- Gold price improves from one-month low amid sluggish US Dollar.

- China-linked risk-aversion, Fed concerns and $1,903 resistance confluence challenges XAU/USD rebound.

- Fed Chair Powell’s speech, US data eyed for clear directions after Friday’s upbeat data renewed hawkish Fed bias.

Gold price (XAU/USD) rebounds from monthly low, grinding higher around intraday tops surrounding $1,878 heading into Monday’s European session. In doing so, the yellow metal snaps a two-day downtrend amid the sluggish US Dollar, despite the sour sentiment and hawkish Fed sentiment.

Friday’s upbeat US jobs report and ISM Services PMI renewed chatters that the Federal Reserve (Fed) has some room to increase the rates. That said, the US shooting of a Chinese balloon and canceling Beijing’s visit of Antony Blinken, US Secretary of State, weigh on the market’s risk profile. On the same line was China’s warning to not aggravate the tense situation while also terming the incident as an ‘obvious overreaction’.

The US Dollar Index (DXY) remains inactive even as the US Treasury bond yields rebound and stock futures print mild losses. The reason could be linked to the DXY bull’s indecision ahead of Tuesday’s speech from Fed Chair Jerome Powell.

Also read: Gold Price Forecast: XAU/USD rebounds but not out of the woods yet

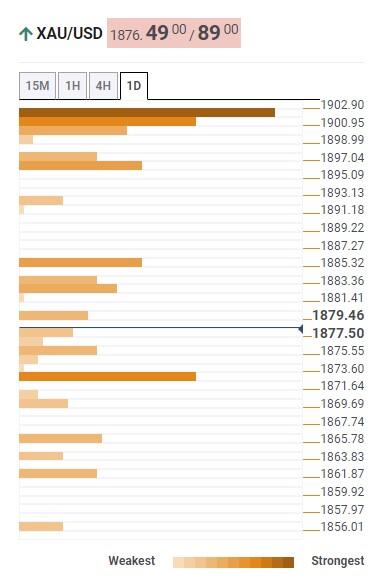

Gold Price: Key levels to watch

The Technical Confluence Detector shows that the Gold price grinds higher towards the key resistance confluence comprising the Fibonacci 38.2% on one month and Pivot Point one day R1, around $1,903.

Before that, Fibonacci 61.8% on one day could challenge the Gold buyers around $1,897.

On an immediate basis, Fibonacci 23.6% on one week guards the XAU/USD upside around $1,885.

Meanwhile, Fibonacci 61.8% on one month, close to $1,870, puts a floor under the Gold price.

In a case where XAU/USD remains weak past $1,870, it’s downturn towards the previous monthly low surrounding $1,825 can’t be ruled out.

Overall, the Gold price remains bearish unless staying below $1,905.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD keeps the red below 0.6400 as Middle East war fears mount

AUD/USD is keeping heavy losses below 0.6400, as risk-aversion persists following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY recovers above 154.00 despite Israel-Iran escalation

USD/JPY is recovering ground above 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price pares gains below $2,400, geopolitical risks lend support

Gold price is paring gains to trade back below $2,400 early Friday, Iran's downplaying of Israel's attack has paused the Gold price rally but the upside remains supported amid mounting fears over a potential wider Middle East regional conflict.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.