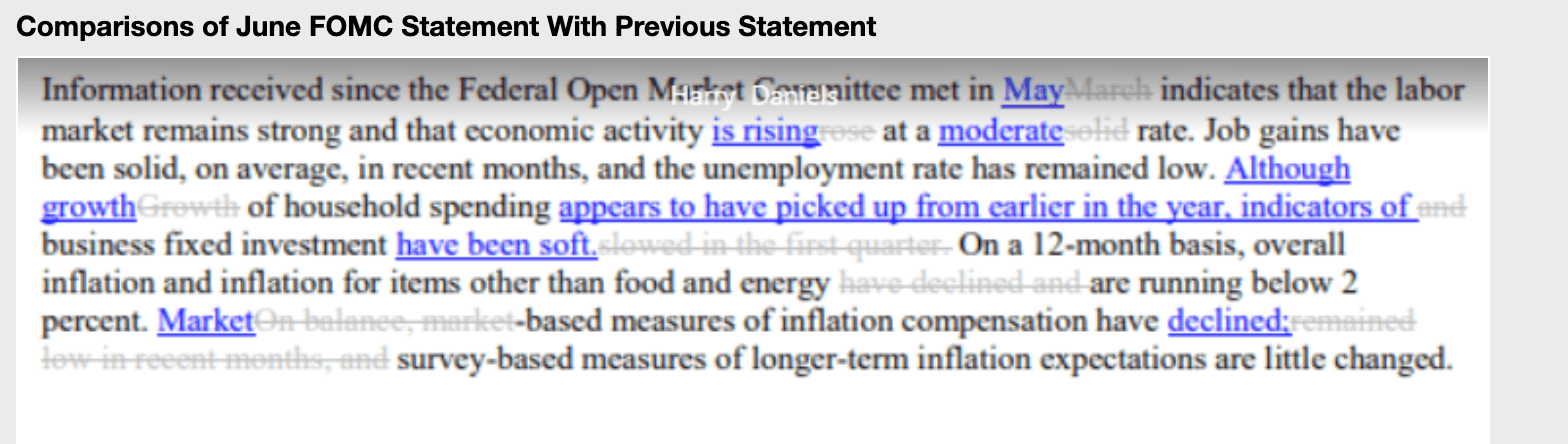

The FOMC Statement comparisons:

The FOMC meeting main takeaways:

- Interest rate on excess reserves unchanged at 2.35%.

- Benchmark interest rate unchanged; target range stands at 2.25-2.50%.

- Drops language saying it would be 'patient' on future policy adjustments.

- Uncertainties have increased regarding outlook for sustained economic expansion.

- 9:1 policy vote, Fed's Bullard dissented because he wanted a rate cut

- To act as appropriate to sustain econ. expansion with a strong labour market, inflation near target

- Economic activity is rising at a moderate rate

- Household spending appears to have picked up but business fixed investment has been soft

Press conference:

Analysts at TD Securities summaries the event as follows:

- "Powell highlighted increased uncertainty and muted inflation pressures as the key reasons for the shift in the Fed's tone.

- While admitting that the economy is doing reasonably well, he noted that "crosscurrents" have reemerged due to trade uncertainty, a drop in business confidence, and the potential for these to translate into weaker data. The fear of a sustained shortfall in inflation also led the Fed to sound more cautious, opening the door to an imminent rate cut.

- We believe that Powell signaled a shift in the reaction function, citing research suggesting that when a central bank is closer to the effective lower bound, it is wise to ease preemptively in order to prevent softness from turning into a prolonged weakening.

- As Powell put it, "an ounce of prevention is worth a pound of cure." The Chair also highlighted that balance sheet policy remains unchanged as it is scheduled to end in September."

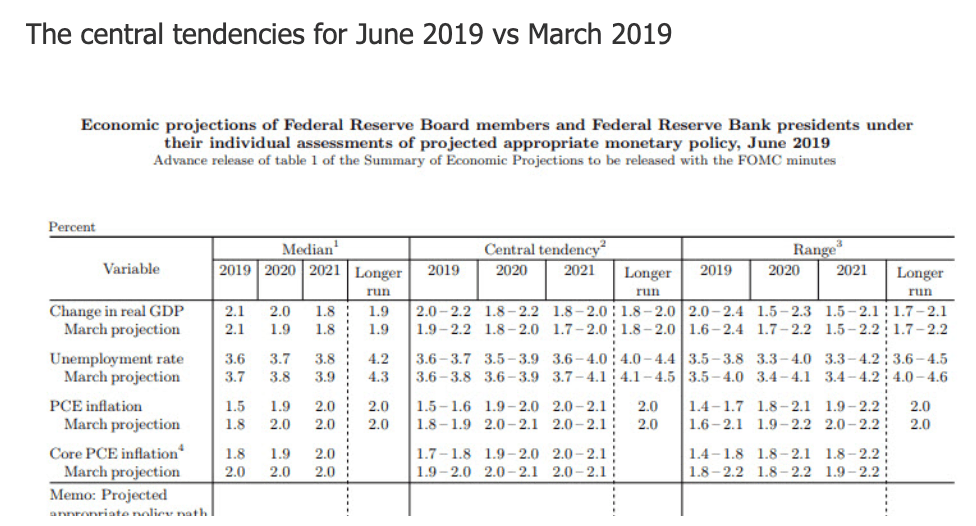

The Dot Plot

"The dot plot was unequivocally dovish across the board. There was a significant shift in the 2019 dots, with 8 members now projecting cuts this year (7 of whom are projecting 50bp of cuts). Despite this shift, the median 2019 dot remained unchanged at 2.375%, which reflects the split among officials as 9 didn't pencil in any easing for 2019. There were also notable downward shifts in the distributions for 2020 and 2021 dots, with the medians dropping to 2.125% and to 2.375%, respectively. Also importantly, the long-run dot was revised 25bp lower to 2.50%," analysts at TD Securities explained.

Gold levels

Gold has rallied way above the July 2016 highs at of 1375s and is taking on 2013 territories. However, while the outlook is bullish, a pullback in a 50% mean reversion of the move opens 1364 as a key target. An 127% fibo extension opens the 1411s ahead of the summer 2013 highs of the 1432s.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.