- Dogecoin price has been shaping a complex top with support holding for the last several days.

- DOGE trades below the anchored VWAP, reinforcing the bearish turn in the outlook.

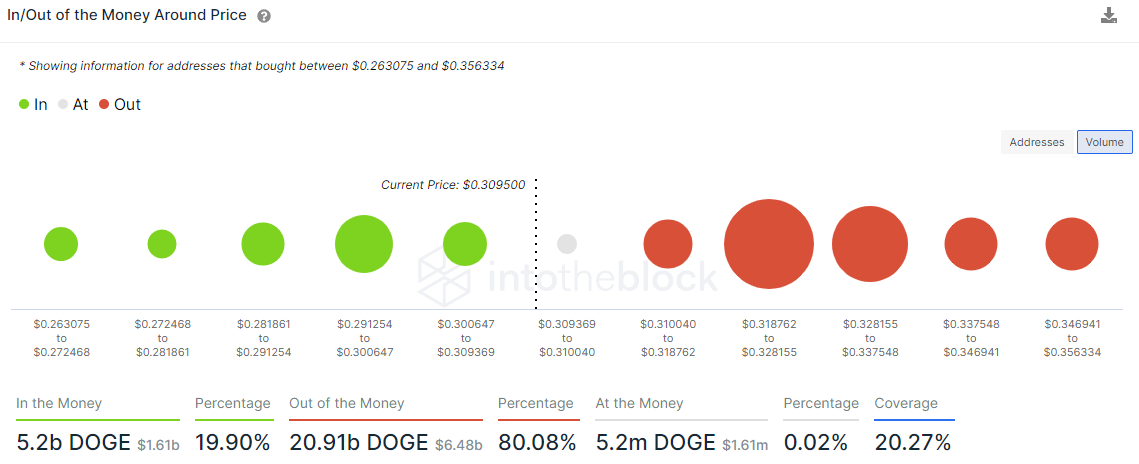

- IntoTheBlock IOMAP data clearly illustrates significant resistance between $0.32 and $0.34.

Dogecoin price was not captivated by the Bitcoin spike of 30% since June 8, opting for consolidation above a short-term support level that will define the future of DOGE. A failure to maintain the support increases the probability that the meme token tests the May 19 low of $0.195.

Dogecoin price has no room for failures

Despite the impressive Bitcoin breach of the psychologically important $40,000, Dogecoin price has not leveraged the BTC rally for a sizeable rally. It is a disappointing response to the most important cryptocurrency event since the May 23 low. Such a withdrawal suggests that DOGE searches for a different catalyst or is more likely swayed by a bearish objective.

Dogecoin price has suggested many potential patterns since the May 19 crash, but none has carried the staying power to reach completion. Today, Dogecoin price illustrates a complex topping formation extending back to May 23, with a clear support line that DOGE is currently holding. The level marks a line in the sand for the altcoin and is the most important barrier to a test of $0.195.

A daily close below the June 13 low of $0.287 will free Dogecoin price to initiate the decline to the May 19 low. The May 23 low of $0.246 will be notable support, but the downside momentum accumulated in the complex topping process should best it.

After the May 19 low, Dogecoin price has a clear path to $0.195, representing a 36% decline from the support level. If the slide is within the context of a breakdown in the cryptocurrency complex, DOGE may target the 200-day simple moving average (SMA) at $0.143.

DOGE/USD daily chart

To shake up the bearish outlook, Dogecoin price will need a daily close above the anchored value-weighted average price (anchored VWAP) at $0.353. DOGE will still have overcome the 50-day SMA at $0.403 and the 2021 rising trend line at $0.426 before a credible bullish outlook can gain traction.

According to the current IntoTheBlock In/Out of the Money Around Price (IOMAP) data, Dogecoin price is suffocated by resistance (out of the money addresses) between $0.318 and $0.337, where 196.42k addresses hold 15.36 billion DOGE.

The range reveals a challenging journey for Dogecoin to defeat the anchored VWAP at $0.353.

DOGE IOMAP - IntoTheBlock

Conversely, the IOMAP shows no support (in the money addresses) down to $0.263, warning of a bearish outlook in the short term.

In the following video, FXStreet's analysts discuss the outlook for DOGE price and how Elon Musk might be the only one who can save DOGE from a crash.

Please follow the link for more timely cryptocurrency market intelligence.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

SEC doubles down on TRON's Justin Sun lawsuit dismissing claims over jurisdiction

The SEC says it has jurisdiction to bring Justin Sun to court as he traveled extensively to the US. Sun asked to dismiss the suit, arguing that the SEC was targeting actions taken outside the US.

XRP fails to break past $0.50, posting 20% weekly losses

XRP trades range-bound below $0.50 for a sixth consecutive day, accumulating 20% losses in the last seven days. Ripple is expected to file its response to the SEC’s remedies-related opening brief by April 22.

ImmutableX extends recovery despite $69 million IMX token unlock

ImmutableX unlocked 34.19 million IMX tokens worth over $69 million early on Friday. IMX circulating supply increased over 2% following the unlock. The Layer 2 blockchain token’s price added nearly 3% to its value on April 19.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?