- Ethereum price has nosedived to $1,527, as traders engage in massive profit taking starting January 20.

- ETH has dominated 21% of the discussions on social media platforms as profit- taking transaction ratio spiked.

- Ethereum price could benefit from the fear, uncertainty and doubt surrounding the asset on crypto community forums.

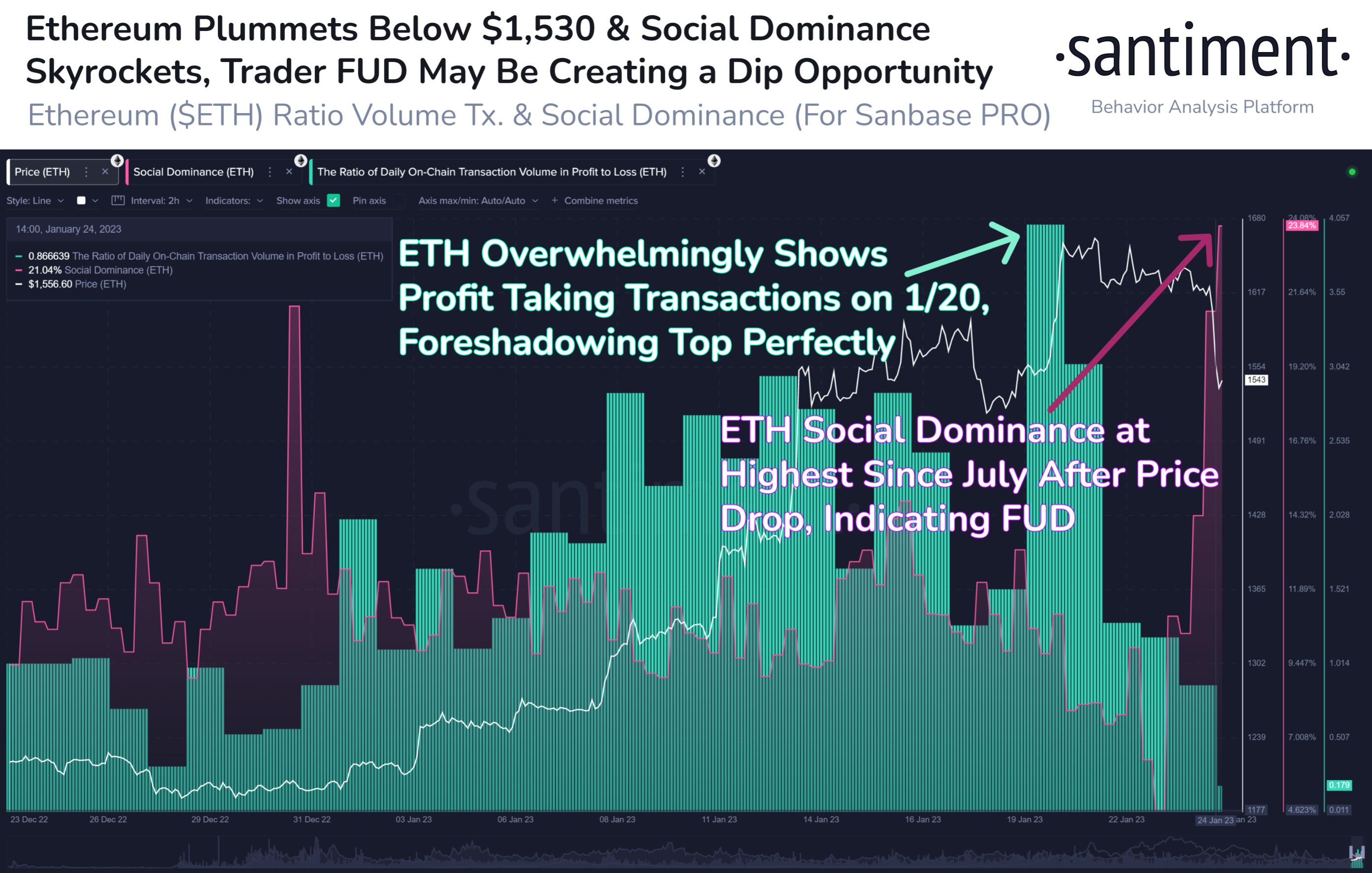

Ethereum price plummeted to $1,527 after hitting the recent high of $1,638. Experts at crypto data aggregator platform Santiment noted that the massive profit-taking transaction ratio spiked on January 20.

The altcoin was discussed in 21% of the conversations on social media platforms. Analysts at Santiment believe the FUD surrounding ETH could fuel a bullish narrative for the asset in the mid-term.

Also read: Here’s how Vitalik Buterin’s privacy solution could be a game changer for Ethereum and privacy coins

Ethereum traders engage in mass profit taking pushing ETH price lower

Ethereum price wiped out its losses from the FTX exchange collapse and made a comeback above the $1,600 level on January 20. This coincided with an increase in profit-taking by ETH holders.

Experts at the crypto intelligence platform Santiment noted a massive spike in the profit-taking transaction ratio. This coincided with an increase in social dominance of the second-largest cryptocurrency by market capitalization.

Ethereum social dominance spikes, price drops below $1,530

ETH was the topic of discussion in 21% of the conversations on crypto Twitter and other social media platforms. The Fear, Uncertainty and Doubt (FUD), and the hype surrounding the asset could benefit its price in the mid-term, according to Santiment analysts.

How to spot and profit from Ethereum whales shedding their holdings

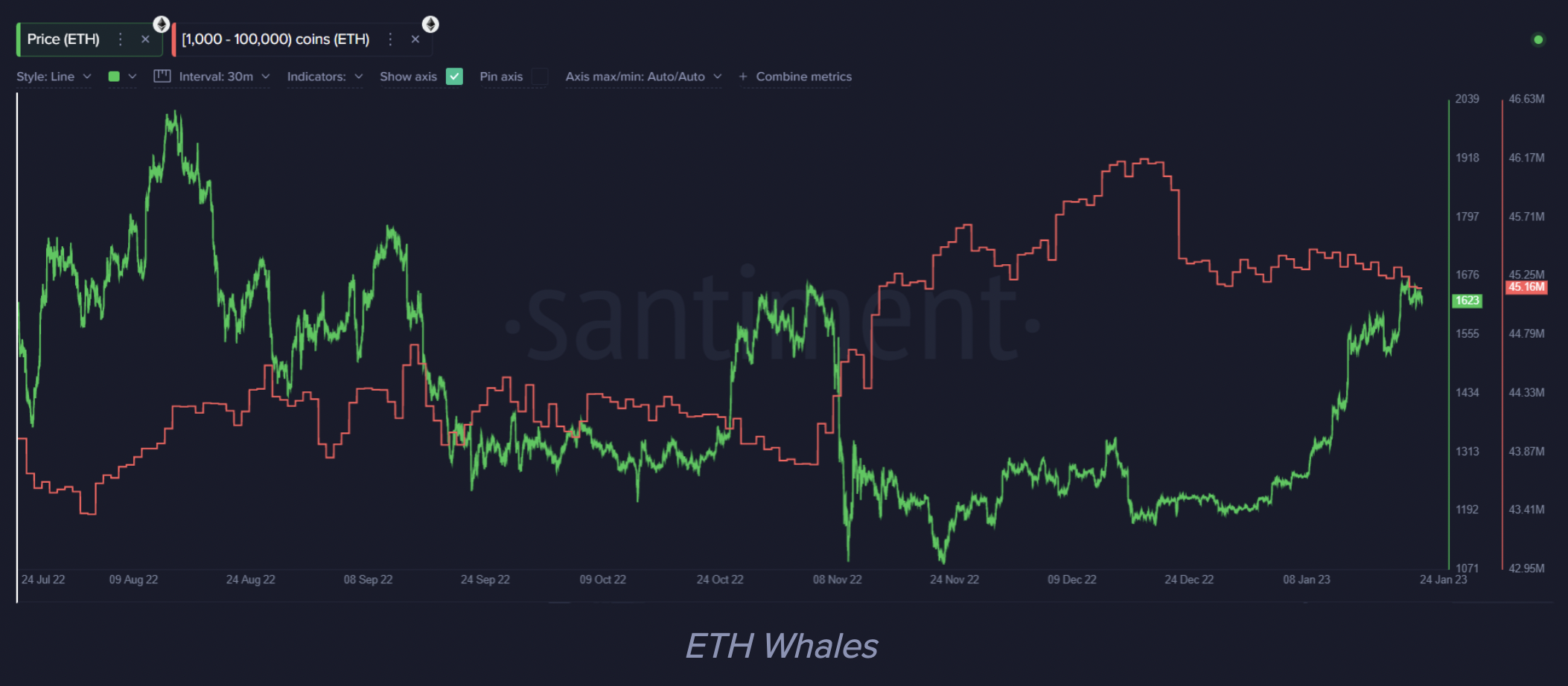

The artificial inflation of an asset’s price is known as a “pump.” A pump implies that the market will soon experience a downturn and the risk vs. reward of buying the asset does not make it a worthwhile investment.

To spot “pumps” it is useful to look at the behavior of large wallet investors, known as whales. In case of Ethereum, whales holding between 1,000 and 100,000 ETH started shedding their holdings consistently throughout January 2023 – a sign of a potential “pump”.

ETH whales

ETH whales

This implies that market participants need to exercise caution and wait for better “buy” opportunities rather than jumping into a potentially unstable trade.

Ethereum price could witness a run up to $2,000 if Bitcoin bulls make a comeback

Technical analysts argue that Ethereum price could hit the bullish target and the psychologically important $2,000 level if Bitcoin bulls make a comeback. Ethereum has enjoyed a high correlation with Bitcoin, at 0.83. Therefore a bullish breakout in Bitcoin could trigger a rally in the altcoin.

Akash Girimath, technical analyst at FXStreet argues that Ethereum price could trigger another run-up despite the obvious exhaustion. Such a move will retain the bearish divergence but will allow market makers to collect the buy-stop liquidity resting above $1,679 and trap the early bears.

ETH/USDT price chart

ETH/USDT price chart

During this liquidity hunt, ETH price could extend as high as $2,000. A decline below the 200-day Exponential Moving Average (EMA) at $1,509 could invalidate the bullish thesis for ETH.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

SEC doubles down on TRON's Justin Sun lawsuit dismissing claims over jurisdiction

The SEC says it has jurisdiction to bring Justin Sun to court as he traveled extensively to the US. Sun asked to dismiss the suit, arguing that the SEC was targeting actions taken outside the US.

XRP fails to break past $0.50, posting 20% weekly losses

XRP trades range-bound below $0.50 for a sixth consecutive day, accumulating 20% losses in the last seven days. Ripple is expected to file its response to the SEC’s remedies-related opening brief by April 22.

ImmutableX extends recovery despite $69 million IMX token unlock

ImmutableX unlocked 34.19 million IMX tokens worth over $69 million early on Friday. IMX circulating supply increased over 2% following the unlock. The Layer 2 blockchain token’s price added nearly 3% to its value on April 19.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?